Setting up Kronos Payroll (also known as UKG Payroll) can help make your employee payments smooth, timely and accurate. Here’s a step-by-step guide using plain language that anyone can follow even if you’re new to payroll systems.

Set Up Basic Company Info

Before anything else, you need to enter your company’s main details. This includes your business name, address, tax information, departments and who manages what. You’ll also need to turn on the correct payroll options, like U.S. or Canadian payroll. Make sure to decide who has access to approve and manage payroll.

Create Your Company Structure

To keep payroll organized, set up a structure that matches how your company is actually organized. This means creating groups like departments, teams or locations. Assign a clear name and unique identifier to every department or section within your company.

This helps the system track where employees work and how their pay is calculated.

Set Your Payroll Rules

Now it’s time to add rules that affect how people get paid. These can include:

- Overtime rules

- Shift bonuses (like night shift pay)

- Different paycheck types (regular pay, bonuses, commissions)

Also, set up your tax rules by adding federal, state and local tax accounts, as well as any other payments like health insurance deductions.

Connect Time Tracking

For payroll to work properly, you need to track employee time accurately. You can use clocks, web apps or mobile apps for this. You can also set special time zones like night shifts or weekends. It’s a good idea to check timecards daily to fix mistakes like missed punches or incorrect hours.

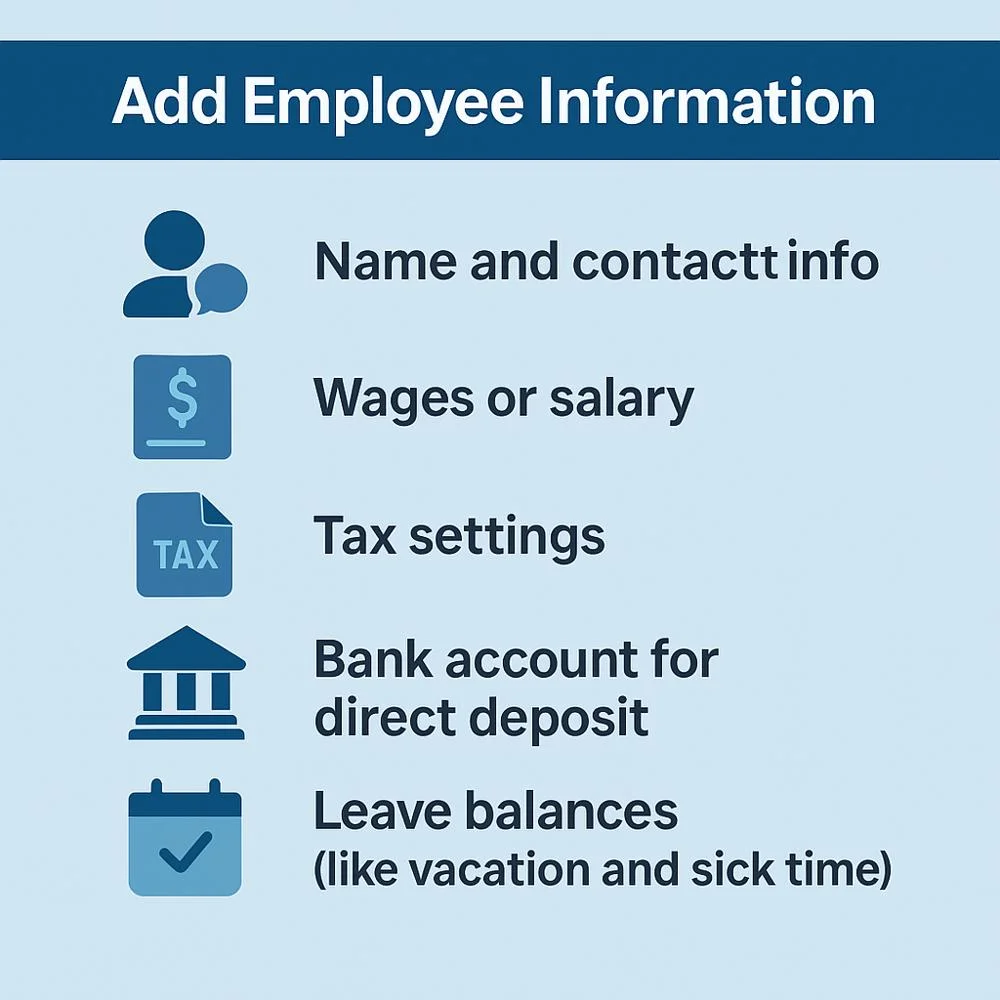

Add Employee Information

Every employee should have a profile in the system. You’ll need to include:

- Name and contact info

- Wages or salary

- Tax settings

- Bank account for direct deposit

- Leave balances (like vacation and sick time)

If you have many employees, you can upload them all at once to save time.

Handle Multiple Business IDs (EINs)

If your company has more than one business tax ID (EIN), make sure each one is set up properly. Connect each employee or department to the right EIN so taxes and payments are reported correctly.

Do a Pre-Payroll Check

Before running payroll, Kronos lets you review everything to catch mistakes. This step will show you:

- New hires and terminations

- Updated pay or deductions

- Any problems that need fixing

You can approve or adjust anything before paychecks are sent out. This helps avoid last-minute errors.

Run Payroll

Once everything looks good, you can go ahead and run payroll. Just select the pay period, review the numbers and approve the batch. Next, generate employee pay statements and forward payment files to the bank for direct deposits.

After that, your employees get paid, and taxes and benefits are automatically deducted.

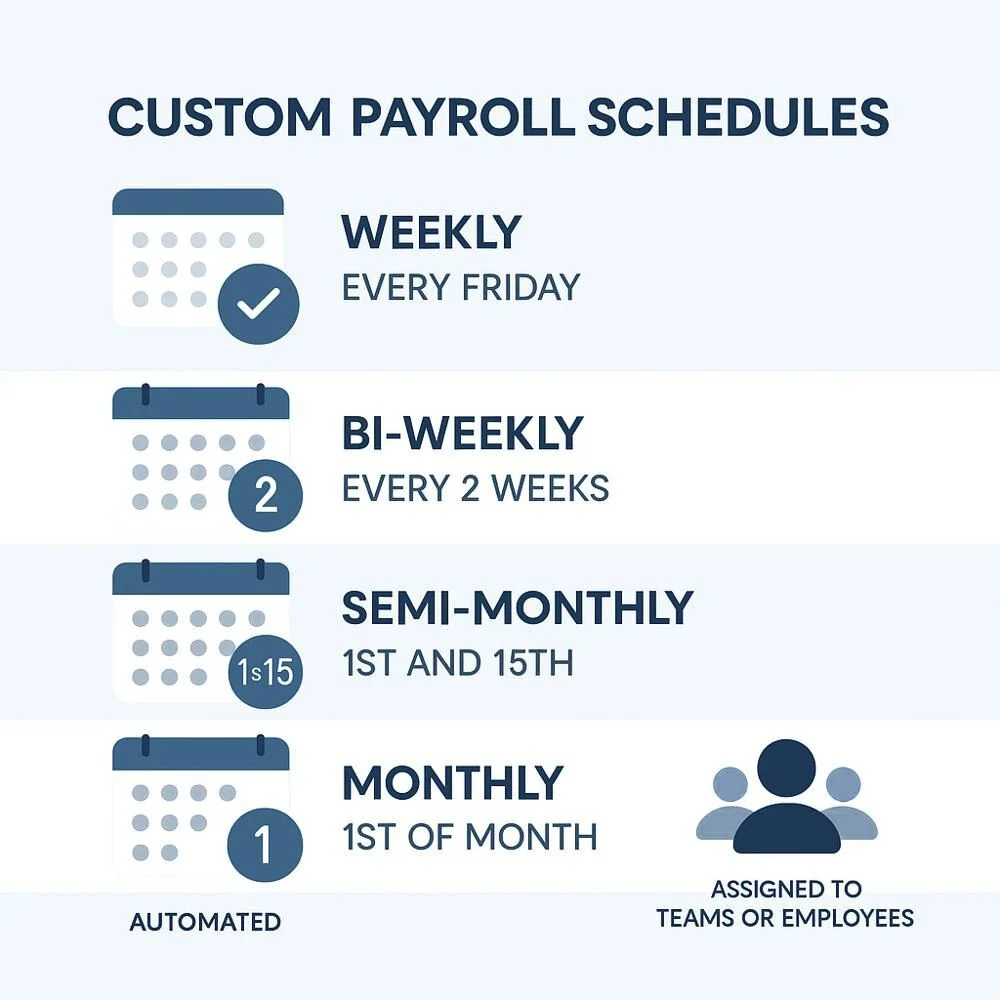

Customize Pay Schedules to Match Your Business

Every business runs payroll differently, and with Kronos Payroll, you can create custom pay schedules that fit your needs.

Whether you pay your employees weekly, bi-weekly, semi-monthly or monthly, the system lets you:

- Set start and end dates for each pay period

- Choose pay dates (when paychecks will be sent)

- Assign pay schedules to departments or individual employees

- Automatically repeat schedules to reduce manual setup

This flexibility is especially helpful if your business has both hourly and salaried workers or operates across different locations. Using the correct pay schedule helps ensure that employees are paid accurately and on time without confusion or delay.

Handle Year-End Payroll and Tax Forms with Ease

Preparing for the end-of-year payroll process is a key responsibility when managing payroll systems. Kronos Payroll includes tools to help you handle this with less stress.

Here’s what you can do:

- Automatically generate W-2 and 1099 forms for your employees and contractors

- Verify that all payroll and tax data is complete and accurate

- Submit electronic copies to government agencies on time

- Employees should be able to access and download their tax documents directly through their self-service account.

The system also offers year-end checklists to guide you through each step. This helps reduce mistakes and ensures that your business stays compliant with tax laws.

By using Kronos for year-end processing, you save time and avoid last-minute issues, especially during the busy holiday season.

Final Steps After Payroll

Once payroll is complete, you still have a few things to wrap up:

- Send payments for taxes and other deductions

- Record the payroll in your accounting system

- Save reports and pay stubs for your records

This helps with audits and year-end tax filing.

1. Use Automation to Save Time

Kronos can connect to other systems like benefits platforms and financial tools. This means you can automatically update payroll when someone signs up for health insurance or changes their 401(k). It reduces manual work and saves time.

2. Make It Easy with Mobile and Self-Service

Employees don’t need to ask HR for everything. They can:

- Clock in and out

- Check their schedule

- View their pay stubs

- Request time off

Managers can also approve timecards or schedules from their phone or computer. It’s faster and easier for everyone.

3. Train Your Team

The success of any system depends on how well its users understand and operate it. Make sure everyone knows how to use Kronos properly:

- Payroll admins should learn how to run payroll, make edits and fix errors

- Supervisors should be able to review and approve timecards

- Employees should know how to use self-service tools

Offer training sessions and refreshers when needed.

4. Keep an Eye on Reports and Performance

Use built-in reports to stay on top of things like:

- Hours worked

- Leave balances

- Payroll history

- Upcoming tax deadlines

Look for patterns or mistakes and fix them early to avoid bigger issues.

5. Best Practices for Smooth Payroll

Follow these helpful tips to keep your payroll process organized and efficient:

- Check timecards daily

- Always review payroll before approval

- Keep tax and benefit info up to date

- Use self-service tools to cut down on admin tasks

- Provide regular training to your team

Why Kronos Payroll Works Well?

Kronos (UKG) is a great choice for businesses because:

- It works with time tracking, HR, and scheduling

- It follows tax laws and updates automatically

- It can handle different types of workers and complex pay rules

- It gives employees control with mobile and self-service tools

- It’s flexible and can grow with your business

Final Thoughts

Setting up Kronos Payroll might take a bit of time at first, but once it’s done, you’ll have a reliable and powerful system to manage payroll with confidence. With clear setup steps, regular checks and smart use of automation, your business can pay employees correctly and on time every time.