Managing money doesn’t have to be stressful. With the right budgeting app, you can take control of your finances, save more, and spend smarter all from your smartphone. Whether you’re trying to track expenses, plan for bills, or just save up for a vacation, budgeting apps can make everything easier .In this guide, we’ll explore the must have budgeting apps that help people from all walks of life organize their money better. We’ll break down what makes each app special, what features to look for, and how they help you save more in your daily life.

Why Budgeting Apps Matter?

Before we dive into the list, let’s talk about why budgeting apps are so important. It’s not just about cutting down on coffee or saying no to that extra snack. Budgeting apps help you:

- See where your money goes every month

- Organize your spending in advance to ensure you always have money left until your next paycheck arrives

- Develop smart financial habits such as setting aside money consistently and gradually paying down your debts

- Reach goals like buying a car, going on a trip, or building an emergency fund

The best part? Many of these tools come at little to no cost, making them accessible for nearly every budget. And once you get started, you’ll wish you’d used them sooner.

Mint: The All In One Budgeting Tool

Mint stands out as a top rated budgeting app, and its popularity is well earned.. It connects to your bank accounts, credit cards, loans, and even investment accounts to give you a full picture of your financial life.

Key Features:

- Automatically tracks your spending

- Sends alerts when bills are due

- Creates a personalized monthly budget that reflects your unique spending patterns.

- Offers free credit score checks

Mint is ideal for people who want a hands off budgeting experience. You just connect your accounts, and it does most of the work for you. It’s also great for beginners who are just starting to learn about managing money.

YNAB (You Need A Budget): For Serious Money Planners

If you’re ready to take full control of your money, YNAB is for you. It uses a “zero based budgeting” system, which means every dollar you earn has a purpose even before you spend it.

Why People Love YNAB:

- Helps break the paycheck to paycheck cycle

- Encourages saving for future expenses like car repairs or gifts

- Allows detailed tracking of every category

It takes a bit of time to learn, but YNAB offers tutorials and support. While it’s not free, many users say it’s worth every penny because it helps them save hundreds or even thousands each year.

Goodbudget: Envelope Budgeting Made Easy

Remember the old envelope system where you’d put cash in different envelopes for groceries, gas, or fun? Goodbudget brings that idea to your phone.

Best For:

- Couples and families sharing a budget

- People who like manual tracking

- Simple, clear spending categories

Instead of linking to your bank, you manually enter your income and spending. This makes you more aware of your choices. It also works well if you want to share a budget with a partner or family member.

PocketGuard: Stop Overspending

PocketGuard is perfect for people who want to know, “How much can I spend right now?” It automatically tracks your income, bills, and savings goals to show you what’s left to spend.

Why Use PocketGuard:

- Shows your “safe to spend” amount

- Finds subscriptions you forgot about

- Helps lower your bills by suggesting better deals

It’s ideal for anyone who finds themselves overspending or unsure where their money goes. The app does a lot of the thinking for you.

EveryDollar: Simple and Clean Budgeting

EveryDollar is a great app for anyone who wants a clean layout and easy setup. Created by financial expert Dave Ramsey, it’s designed around giving every dollar a job.

What Makes It Great:

- Drag and drop budget planning

- Syncs with your bank (in the paid version)

- Quick and easy to understand

Even the free version offers a solid budgeting system. If you like to plan your month out in advance and stay organized, EveryDollar is a great choice.

Spendee: Beautiful Interface, Shared Wallets

If design matters to you, you’ll love Spendee. It has one of the nicest layouts among budgeting apps and offers easy options for shared wallets.

Good For:

- Visual thinkers

- Families managing shared expenses

- Multi-currency tracking (great for travelers)

Spendee also lets you upload cash receipts and analyze your habits with visual graphs. It makes money management feel less like work.

Zeta: Budgeting for Couples

Zeta is made specifically for couples. Whether you’re dating, living together, or married, this app helps you healthily handle shared finances.

Why Couples Love Zeta:

- Combines shared and personal budgets

- Split expenses easily

- Chat feature to talk about money inside the app

Zeta makes it easier to talk about money and avoid common misunderstandings. It supports all relationship types and even offers a joint bank account option.

Wally: Smart Expense Tracking

Wally focuses on tracking every rupee, dollar, or euro you spend. It’s ideal for people who love digging into numbers or want to track multiple currencies and locations.

Features:

- Manual or automatic entry

- Currency conversion

- Budget planning and goal setting

It’s especially useful for freelancers, digital nomads, or people working across borders.

Honeydue: Budgeting for Couples Made Fun

Like Zeta, Honeydue is designed for partners managing money together. But it also adds a bit of fun and playfulness.

Highlights:

- Send messages about purchases

- Share bill reminders

- Choose what to keep private

You and your partner can each keep your own accounts but still see the full picture together. It helps build better communication around money.

Fudget: Simple Budgeting Without Extras

If you want something fast, simple, and distraction free, Fudget is a good pick. It doesn’t link to your bank or offer complex graphs. Just input your income and expenses, and that’s it.

Great For:

- Beginners

- People who prefer not to link accounts

- Quick daily spending tracking

Fudget works offline and is available on all devices. It’s like a digital notepad for your money.

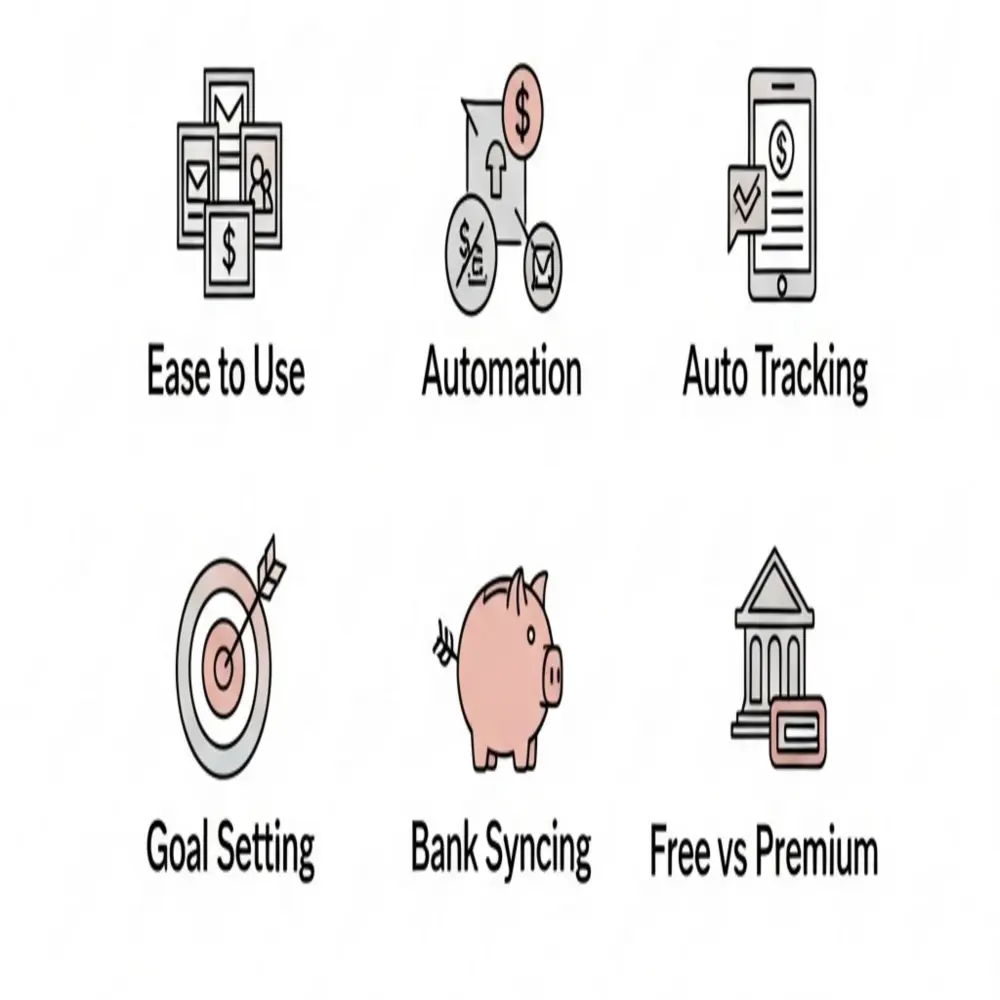

What to Look for in a Budgeting App?

Not all budgeting apps are the same. Here’s what to consider before choosing one:

- Ease of Use: Can you understand it quickly without reading a manual?

- Automation: Does it track your expenses and bills automatically?

- Goal Setting: Can you set savings goals or debt payoff plans?

- Bank Syncing: Do you want it to link with your accounts or enter info manually?

- Cost: Does the app come at no charge, or are you comfortable investing in additional premium features?

- Privacy: Does it use encryption and safe logins to protect your data?

Try a few apps for a week or two and see what works best for you. The majority of these apps provide either a no-cost version or a limited time trial to help you explore their features before committing.

Tips to Save Even More with Budgeting Apps

Just having an app won’t make you save more. Here’s how to get the most out of any budgeting tool:

- Check it daily: Just as you brush your teeth daily, get into the routine of reviewing your finances regularly.

- Set small weekly goals: Try saving just $5 or cutting one expense per week.

- Turn on alerts: Let the app warn you if you’re spending too fast.

- Review your categories: Take a closer look could your budget be slipping due to frequent online purchases or regular takeout orders?

- Celebrate small wins: Saved $20 this week? That’s awesome!

Final Thoughts

Budgeting apps are like having a personal money coach in your pocket. They show you the truth about your finances and help you make smarter choices without stress or judgment. Whether you want to fix bad habits, save for something special, or just stop living paycheck to paycheck, there’s an app that can help you do it. The key is to start. Pick one app, test it for a week, and watch how even small changes can lead to bigger savings and more peace of mind.