BuzzFeed is preparing to announce its second-quarter 2025 earnings on August 7, 2025, after market close, with CEO Jonah Peretti and CFO Matt Omer hosting an earnings call shortly thereafter. Investors have been closely watching, especially following its Q1 performance, which signaled foundational shifts in its business strategy.

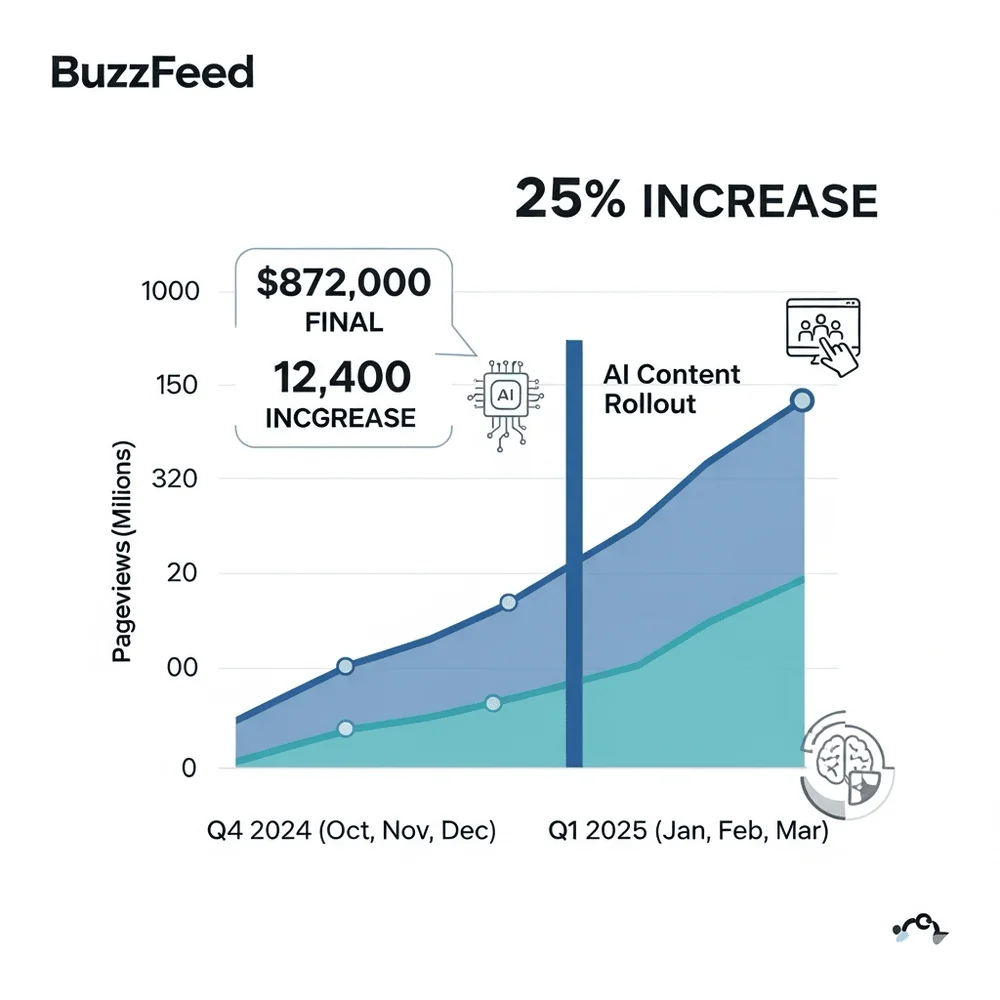

In Q1 2025, revenue came in at $36.0 million, down from $37.0 million a year earlier. BuzzFeed successfully narrowed its net loss to $12.5 million in Q1 2025, representing a significant recovery compared to the $27 million deficit recorded in the same quarter of 2024. Advertising revenue showed strength, rising to $21.4 million, supported by growth in programmatic advertising and affiliate commerce. The company’s AI-driven content strategy also played a key role, boosting user engagement. According to BuzzFeed, these initiatives resulted in a 25% increase in pageviews.

In May 2025, BuzzFeed secured a $40 million term loan from Sound Point Agency, aimed at strengthening its liquidity position and refinancing existing obligations to support ongoing strategic initiatives. The loan is expected to enhance financial flexibility and accelerate BuzzFeed’s growth in high-potential areas.

Looking back at 2024, the company generated approximately $189.9 million in revenue, down about 17.6% year-over-year, while net losses improved from $55.7 million in 2023 to $34.0 million in 2024. As part of its restructuring, BuzzFeed implemented a 1-for-4 reverse stock split in mid-2024 to regain compliance with Nasdaq listing minimum share price requirements.

Corporate shakeups continued: activist investor Vivek Ramaswamy acquired around 8.4% of outstanding shares but lacks significant voting power, as control remains concentrated with founder-held Class B shares.

BuzzFeed, initially built on viral quizzes, listicles, and entertainment content, has transformed into a diversified digital media platform with brands like Tasty and HuffPost, emphasizing content‑commerce integration and scalable ad products.

Upcoming Q2 earnings and the conference call could shine light on whether AI-driven engagement, cost discipline, and high-margin advertising efforts are enough to continue narrowing losses and rebuild investor confidence.

Key points to watch before investing:

- Whether Q2 revenue and loss trends continue improving

- Impact of AI personalization on traffic and monetization strategies

- Performance of programmatic and affiliate commerce lines

- Analyst sentiment and revised price targets (moderate coverage so far)