In today’s competitive world, every business owner dreams of growing their business quickly and reaching more customers. One of the ways to make this happen is by using leverage finance. While it may sound complicated, the idea is simple: use borrowed money to invest in your business so you can grow faster than you could with only your own money. However, this approach comes with both benefits and risks, so it’s important to understand how it works before jumping in.

What Is Leverage Finance?

Leverage finance is when a business borrows money, usually from a bank or private investors, to fund new projects, expand operations, or buy new equipment. Instead of using only the company’s own savings or profits, leverage allows you to use other people’s money to move forward more quickly.

This method is popular among big companies and also in private equity deals, but small and medium businesses can use it too if they plan carefully.

Why Use Leverage Finance?

There are many reasons why a business might choose leverage finance to grow. Here are some common reasons:

- Expand operations: Open new branches, enter new markets, or grow production capacity faster.

- Buy new equipment or technology: Stay competitive with updated tools and systems.

- Acquire another company: Grow quickly by buying an existing business.

- Improve cash flow: Free up working capital for day-to-day needs while investing in growth.

By borrowing, you can achieve goals that might otherwise take years if you rely only on your own savings.

Types of Leverage Finance

There are different ways to use leverage finance, depending on what suits your business best. Here are a few common types:

- Bank loans: The most traditional form. You borrow a lump sum and pay it back over time with interest.

- Lines of credit: Flexible borrowing that allows you to take money as needed up to a set limit.

- Bonds: Usually used by larger companies. Investors buy your bonds, and you promise to pay them back with interest.

- Private equity or venture debt: Funding from investors or private firms, often with special terms.

Each type has its own pros and cons, and it’s important to choose carefully depending on your goals and your ability to repay.

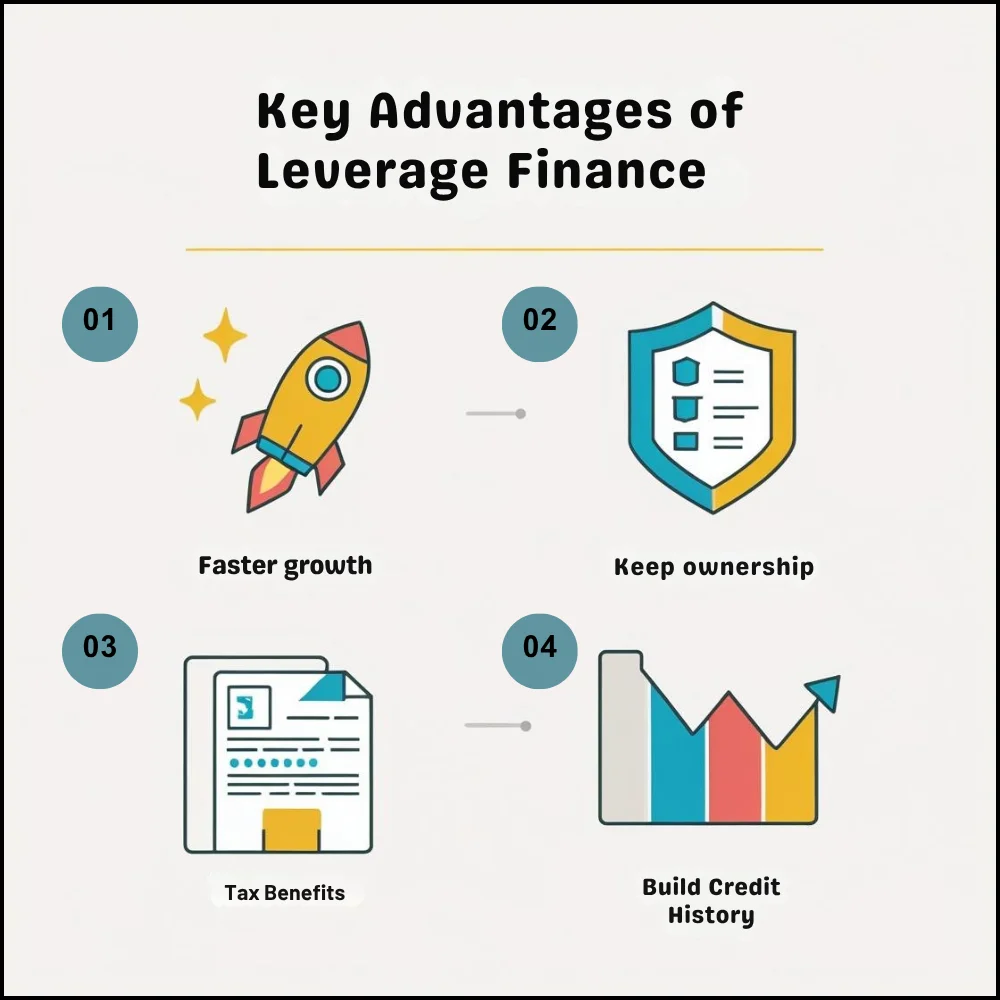

Advantages of Leverage Finance

When used wisely, leverage finance offers several strong advantages:

- Faster growth: You can seize new opportunities quickly without waiting to save up profits.

- Keep ownership: Compared to bringing in investors who want equity, loans allow you to keep full control of your business.

- Tax benefits: In some cases, interest payments on debt are tax-deductible, reducing your overall tax burden.

- Build credit history: Successfully managing loans can improve your business’s credit score, making future borrowing easier.

Risks of Leverage Finance

While the benefits are clear, there are also serious risks if not handled carefully:

- Repayment pressure: You must make regular payments, no matter how your business performs. This can create cash flow stress.

- Higher financial risk: If the business does not grow as planned, you might struggle to repay debt, risking bankruptcy or loss of assets.

- Interest costs: Over time, paying interest can add up and reduce profits.

- Impact on credit rating: Missing payments or taking on too much debt can hurt your credit score.

How to Decide If Leverage Finance Is Right for You?

Before taking on debt, you need to consider several factors carefully:

- Cash flow stability: Can your business generate steady cash to cover repayments?

- Growth potential: Will borrowing actually help you grow faster and bring in enough extra profit to justify the risk?

- Market conditions: Is your industry stable enough to support growth? Are interest rates favorable?

- Risk tolerance: Are you comfortable with the possibility of financial loss if things do not go as planned?

Talking to a financial advisor can help you weigh these factors and decide the best path.

Tips for Using Leverage Finance Wisely

If you decide to use leverage finance, here are some tips to help you manage it smartly:

- Start small: Borrow only what you truly need, not the maximum you can get.

- Plan repayments carefully: Make sure you understand when and how much you need to pay each month.

- Invest in profitable projects: Use borrowed money only for plans that have a clear path to generate extra income.

- Keep an emergency fund: Always have backup cash in case of unexpected downturns or slow sales periods.

- Monitor financial health regularly: Check your balance sheet and cash flow statements to spot problems early.

Real-World Examples

Many successful companies have used leverage finance to grow. For example, a small manufacturing company might borrow to buy new machines, allowing them to produce more items and take on larger contracts. Over time, the extra revenue covers the loan payments and creates higher profits.

Another example is a retail brand that uses a bank loan to open new stores in different cities. The expansion helps them reach more customers, boost sales, and build a stronger brand presence.

Alternatives to Leverage Finance

If you’re unsure about taking on debt, there are other ways to finance growth:

- Equity financing: Bring in investors who give money in exchange for a share of your business.

- Reinvesting profits: Use your own profits to fund growth slowly but safely.

- Grants and subsidies: Some industries or government programs offer support for business expansion.

These options may come with different trade-offs, like giving up some ownership or slower growth speed.

Final Thoughts

Leverage finance can be a powerful tool for businesses that want to grow faster and stay competitive. However, it is not without risks, and it requires careful planning and disciplined financial management. By understanding how it works and using it wisely, you can take your business to the next level without losing control or getting into financial trouble.

Related Topic: What is Debt Financing?