The real cost of a loan after taxes is found by adjusting the interest rate based on how much you save through tax deductions. Unlike selling part of your company (equity financing), debt means taking on a loan or issuing bonds, but the borrower keeps full ownership.

What Is Debt Financing?

Debt financing simply means getting money now and agreeing to pay it back later, usually with interest. This can involve:

- Bank loans

- Bonds

- Lines of credit

- Equipment financing

- Invoice financing (also called receivables financing)

When a business uses debt financing, it’s taking a calculated risk: getting capital without giving up ownership but committing to regular repayments.

Common Types of Debt Financing

There are many ways to borrow. The main types include:

- Term Loans: Lump-sum loans repaid over months or years, ideal for buying equipment or funding expansion

- Lines of Credit: Like credit cards borrow up to a limit, pay interest only on what you use

- Bonds & Debentures: Long-term IOUs businesses or governments sell to investors, with set interest and maturity

- Invoice (Receivables) Financing: Borrowing against money customers already owe you.

- Equipment & Inventory Financing: Loans secured by the items you’re buying, like machinery or stock.

- Merchant Cash Advances: Lender gives money upfront then gets repaid as a percentage of future sales.

Each option fits different needs like short-term cash flow or long-term growth funding.

Why Businesses Use Debt Financing?

Here are the biggest reasons many choose debt financing:

- You retain full ownership of your business since debt financing doesn’t require giving away any equity or control.

- Predictable repayment: You know exactly what to expect monthly.

- Tax advantages: You can usually deduct interest payments from taxable income.

- Debt allows businesses to access more capital, making it easier to invest and grow without relying solely on their own funds.

- Build credit history: Paying back on time helps secure better terms later.

- Flexible funding: Short‑ and long‑term options cover many needs.

Risks and Disadvantages

Borrowing isn’t without drawbacks. Watch out for these:

- Required repayments: You must pay interest and principal even if business slows.

- Collateral risk: Lenders may require assets, which they can take if you default.

- Restrictive covenants: Loans can limit additional borrowing or set financial rules.

- Interest rate risk: Variable rates can raise repayment costs later.

- High leverage hazards: Too much debt can hurt your credit score and cash flow.

How Interest Rates Affect Debt Financing?

Interest rates play a huge role in the real cost of debt financing. They determine how much you’ll repay over time and can either make borrowing affordable or overly expensive.

When rates are low, businesses are more likely to borrow because the monthly cost is easier to manage. Low-interest periods are ideal for long-term loans, mortgages or expansion borrowing.

But when rates rise, so does the cost of borrowing. That’s especially risky for loans with variable interest rates, where payments can increase unexpectedly.

Here’s what to keep in mind:

- Fixed vs Variable Rates: Fixed gives predictable payments, while variable changes with the market.

- Timing Your Loan: Taking a loan when rates are low can save thousands over its life.

- Refinancing Options: You might refinance later if rates drop again.

Understanding interest trends helps you make smarter choices and avoid unnecessary financial stress.

How to Use Debt Financing Smartly?

Follow these steps to borrow wisely:

- Evaluate your cash flow: Make sure your business can handle regular payments during slow periods.

- Choose the right type: Short-term loans help with inventory, long-term one’s fund big projects.

- Study the terms: Know your interest rate, repayment schedule, and any covenants or collateral required.

- Compare lenders: Traditional banks, SBA loans (in the U.S.), alternative lenders, or bonds have different costs.

- Borrow only what you need: Excess debt can bind your future cash flow.

- Plan repayments before borrowing: Forecast your budget based on worst-case scenarios.

- Use debt to grow revenue: Borrow for projects that increase profits, not cover running losses.

Debt Financing for Startups and Small Businesses

Many startups hesitate to borrow money but when used correctly, debt financing can help a new business grow without giving up equity.

For early-stage companies, small business loans or microloans can cover essentials like:

- Buying inventory or equipment

- Hiring staff or renting space

- Funding marketing or website development

Some key points for startups to remember:

- Start small: Avoid large loans early on. Borrow only what you can repay.

- Look for government-backed loans: Programs like SBA loans in the U.S. offer lower interest and easier terms.

- Have a solid business plan: Lenders want to see how you’ll make money and repay the loan.

Debt financing can be a powerful launchpad if handled wisely. It helps build credit, keeps ownership intact and funds early growth without relying solely on investors.

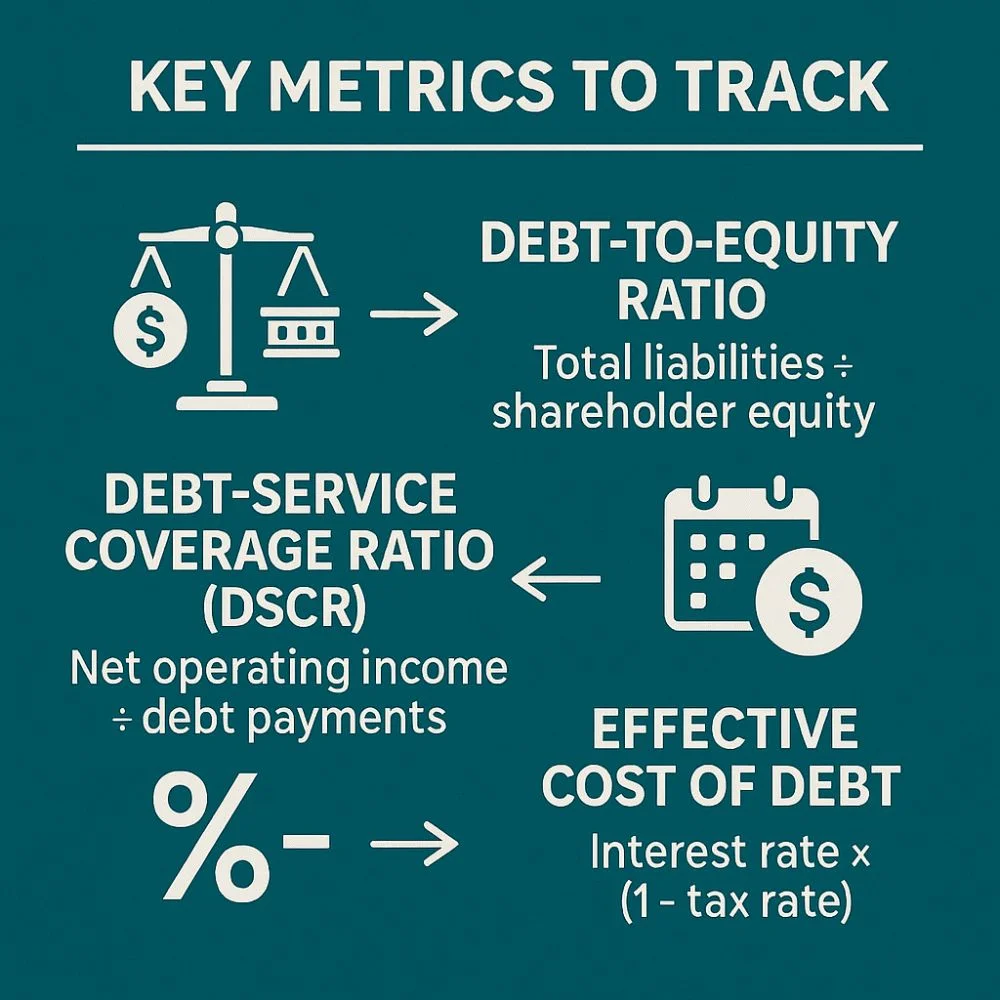

Key Metrics to Track

When using debt, some financial ratios help monitor your situation:

- Debt-to-Equity Ratio = Total liabilities ÷ shareholder equity measure leverage.

- Debt-Service Coverage Ratio (DSCR) = Net operating income ÷ debt payments shows repayment ability.

- The effective cost of debt, after accounting for tax savings, is calculated by multiplying the interest rate by one minus the tax rate.

These indicators help evaluate if your debt level is manageable or too risky.

Debt Finance vs Equity Finance

Debt finance involves borrowing money that must be repaid with interest, typically through loans or bonds. It allows full ownership retention but adds financial pressure due to fixed repayments and potential collateral requirements. In contrast, equity finance raises capital by selling ownership shares to investors. It reduces financial risk and brings in expertise but dilutes control and ownership. Choosing between the two depends on your business’s stage, cash flow, and growth strategy debt suits stable companies, while equity is ideal for startups seeking long-term capital without repayment stress.

Real-World Examples

Shopify used “venture debt” to fuel growth early on without giving up equity

Large corporations regularly issue bonds to fund acquisitions or improvements borrowing from investors, no change in ownership.

Small businesses often use an SBA‑backed loan in the U.S. for equipment or real estate purchases, benefiting from lower rates.

When to Choose Debt Financing?

Debt financing is a good fit if:

- Your business has reliable cash flow.

- You need funds now but don’t want to sell equity.

- You want to maintain control of your company.

- You can benefit from tax-deductible interest.

- You expect returns on borrowed funds to exceed the interest cost.

Skip it if your business is too new or unpredictable, or you don’t have collateral and can’t meet regular payments.

Final Thoughts

Debt financing can be a powerful tool when used intelligently. By borrowing to grow while keeping ownership, you stand to gain but it comes with commitments and risk. Make smart choices:

- Match the loan type to your goal

- Know all costs and terms

- Track your financial health regularly

- Use debt only when it brings growth

With careful planning and responsible use, debt financing can help take your business to the next level without giving away control.