Managing money can be overwhelming, but with the right guidance, it gets easier. The digital tools are designed to simplify budgeting, saving, investing, and staying on top of bills. Whether you’re a student, working professional, or running a household, these apps can make a huge difference in your financial life. In 2025, there are plenty of digital tools that help you track your expenses, save money, plan your budget, invest smartly, and reduce financial stress.

Why Financial Management Matters?

Good financial management helps you stay in control of your money. It lets you plan ahead, avoid debt, and reach your goals. Whether you want to save for a home, take a vacation, or just keep up with bills, managing your money the right way makes a big difference. When you know where your money goes each month, it’s easier to spot bad habits and make changes. Tools in 2025 help you do all that with just a few taps on your phone or clicks on your laptop.

What Makes a Good Financial Tool in 2025?

Before choosing the best finance tool, it’s helpful to know what features to look for. Here are some important things modern tools offer:

- Easy to use: Apps and websites are designed for everyone, even beginners.

- Real time tracking: You can see your income, spending, and savings as they happen

- Security: Your data is protected with strong encryption and password systems.

- All in one solutions: Many tools combine budgeting, saving, investing, and bill tracking in one place.

- AI and automation: Tools use smart technology to suggest ways to save or budget better.

Let’s look at the top tools that can help you handle money the smart way.

Mint: The Classic Budget Helper (2025 Edition)

Mint has been around for years, but in 2025, it continues to be one of the best free tools for managing personal finances.

You link your bank accounts, credit cards, and bills, and Mint brings everything together. It tracks your spending by category like groceries, rent, and fun and shows how much you’re spending each month. You can set goals (like saving $1,000 in three months) and Mint will track your progress.

Mint also alerts you if you’re spending too much in a certain category. The latest version has AI tips that suggest where to cut back based on your habits.

You Need A Budget (YNAB): Build Better Habits

YNAB is all about helping you plan for the future. Instead of just tracking money, it teaches you to give every dollar a job. That means every time you earn money, you plan where it goes whether it’s rent, savings, food, or fun.

YNAB’s simple design is easy to follow. It helps you break the paycheck-to-paycheck cycle. The app also syncs with banks and credit cards and offers powerful reports to help you see how you’re improving. People who use YNAB often say they feel more in control and less anxious about money.

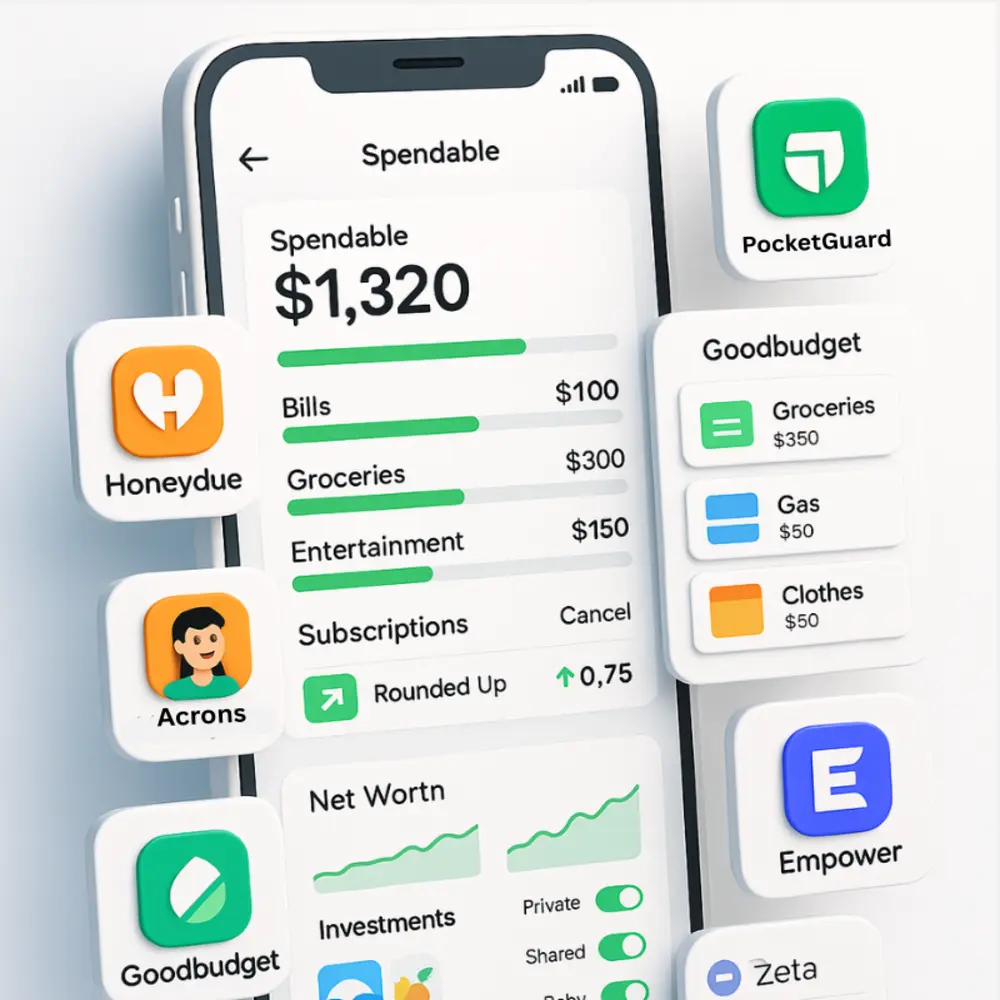

PocketGuard: Say Goodbye to Overspending

PocketGuard is perfect for people who want to stop spending more than they earn. The app shows you how much “spendable” money you have after you pay for bills, savings, and necessities.

It groups your spending into smart categories and points out subscriptions you forgot about. You can even cancel them directly from the app. In 2025, PocketGuard added new tools to help you lower bills and save automatically by rounding up purchases and placing the extra change in savings.

Goodbudget: Envelope Budgeting Made Digital

Goodbudget is based on the old envelope system where you divide cash into envelopes for each expense. Now it’s all digital. You create categories like gas, groceries, and clothes and decide how much to “put” in each. As you spend, the app subtracts the amount from each digital envelope. This method helps you stay disciplined and not overspend. Goodbudget is great for couples and families because it allows sharing across devices.

Empower: Track Wealth and Plan Your Future

Empower is a finance app that focuses on your bigger goals. It tracks your net worth, investment performance, retirement savings, and spending all in one place.

It’s ideal for people who want to go beyond monthly budgeting. Empower helps you plan for retirement, shows how your investments are doing, and even gives free financial advice.

The 2025 version offers a new “Future You” feature that lets you test how different financial decisions (like buying a car or switching jobs) will affect you in the long run.

Honeydue: Manage Money as a Couple

Money talk can be stressful in relationships, but Honeydue helps couples manage finances together without arguments.

You and your partner can link bank accounts and share what you want, like groceries and rent. You can leave notes, send emojis, and chat inside the app when expenses come up.

There are reminders for bills and monthly summaries that show who paid for what. In 2025, it also added tools for saving together for things like weddings or trips.

Zeta: Family and Shared Finance Tool

Zeta is built for families, roommates, or anyone managing shared finances. It helps divide bills, track shared goals, and plan for big expenses together.

The app is user friendly, with options to link or keep accounts private. In 2025, Zeta added a tool that helps couples plan for having kids, buying a home, or taking parental leave.

You can track personal spending separately while still staying on the same page financially with your partner or family.

Spendee: Visual Finance Tracking

Spendee is one of the most colorful and visually pleasing finance apps. It uses graphs and charts to make your money picture clear.

The 2025 version includes budgeting by wallet (cash, card, or bank), shared wallets with family members, and category based alerts.

If you prefer seeing your financial life in bright visuals instead of rows of numbers, Spendee is a fun and useful choice.

Acorns: Save and Invest Automatically

Acorns makes investing easy by rounding up your purchases and investing the spare change. Say you buy a coffee for $4.60 , Acorns will round it up to $5 and automatically invest the remaining 40 cents for you.

You can also set up recurring investments. In 2025, Acorns introduced new options for eco friendly investing and added tools for kids’ savings accounts.

It’s ideal for beginners or anyone who wants to grow money slowly and steadily without much effort.

Revolut: International Finance Made Simple

If you travel or spend money across borders, Revolut is a strong option. You can hold money in different currencies, send payments internationally, and get spending reports.

Revolut’s budgeting tools now include travel tracking, allowing you to see how much you’ve spent abroad. It also has investment tools, savings vaults, and crypto options, making it a multi-purpose finance platform.

Helpful Tips to Make the Most of These Tools

Choosing a tool is just the beginning. To really manage your money well, try these simple habits:

- Check in weekly: Make it a habit to review your budget and financial goals for 10 to 15 minutes each week to stay on track.

- Set reminders: Use alerts for bill payments so you never miss one.

- Make savings automatic: Set up auto transfers into savings, even small amounts add up.

- Use categories: Group your spending (like food, bills, fun) to spot where you can save.

- Track progress: Look at reports each month to celebrate wins and spot areas to improve.

How do These Tools Improve Everyday Life?

In 2025, finance tools do more than manage money. They reduce stress, help you sleep better, improve relationships, and even support long term dreams like owning a home or retiring early. You don’t need to be a math expert to use them. Most tools have friendly interfaces, clear reports, and smart suggestions. The earlier you start using them, the better your financial future will look.

Final Thoughts

Money management doesn’t have to be hard or boring. With the right tools, you can understand your finances, take charge of your future, and reach your goals. Whether you’re a student, parent, or small business owner, there’s a 2025 finance tool made for you.Try a few, see which one fits your lifestyle, and build a habit of checking your finances just like you check social media or emails. You’ll be amazed at how confident and calm you feel once you’re in control. Let 2025 be the year you take charge of your money with smart tools that guide you every step of the way.