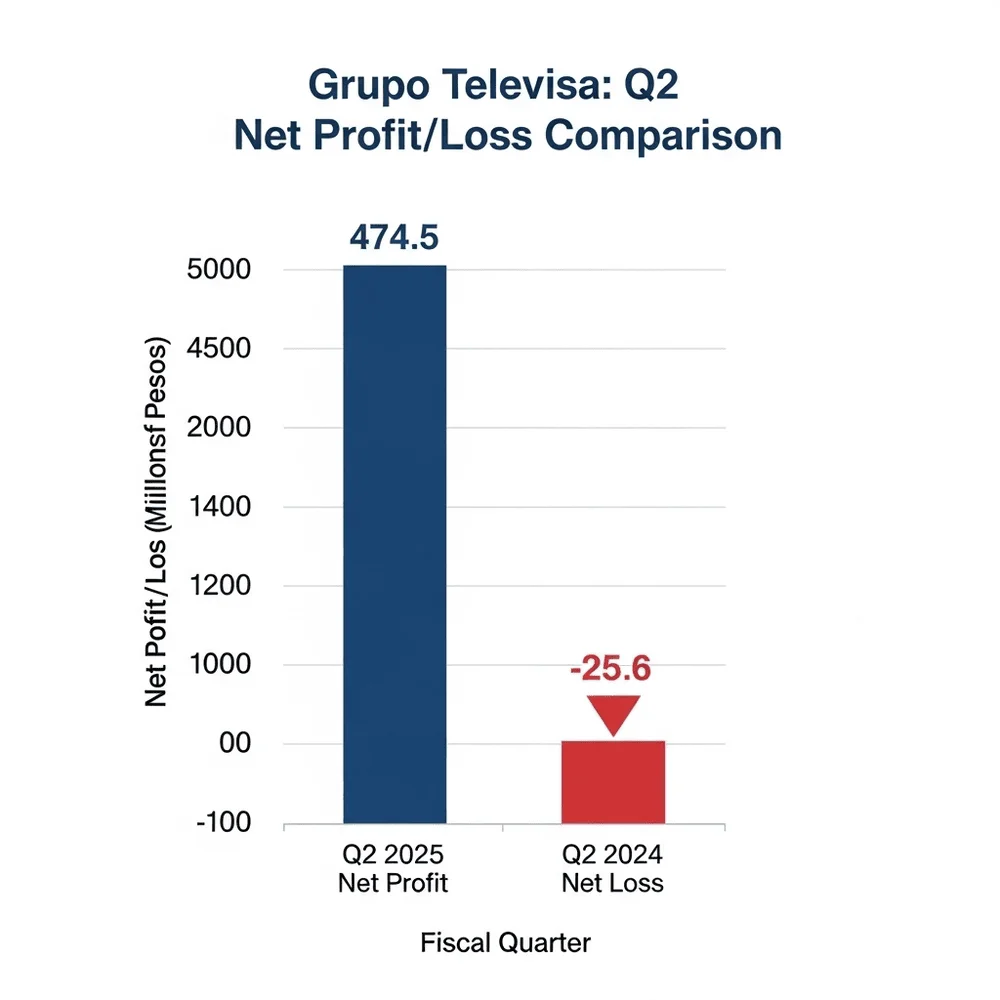

Grupo Televisa S.A.B., Mexico’s largest broadcaster, has reported a significant financial turnaround in the second quarter of 2025. The firm reported earning 474.5 million pesos, or about $25.3 million, in net profit for Q2 2025, marking a sharp turnaround from the 25.6 million pesos loss recorded in the same period a year earlier. This improvement was driven primarily by cost reductions and operational efficiencies, even though total revenue declined by 6% to 14.73 billion pesos. The depreciation of the Mexican peso had a negligible effect on revenue when adjusted for currency variations.

Shares of Televisa (NYSE: TV) rose in reaction to the news, trading at $2.38 representing a modest gain compared with the prior session’s closing price. Analysts have adjusted their outlook for the company, reflecting growing confidence in its operational strategy. Benchmark increased its price target to $9.00 from $7.00, citing improved cost management and a 10% rise in adjusted operating income from the TelevisaUnivision joint venture. UBS also raised its target to $2.50 while maintaining a neutral rating.

Despite this positive trend, the company faces challenges in its satellite TV segment, SKY, which experienced a 16.3% revenue drop and lost 350,000 subscribers. To further optimize spending, Televisa reduced its 2025 capital expenditure budget from $665 million to $600 million, attributing the reduction to favorable supplier negotiations. While this will help improve cash flow, it may impact long-term growth initiatives.

Televisa continues to diversify its content and invest in digital platforms, aiming to strengthen its position in the evolving media landscape. Analysts note that the combination of cost control measures, strategic budget management, and content diversification positions the company for potential growth, although careful monitoring of subscriber trends in SKY and other segments remains critical.

Key Highlights:

- The company recorded a net profit of 474.5 million pesos in the second quarter of 2025

- Revenue declined 6% to 14.73 billion pesos

- SKY satellite service lost 350,000 subscribers

- 2025 capital expenditure reduced from $665M to $600M

- The stock price is currently at $2.38, with optimistic analyst outlooks