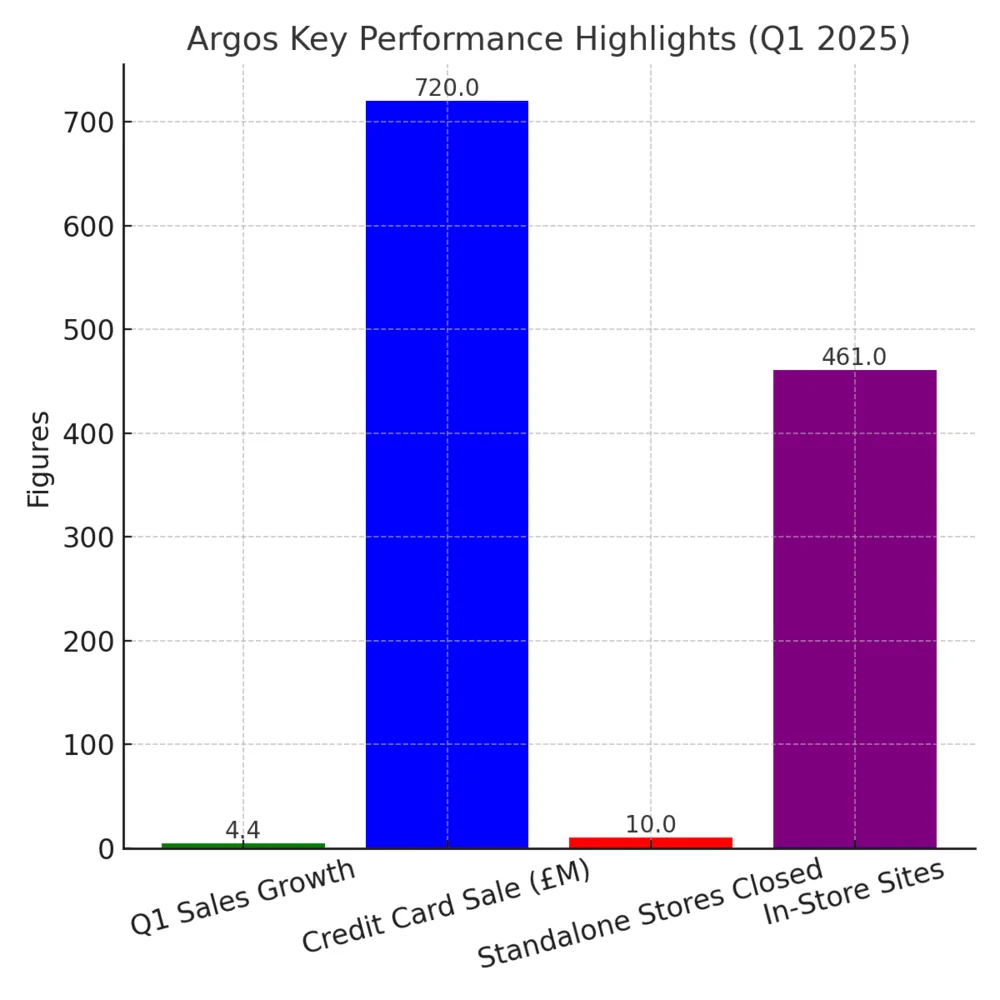

Argos is making a confident comeback, showing strong sales growth while accelerating its transformation under Sainsbury’s strategic vision. In the latest quarterly update, Argos under Sainsbury’s posted a 4.4% rise in sales over the 16 weeks to 21 June 2025, its strongest performance in two years and a key contributor to the group’s overall 4.9% like‑for‑like grocery growth. This represents a positive shift in Argos’ general merchandise performance after experiencing slower sales in the earlier part of the year.

Alongside sales momentum, Sainsbury’s continues its strategic reshaping of the Argos estate. Between March 2024 and March 2025, it opened 16 new Argos concessions inside Sainsbury’s stores while shutting down ten standalone high‑street branches. By March 2025, Argos operated 461 in‑supermarket sites as part of a broader shift away from standalone operations. Additional planned closures aim to reduce standalone locations from around 213 today to approximately 190 by the end of next financial year.

In its financial services division, Sainsbury’s has officially handed over the beneficial ownership of Argos’ credit card portfolio to NewDay Group. This follows the £720 million sale announced in late 2024 and paves the way for transferring legal title during early 2026. The move underscores Sainsbury’s broader exit from ancillary financial businesses and focus on core retail operations.

In line with its Next Level strategy, Sainsbury’s also highlights recent digital innovation under the Argos brand. It has partnered with StoryStream a content and user‑generated social‑shopping specialist to power visual shopping experiences across Argos product pages. The collaboration reflects a push toward more authentic, engaging discovery channels online.

Analysts describe this transition as both necessary and challenging: Argos is being modernised around strong online growth and integration efficiencies, yet still lags behind in-store traffic in non‑food categories. Despite this, strengthening online operations and streamlined collection points have helped sustain momentum. The preliminary full‑year results indicate steady progress in improving the Argos offer within the broader Sainsbury’s ecosystem.

Looking ahead over the summer, Sainsbury’s CEO Simon Roberts emphasises cost discipline and investment in areas most aligned with its food growth strategy. Retail analysts expect Argos to play a supporting role, boosting convenience in supermarket locations and reinforcing customer loyalty while standalone presence gradually shrinks.