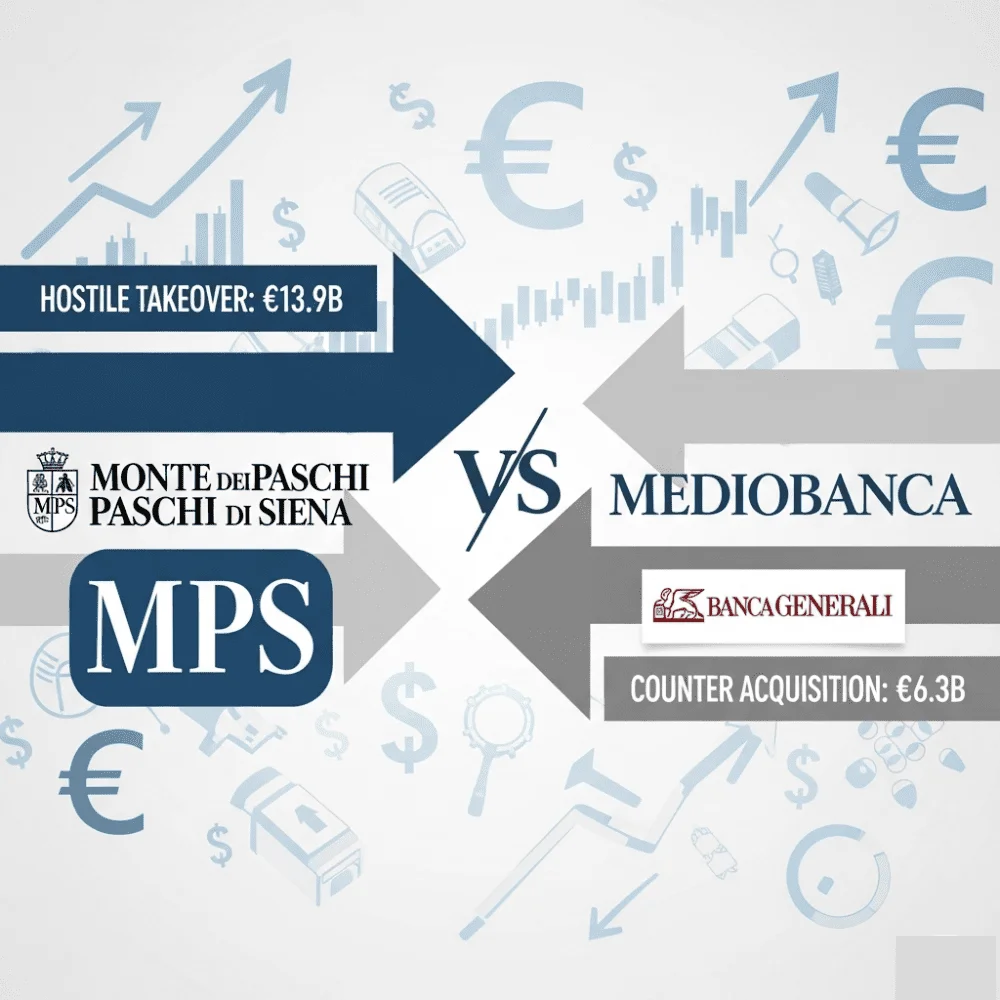

The Italian banking sector is in the spotlight as Monte dei Paschi di Siena (MPS) and Mediobanca remain locked in a corporate standoff that could reshape the country’s financial industry. Earlier this year, MPS launched a €13.9 billion all-share hostile takeover bid for Mediobanca, aiming to strengthen its retail banking presence and consolidate market power. The European Central Bank gave its approval, enabling MPS to move ahead with the proposal. However, Mediobanca’s board unanimously rejected the proposal, calling it undervalued and misaligned with the bank’s long-term strategy.

To counter the move, Mediobanca has put forward its plan to acquire Banca Generali in a €6.3 billion transaction through a share-swap deal. This acquisition is designed to reinforce Mediobanca’s wealth management arm and position it as Italy’s second-largest wealth manager. The ECB has already approved this acquisition, and a decisive shareholder vote is set for August 21, which will likely determine the direction of Mediobanca’s future.

Key details of the rival strategies can be seen below:

| Bank | Strategic Move | Deal Value | Regulatory Status | Expected Impact |

| MPS | Hostile takeover of Mediobanca | €13.9 billion | ECB approved | Expand retail banking footprint |

| Mediobanca | Acquisition of Banca Generali | €6.3 billion | ECB approved | Become Italy’s 2nd-largest wealth manager |

Market analysts say the situation is emblematic of a wider wave of consolidation in Europe’s banking sector, where scale and diversification are becoming vital to survival. While MPS is betting on expanding its traditional banking footprint, Mediobanca is doubling down on wealth management and investment banking to create a more resilient model.

Several crucial points stand out for investors and market watchers:

- Mediobanca’s rejection of the MPS bid highlights its desire to remain independent.

- Shareholder advisory firms such as Glass Lewis are backing Mediobanca’s Banca Generali deal.

- Influential families with stakes in Mediobanca and Generali are expected to play a decisive role in the shareholder vote.

- Investor sentiment has favored Mediobanca’s counter-strategy, with shares rising after the Banca Generali deal was announced.

The outcome of this battle will not only decide the fate of two of Italy’s most important financial institutions but also influence the broader trajectory of the Italian banking industry. With consolidation trends accelerating, both domestic and European rivals will be watching closely to see whether scale through retail dominance or strength in wealth management emerges as the winning model.