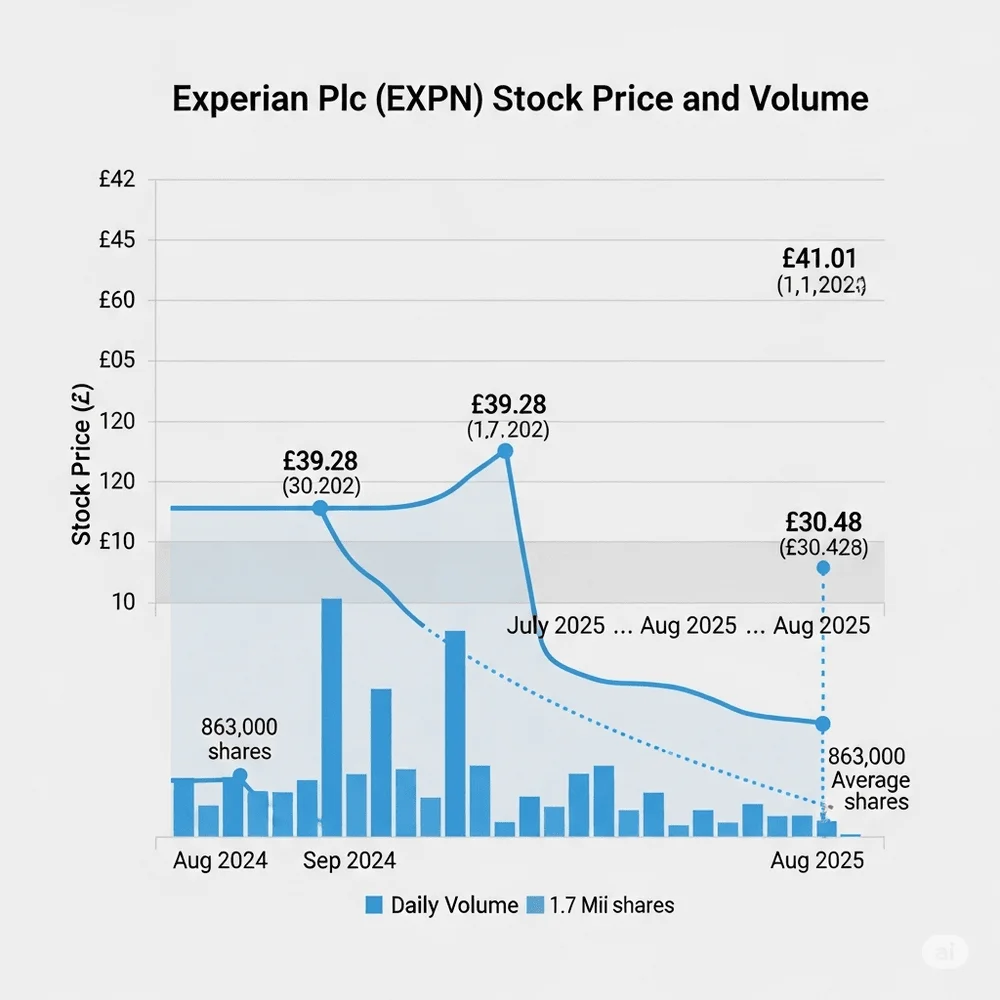

Experian’s share performance recently dipped by around 1.9%, closing at approximately £39.28, underperforming the FTSE 100 index, which fell about 0.7% on the same day. Despite this pullback, the stock remains within a solid position, trading about 4.2% below its 52‑week high of £41.01 reached in mid‑July. Trading volume was noticeably subdued at roughly 863,000 shares, significantly lower than the 50‑day average of 1.7 million.

From a broader vantage, as of early August 4, 2025, Experian shares were quoted around 3,929 GBp (~£39.29), with just a slight uptick of +1 GBp (+0.03%) on that latest trading session. The 52‑week trading range lies between 3,049 GBp and 4,101 GBp, reflecting moderate volatility but overall stability.

Key financial metrics underscore Experian’s robust fundamentals:

- Forward P/E ratio: ~29.7–30, indicating market confidence in future earnings.

- Dividend yield: The dividend yield stands at approximately 1.20%, supported by a prudent payout ratio of around 47%, indicating sustainable returns for investors.

- Annual revenue 2025: £7.523 bn, up from £7.097 bn in 2024. Adjusted EPS increased by ~8% to 156.9 pence.

Strategically, Experian continues to innovate. Its recent regulatory filings revealed a share‑buyback transaction announced on August 4, 2025, underscoring management’s confidence in long‑term value creation.

In product and technological developments, Experian is emphasizing generative AI. It has rolled out a new AI‑powered assistant specifically for model risk management and governance, which earned recognition in industry awards in July 2025. Their corporate survey in late July revealed that over one‑third of global businesses now use AI to fight fraud, and the company deepened its partnerships with Mastercard and Plaid to deliver real‑time insights for smarter credit decisions.

Summary table:

| Metric | Value/Detail |

| Latest Share Price | ~£39.29 (3,928 GBp) |

| Recent Movement | −1.9% decline |

| 52‑Week Range | 3,049 – 4,101 GBp |

| Forward P/E | ~29.7–30 |

| Dividend Yield | ~1.20% |

| Annual Revenue (2025) | £7.523 bn |

| EPS Growth | ~8% |

| Share Buyback | Recent transaction (Aug 4, 2025) |

| AI Innovation | New assistant, fraud-fighting tools, partnerships |

Experian continues to demonstrate strong performance within the credit analytics and data intelligence sector, maintaining its position as a trusted market leader. While the recent dip reflects broader market weakness and caution following sector influences, the company’s balance sheet, dividend consistency, forward earnings multiple, and AI investments maintain investor confidence. With its shares sitting modestly below recent highs and healthy fundamentals intact, Experian continues to present a growth‑oriented investment with clear strategic direction.