Investors who took part in the Laxmi India Finance IPO found themselves facing a disappointing debut on August 5, 2025. The shares were listed at a notable discount to the offer price, trading at ₹136 on the BSE, representing a 13.9% decline from the ₹158 IPO price, while on the NSE, they debuted at ₹137.52, off 12.96%.

The IPO was reasonably subscribed, closing at about 1.85–1.86× oversubscription, with strong retail participation (2.20×) and institutional interest at moderate levels. Grey market premiums also cooled to nearly flat by the listing day, signaling muted listing expectations.

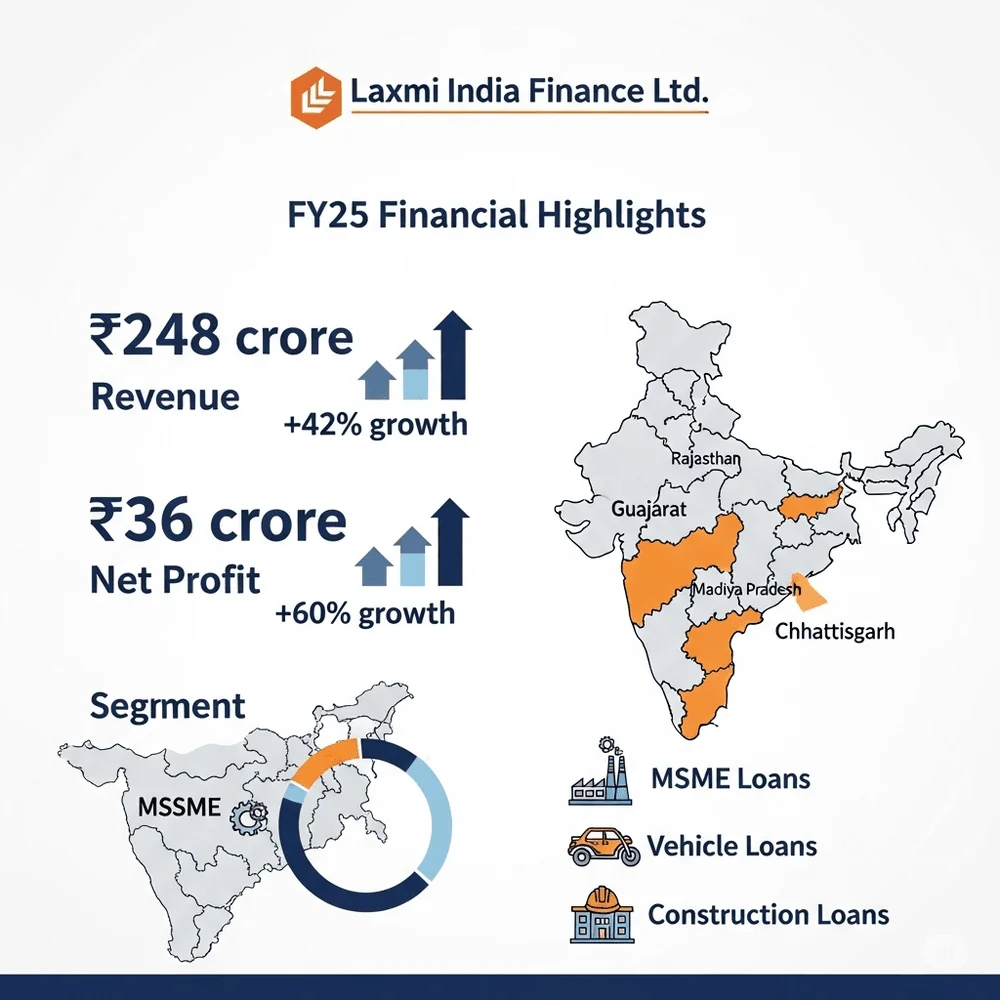

Laxmi India Finance, a Jaipur-based NBFC specialized in MSME, vehicle, and construction lending, operates in semi-urban and rural areas across Rajasthan, Gujarat, Madhya Pradesh, and Chhattisgarh. Its AUM stood at ₹1,277 crore, and the company posted FY25 net profit of ₹36 crores on revenues of ₹248 crore, showing robust YoY growth of around 60% in profit and 42% in revenue.

Key points:

- IPO size was ₹254.26 crores, comprising fresh issue and offer-for-sale, priced at ₹150–158 per share.

- Listing prices: ₹136 (BSE), ₹137.52 (NSE), both reflecting 13–14% discounts.

- IPO subscription: ~1.86× overall, retail portion 2.20×, QIB portion 1.30×.

Immediate market sentiment remained cautious. Analysts pointed out that Laxmi India Finance’s regional concentration, modest asset quality metrics, and relatively high leverage raised concerns despite its strong borrower growth and efficient operational model. Nonetheless, its hub-and-spoke branch setup, tech-enabled sourcing, and high proportion of first-time borrowers were seen as longer‑term positives.

Here is a summary table:

| Metric | Details |

| IPO Size | ₹254.26 crore |

| Price Band | ₹150–158/share |

| Listing Price (BSE) | ₹136/share (~–13.9%) |

| Listing Price (NSE) | ₹137.52/share (~–13%) |

| Subscription (Overall) | ~1.85–1.86× |

| Retail Subscription | ~2.20× |

| GMP Just Before Listing | Flattened to around ₹1 (~0.6% pop) |

| FY25 Net Profit | ₹36 crore (up ~60%) |

| AUM | ~₹1,277 crore |

For investors who subscribed at ₹158 but held through listing, the paper loss was immediate, while those tracking grey market trends may have prepared for a flat or slightly negative listing. Going forward, the trajectory depends on whether the company can deliver consistent loan growth and maintain asset quality in its targeted regions.