In the world of medical billing, insurance denials are a common challenge. One of the denial codes that often confuses people is CO 22. If you’re new to billing or just trying to understand what this code means, don’t worry, this guide will walk you through everything in plain, simple language.

Why Insurers Use CO-22 Denial Code?

The CO 22 denial code stands for “Covered services are not payable under the terms of the patient’s insurance plan.” That’s a formal way of saying that the insurance company doesn’t cover the bill if the service falls outside the patient’s current plan benefits. This might seem frustrating at first, but the good news is that it’s often fixable.

Breaking Down CO 22 Denial Code

Let’s break this down to understand the core idea better. When a healthcare provider bills an insurance company for a service, the payer checks if the service is covered under the patient’s policy. If the service isn’t covered, the insurer rejects the claim and assigns the CO 22 denial code.

Here are a few key reasons why this may happen:

- The service is not included in the insurance policy

- The patient’s plan excludes that type of care

- The provider is not in-network, and the plan doesn’t cover out-of-network care

- Pre-authorization was required but not obtained

- The patient is covered under another plan for that service

Real-World Example

Let’s say a patient goes for a routine dental cleaning and the provider bills the service to their medical insurance instead of their dental plan. The claim would likely be denied with CO 22 because the medical plan doesn’t cover dental services.

Why Insurance Companies Use Denial Codes?

Insurance companies use codes like CO 22 to communicate clearly why a claim was denied. It helps billing departments quickly identify the problem and take steps to fix it. Without these codes, understanding denials would be much more complicated and time-consuming.

Common Situations That Trigger CO 22

There are several common scenarios where a CO-22 denial might occur. Below are a few examples:

- Non-Covered Service: The service is not listed in the patient’s plan benefits

- Out-of-Network Provider: The provider is not approved under the plan’s network

- Missing Referral or Authorization: Some plans need referrals or pre-approvals

- Plan Coverage Limitations: Some benefits have yearly or lifetime limits

- Incorrect Insurance Billed: The provider billed the wrong insurance company

- Coordination of Benefits (COB): The patient has more than one policy, and this one is not primary

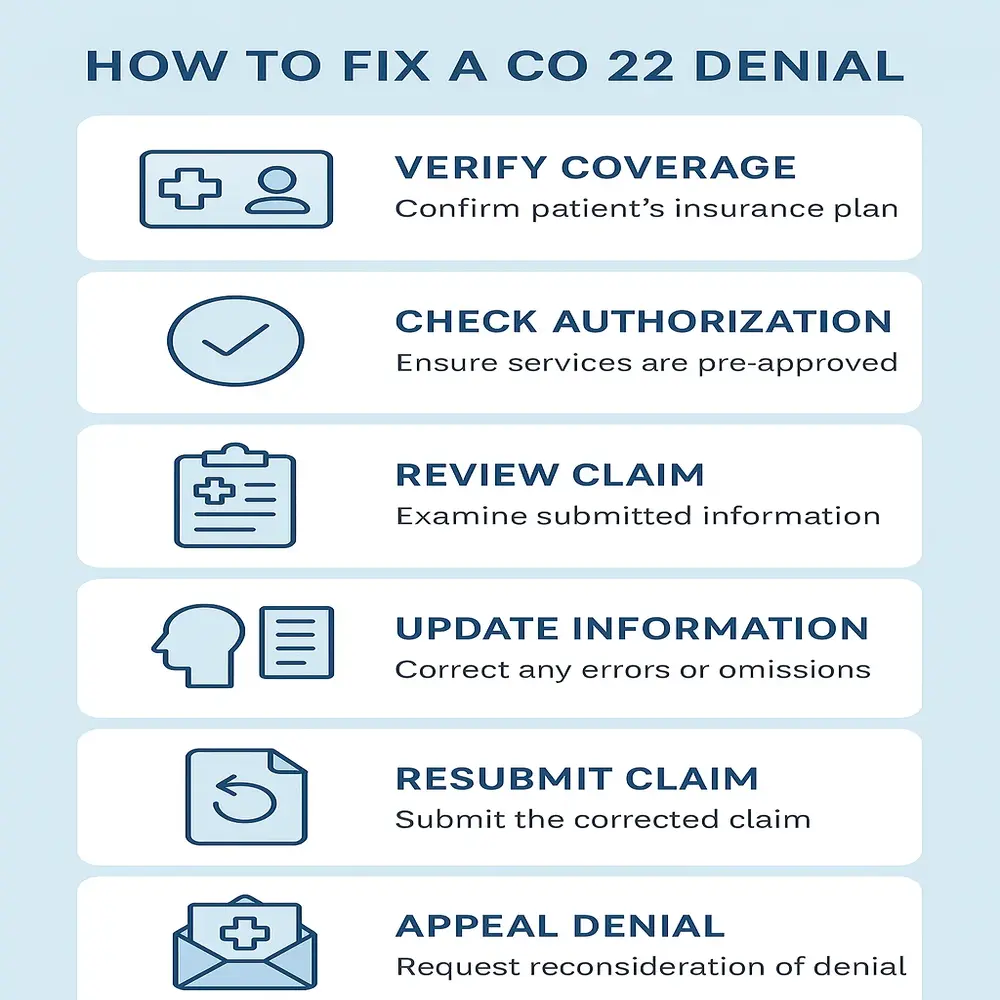

How to Fix a CO 22 Denial?

Now that you know what CO 22 means, the next logical step is figuring out how to resolve it effectively.

Fixing a CO 22 denial often requires some investigation and communication. Here are some steps to take:

1. Verify Insurance Coverage

Before anything, double-check the patient’s benefits. You can:

- Call the insurance company

- Check the online portal

- Review the Explanation of Benefits (EOB)

2. Check for Prior Authorization

If the service required prior approval and you didn’t obtain it, that may have caused the denial.

3. Confirm Provider Network Status

Verify that the provider participates in the patient’s insurance network to avoid non-covered charges.

If not, explain the situation to the patient and discuss next steps.

4. Review the Claim for Errors

Sometimes, a simple typo can cause big issues. Make sure:

- You billed the right insurance.

- You used the correct service codes.

- The patient’s information is accurate

5. Contact the Patient

If the denial is due to the type of coverage, the patient might need to:

- Contact their HR department (for employer plans)

- Check whether you should bill another insurance plan.

- Update their insurance information

6. Submit a Corrected Claim or Appeal

If you find a fixable error, submit a corrected claim. If you’re confident the service is covered, gather your documents and file an appeal.

Tips to Prevent CO 22 Denials

You can often avoid CO 22 issues, which helps you prevent payment delays and reduce stress. Use these practical steps to minimize the risk of receiving a CO 22 denial:

- Verify insurance details during every visit

- Keep patient records up-to-date

- Educate patients on their coverage

- Use eligibility verification tools

- Train your billing staff on common denial reasons

- Check for prior authorizations before services

Coordination of Benefits (COB) & CO 22

In cases where patients have multiple insurance plans, it’s critical to understand which plan is primary. The insurance company may issue CO 22 when you bill the secondary plan before the primary one. Always make sure to verify the COB status to avoid unnecessary denials.

Can the Patient Be Billed After a CO-22 Denial?

This is a very important question. Whether the provider can bill the patient depends on why the payer denied the claim and what the contract states.

- If the provider is in-network, you usually cannot bill the patient for non-covered services unless the patient signed an Advance Beneficiary Notice (ABN) or similar document

- The insurance company may hold the patient financially responsible when the provider is out-of-network, depending on the plan’s terms.

Always check the terms of the contract and follow the rules strictly to avoid compliance issues.

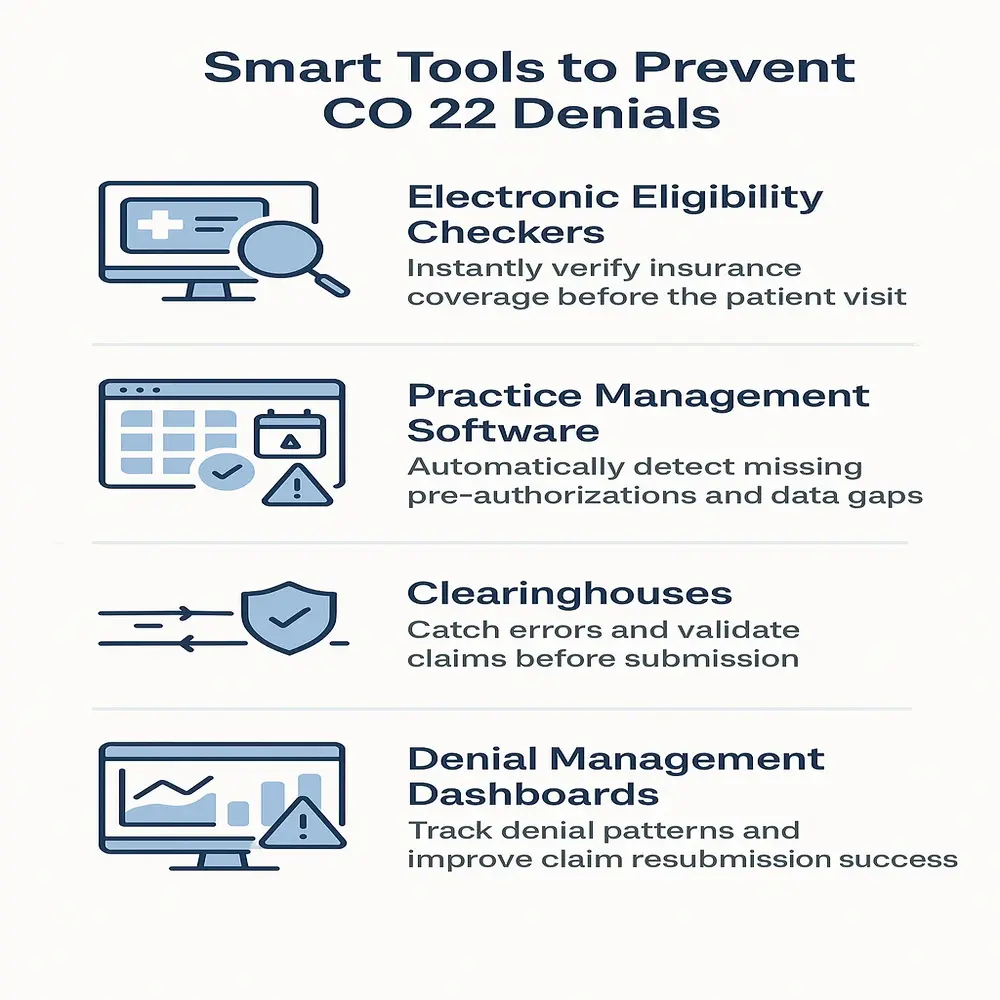

Tools That Can Help

Here are a few tools and systems that can help manage and prevent CO-22 denials:

- Electronic Eligibility Checkers: Instantly verify coverage before visits

- Practice Management Software: Flags missing authorizations

- Clearinghouses: Alert you to errors before claims go out

- Denial Management Dashboards: Help track and analyze denial trends

Final Thoughts

The insurance company denies the claim with CO 22 when the patient’s plan doesn’t cover the service, but you can often fix it by taking the right steps. By verifying coverage early, educating staff, and using billing tools, providers can reduce denials and improve claim success. Fast follow-up and proper documentation are crucial for resolving issues and maintaining a smooth revenue cycle.