Netweb Technologies’ share price has had a notable performance recently, driven by strong AI demand and solid Q1 financial results. Following the release of June 2025 quarter earnings, the stock jumped approximately 13% intraday, touching Rs 2,295 on BSE before paring gains. As of early August, the stock was trading around Rs 2,220–2,225, down roughly 3–3.5% from the previous close of Rs 2,304.10, reflecting profit‐taking after the sharp rally.

The quarterly results were impressive: net sales surged over 100 % year‑on‑year (up from about Rs 150 Cr to Rs 301 Cr), while net profit doubled to about Rs 30 Cr, buoyed by explosive growth in the AI segment, which grew nearly 300 % year‑on‑year. Margin metrics also improved materially, reinforcing confidence in scalable profitability.

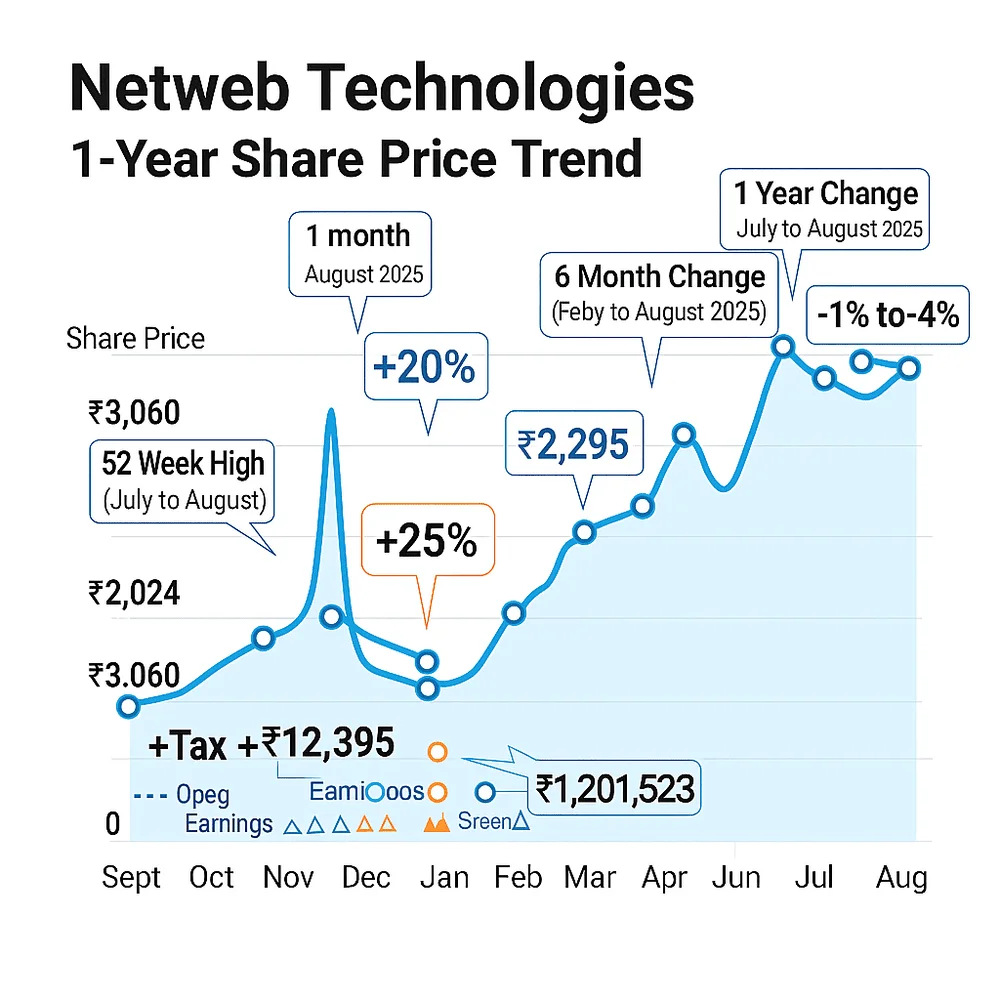

From a broader perspective, the stock has delivered strong medium‑term returns: up over 20 % in the past month and climbing more than 25 % in the last six months. However, on a 12‑month basis, it remains down by about 1–4 % (depending on the data source) from its 52‑week peak of Rs 3,060 achieved in November 2024. The one‑year low stands at approximately Rs 1,251.55.

On the fundamentals front, Netweb is trading at a price‑to‑book ratio of around 24.5× and a P/E of 97–100× earnings. The company is essentially debt‑free, with interest expense below 1 % of revenue, and delivers a healthy return on equity of around 24 % with consistent net profit growth over recent years. It announced a modest dividend of Rs 2.5 per share in May 2025, payable in August 2025.

Analysts have generally maintained a ‘buy’ or ‘strong buy’ stance, although consensus price targets imply limited upside (~0.6 % from current levels). The stock was also featured in a recent RSI momentum scan by ET Markets, showing a rising RSI above 60, suggestive of strengthening technical momentum.

To sum up:

- Q1 FY26 earnings beat expectations with AI‑led growth

- Stock surged ~13 % intraday, then corrected about 3–3.5 %

- Strong price returns over 1‑6 months, modest decline over 12 months

- Rich valuations, strong fundamentals, dividend policy, and technical signals

- Analyst ratings positive, but limited near‑term upside implied

This blend of robust earnings, increasing investor attention to AI infrastructure, and improved technical momentum could support sustained interest in Netweb’s stock, particularly for growth‑oriented investors comfortable with high valuation multiples.