Molina Healthcare is feeling the heat as ongoing medical cost pressures push it to downgrade its 2025 earnings guidance again. Just this week, the California-based insurer cut its full-year adjusted earnings outlook to “no less than $19 per share,” down from a prior midpoint of $22. This marks a sharp decline for a company already under pressure in its core government-program segments.

The main culprit? Elevated spending in its Affordable Care Act (ACA) exchange plans. Despite strong membership growth with ACA enrollments surging by 71% since late 2024, the increased healthcare demands of these members have significantly reduced profit margins.

Molina’s second-quarter adjusted earnings per share are projected at around $5.50, falling short of prior expectations and analysts’ forecasts. This mirrors a broader challenge across the industry, as peers like UnitedHealthcare and Centene report similar earnings hits tied to mismatches between healthcare cost trends and premium rates.

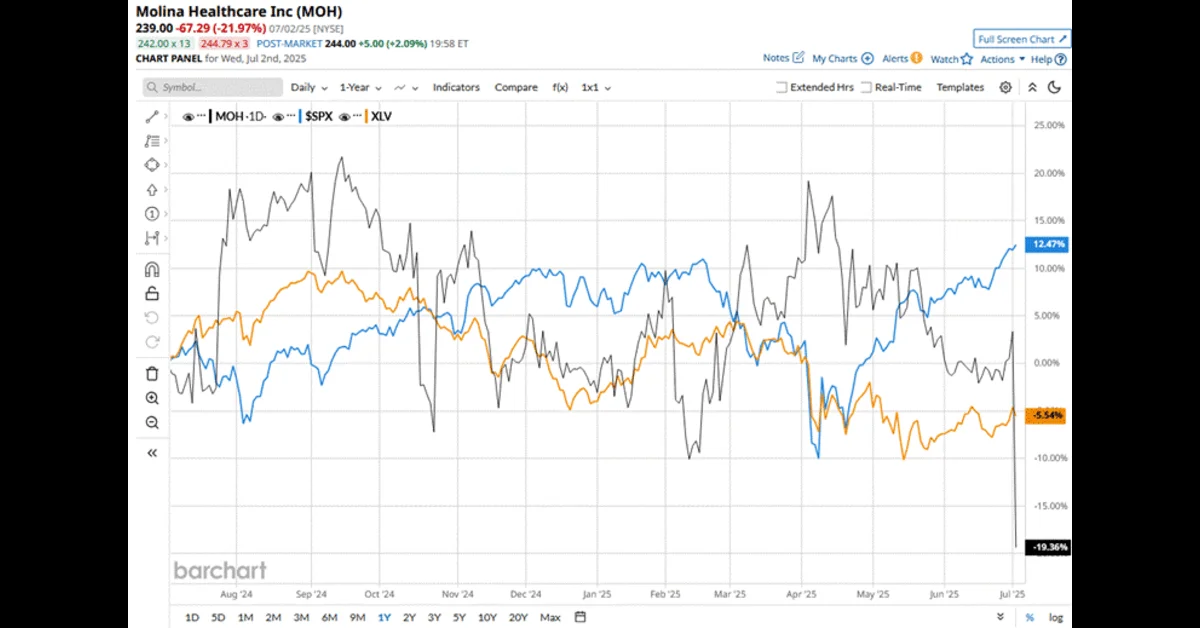

Analysts are reacting accordingly. Simply Wall St notes emerging concerns about sustained negative margins in Molina’s ACA segment, while warning of potential securities law investigations tied to earnings volatility. Another report highlights Molina entering a “technical bear phase,” suggesting caution for investors.

Despite these setbacks, Molina continues serving around 5-6 million members across Medicaid, Medicare, and ACA exchanges, providing critical coverage to underserved populations. The company is hopeful that its long-term outlook remains intact, even as it navigates this “season of great uncertainty,” to borrow CEO Joe Zubretsky’s words.

To put it simply:

- Challenge: Rising medical costs across all government program lines.

- Impact: Multiple earnings guidance reductions from ~$24.50 to now, “no less than $19.”

- Investor Reaction: Weakening sentiment, legal scrutiny, and cautious market positioning.

- Hope: Long-term fundamentals are still believed to be solid, but the short-term turbulence is real.

The company’s future success will largely hinge on controlling cost trends, improving ACA segment margins, and rebuilding investor trust.

Key Developments:

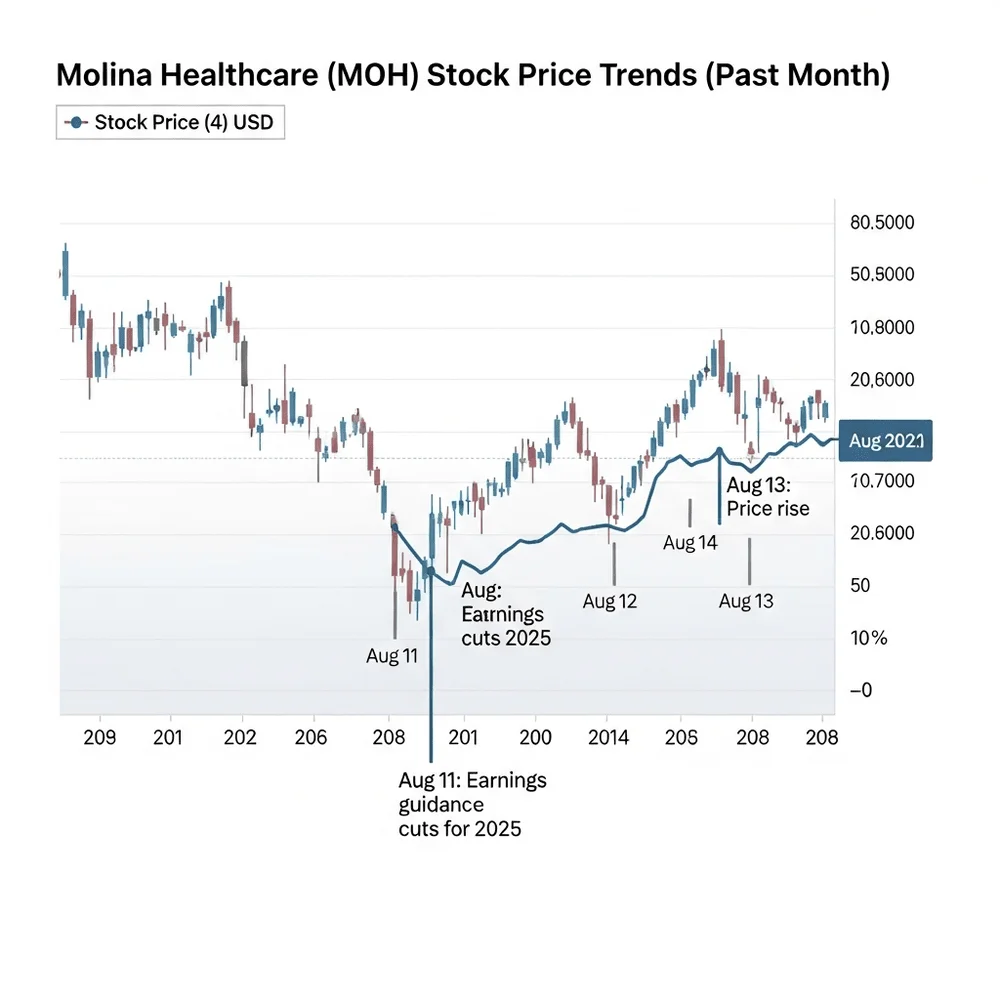

| Event | Impact on Molina (MOH) |

| Guidance cut (>10%) | Lowered FY2025 EPS outlook |

| August 13 price rise | +2.48%, but still underperforms peers |

| August 11 price drop | −1.96%, breaking recent gains |

| Broader health sector rally | Molina up >4.4% premarket amid Fed rate cut optimism |

| Institutional buying | Citigroup & others increasing stake |

| Analyst ratings update | Mixed outlook—target range: $180–$414 |