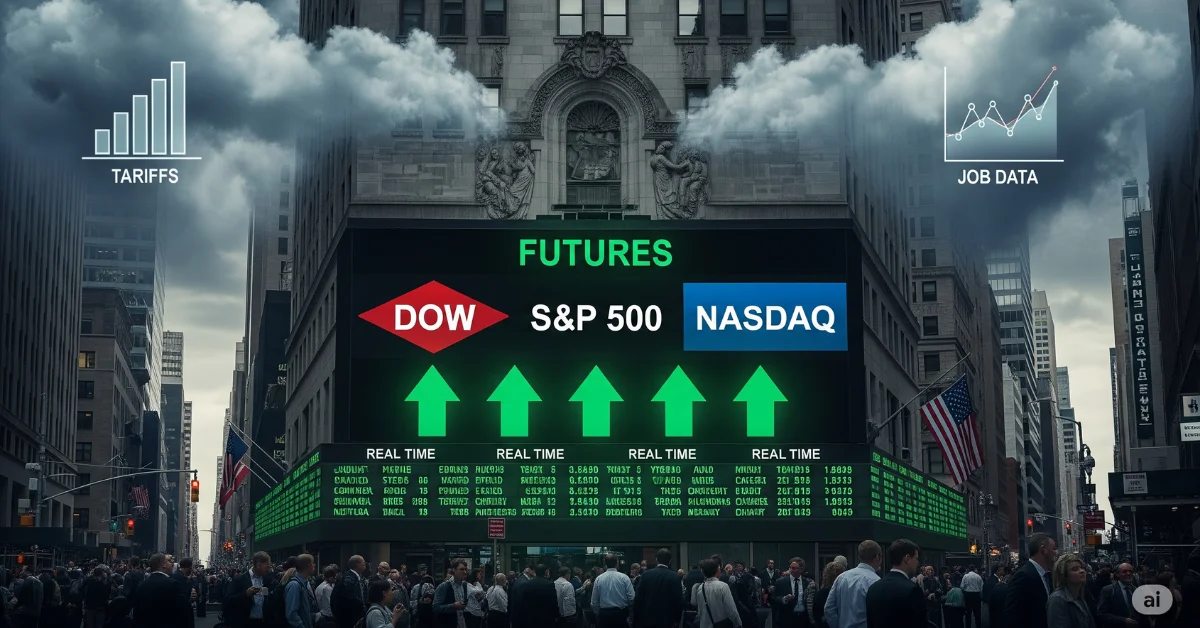

On August 1, 2025, US stock markets dropped sharply after weak job numbers and a new round of tariffs announced by President Trump. The Labor Department said the US economy added only 73,000 jobs in July, much lower than expected. The unemployment rate stayed at 4.2 percent, which matched earlier predictions.

In response to the disappointing report, President Trump said he had ordered the removal of Erika McEntarfer, the head of the Bureau of Labor Statistics. He accused the agency without offering any proof of releasing politically biased job data. He also said she would be replaced with someone he believed was more capable.

This news combined with Trump’s aggressive tariff policy caused stocks to fall. The Dow Jones Industrial Average tumbled by 542 points, a decline of 1.2 percent, making it the index’s poorest weekly performance since early April. Meanwhile, the S&P 500 slipped by 1.6 percent, and the Nasdaq recorded a sharper drop of 2.2 percent, led primarily by heavy losses in the technology sector.Market fears rose sharply as shown by a jump in the VIX index which tracks volatility.

Investors now expect the Federal Reserve might lower interest rates to support the slowing economy. Bond yields also dropped with 10-year Treasury note yields falling to 4.218 percent.

In terms of global trade, Trump increased tariffs on multiple countries. Switzerland will now face a 39 percent tariff up from 31 percent and Taiwan’s goods will be taxed at 20 percent. Canada was hit with a 35 percent tariff on products that don’t meet rules under the North American trade deal. However, Canada’s prime minister Mark Carney said his country has no plans to strike back. Countries with small trade surpluses with the US will see 15 percent tariffs while those with deficits will face 10 percent. Mexico was given a 90-day extension to negotiate and avoid higher tariffs.

Amazon shares dropped 8.3 percent after it posted slower than expected growth in its cloud business. Several other companies also warned that tariff uncertainty is hurting their operations.

Around the world, markets were also under pressure. European stocks in Italy, France, and Germany all fell more than 2.5 percent. In Asia, South Korea’s Kospi dropped 3.9 percent after the government there suggested raising taxes on corporations and investors.

The dollar had its worst single-day loss since April 10, falling 1.1 percent according to the WSJ Dollar Index.

Markets reacted strongly across the board reflecting investor concerns about both economic slowdown and trade tensions.