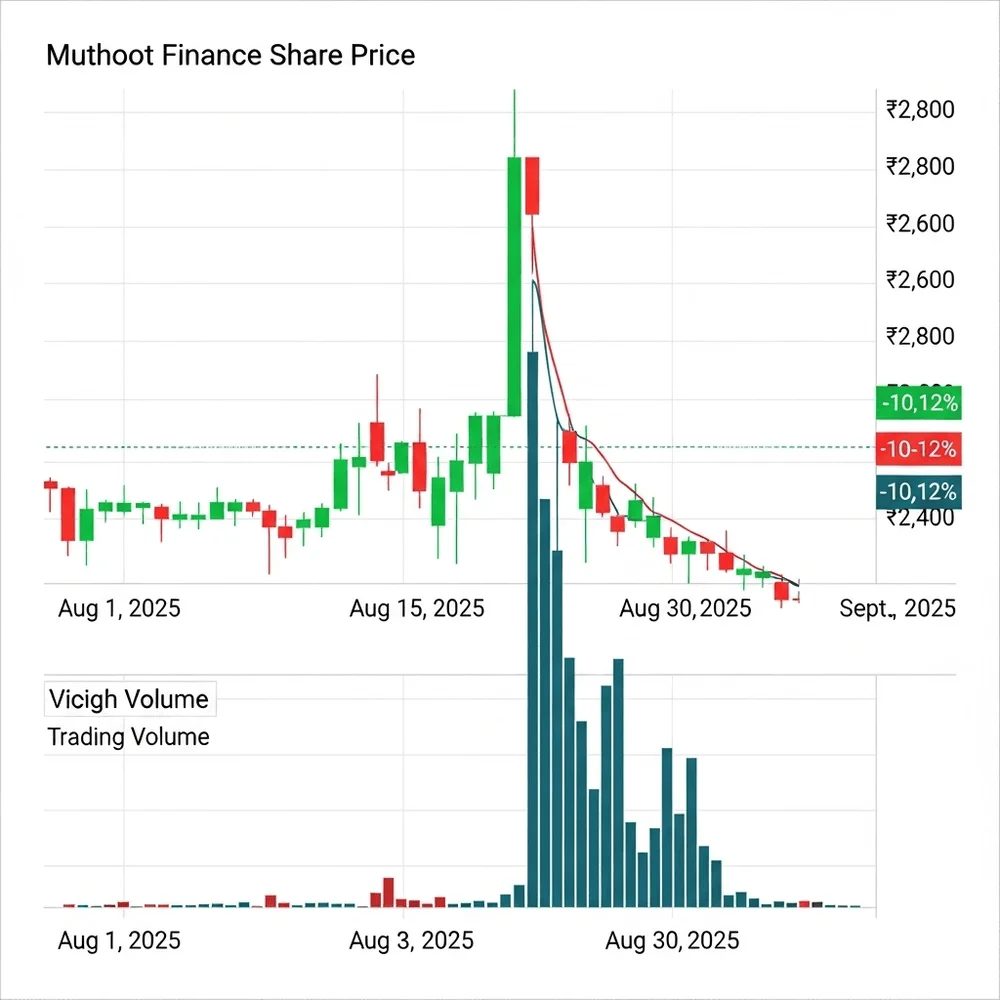

Muthoot Finance’s shares witnessed a spectacular rally today, surging nearly 10–12% to hit an all-time high in response to an outstanding first-quarter (Q1 FY26) performance. The stock soared to as high as ₹2,800, reflecting robust investor confidence across the board.

The stock soared to as high as ₹2,800, reflecting robust investor confidence across the board.

The company delivered remarkable financials for Q1: consolidated profit after tax jumped 65% year-on-year to ₹1,974 crore, compared to ₹1,196 crore in the same quarter a year ago. Some analysts pegged the standalone profit even higher, around 90% YoY growth to ₹2,046 crore, marking a record quarterly high.

The impressive growth was driven by a sharp rise in loan assets, with consolidated loan AUM climbing 37% year-on-year to ₹1.33 lakh crore, and standalone gold-loan AUM advancing 42% to ₹1.20 lakh crore. The underlying strength in gold loan demand, supported by rising gold prices, emerged as a key driver of the surge.

Market interest was explosive: volumes skyrocketed nearly 74-fold over the two-week average, with early trades seeing about 4.55 lakh shares changing hands on the BSE. On the Nifty Financial Services index, Muthoot emerged as the top gainer, underscoring its dominance in the NBFC space.

Analysts responded positively, with several brokerages revising their earnings forecasts and price targets upward. Jefferies and Nuvama both maintained “Buy” ratings, raising targets to ₹2,950 and ₹2,993, respectively. Morgan Stanley upgraded its rating to “Higher weight”, boosting its target to ₹2,920, citing strong earnings growth and a projected return on equity of ~24%. Meanwhile, Motilal Oswal retained a “Neutral” stance, targeting ₹2,790 but warned that the valuation might already reflect much of the optimism, especially given potential volatility in gold prices.

Summary:

- Standalone PAT surged nearly 90% YoY in Q1 FY26; consolidated PAT up 65% YoY.

- Gold-loan AUM climbed 42% YoY, while the total loan book rose 37% YoY to ₹1.33 lakh crore.

- Stock rallied 10–12% to ₹2,800, hitting an all-time high.

- Trading volumes spiked 74× the two-week average, signaling intense market interest.

- Strong gold prices and robust demand boosted growth momentum.

- Jefferies, Nuvama, and Morgan Stanley issued bullish price targets above ₹2,900.

- Motilal Oswal stayed neutral, citing possible gold price volatility risks.