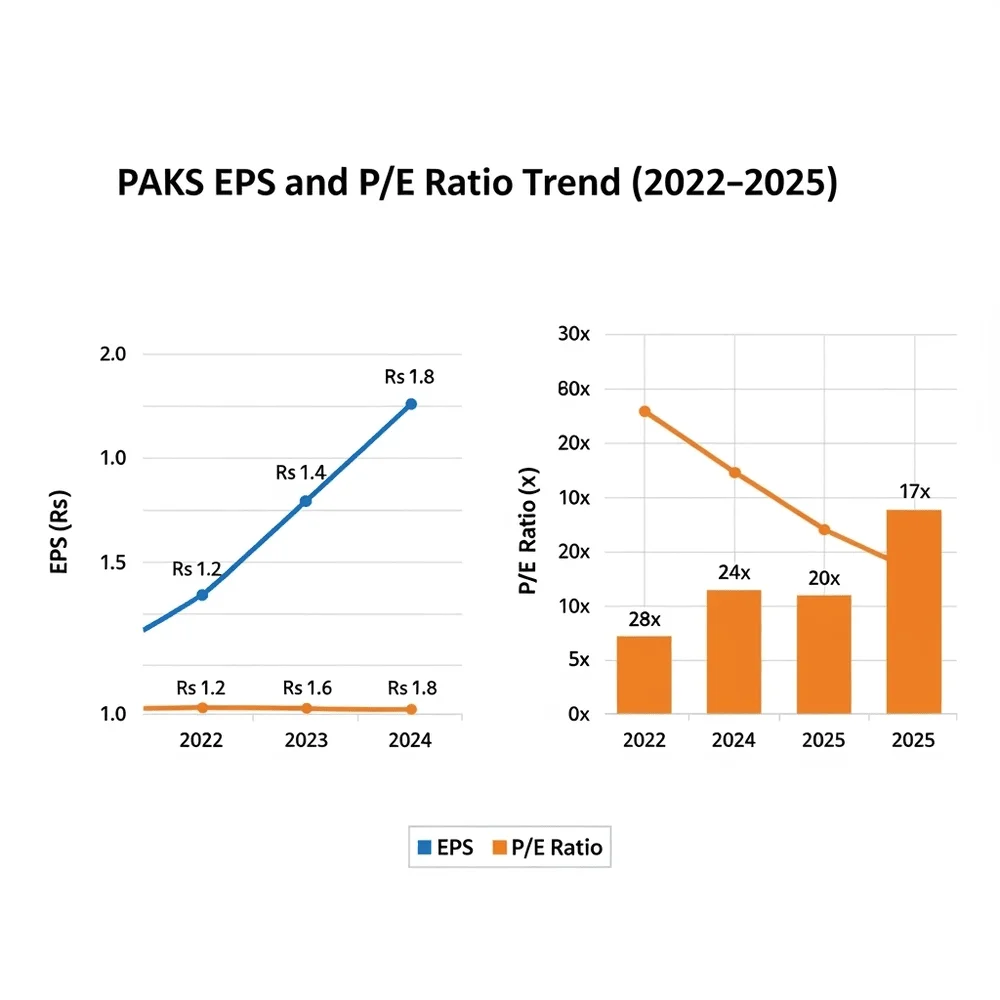

Pakistan’s earnings per share (EPS) have shown steady growth over the past year, with the trailing twelve‑month EPS of Pakistan Stock Exchange Ltd (PAKS) now standing at approximately ₨ 1.69–1.80 per share as of March 2025. Given the current share price of ₨ 30.13, the corresponding price-to-earnings (P/E) ratio falls between 16.7 and 17.8, indicating that the stock is trading at a significantly lower valuation compared to its historical average, which typically ranged between 29 and 30.

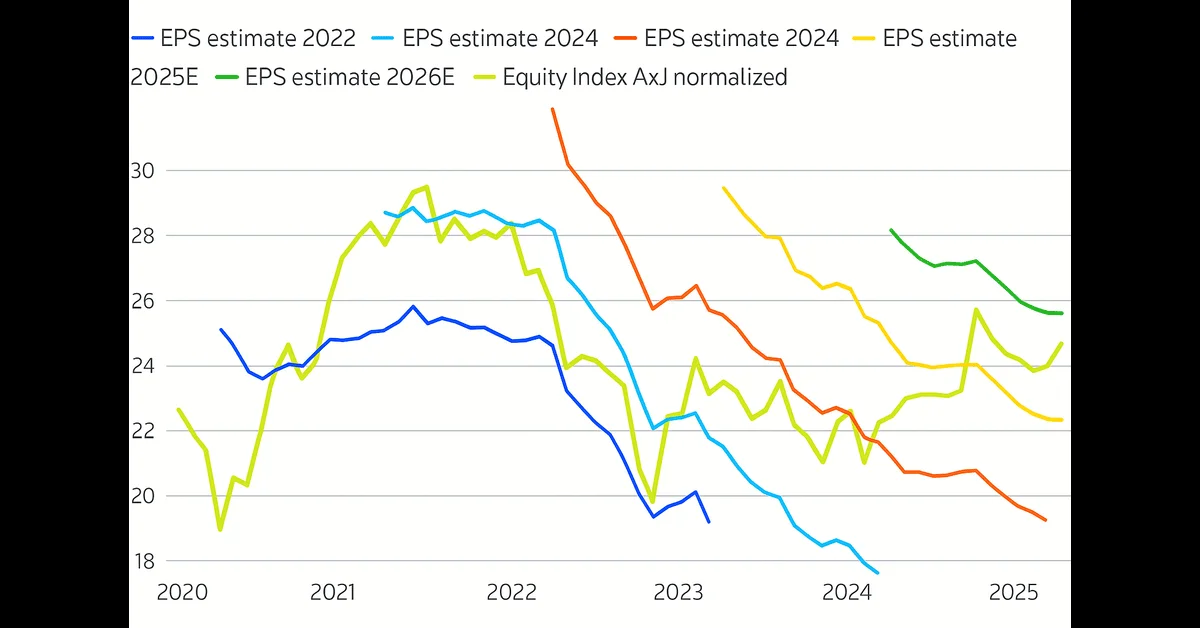

Over the last three years, revenue growth among Pakistani-listed companies averaged 15% annually, while EPS grew at about 6.5% annually. This pattern reflects a market where sales are increasing faster than profitability, pointing to margin pressures, cost of capital, and currency factors influencing bottom‑line growth.

The latest earnings reports reveal varied performance results across different industry sectors. For instance, cement companies and oil‑and‑gas firms delivered strong topline numbers, but net margins remain tight due to high input and finance costs. Financial firms also faced challenges from rising interest rates, which squeezed spreads and limited EPS expansion.

The overall low P/E ratio of the market is viewed positively by some analysts. A forward P/E ratio near 5×, although unusual in emerging markets outside crisis conditions, has historically preceded strong returns over the following two to three years, with past data showing average gains of 20–30% annually when P/E remained one standard deviation below the historical average.

Investors’ confidence has also been boosted by macroeconomic signals, including improving exports and remittances, easing inflation trends, and a renewed push toward IMF- and investor-friendly fiscal reforms. These factors collectively support expectations of earnings growth and upward re‑rating in valuations.

In summary:

- PAKS EPS is ₨ 1.69–1.80 TTM, with a current P/E around 17×, below long‑term medians.

- Company‑level EPS growth lags revenue growth, reflecting margin pressures.

- Very low market valuations historically led to strong multi‑year returns.

- Macro tailwinds (export growth, IMF support, inflation easing) could spur EPS recovery and rerating.

Key EPS metrics:

| Metric | Value |

| EPS (TTM PAKS) | ₨ 1.69–1.80 |

| Share Price | ₨ 30.13 |

| P/E Ratio | ~16.7–17.8× |

| Historical Median P/E | ~29–30× |

| Revenue Growth (3‑yr CAGR) | ~15% annually |

| EPS Growth (3‑yr CAGR) | ~6.5% annually |

With valuations still low and macro trends turning constructive, analysts see EPS recovery and multiple expansion as key drivers for potential market upside in the near to medium term.