The Sarbanes-Oxley Act (SOX) is a U.S. law passed in 2002 to ensure honest financial reporting by companies. It was introduced after scandals like Enron and WorldCom, where false profit reports and hidden debts led to major losses. SOX aims to protect investors and restore trust by setting strict rules for corporate financial practices and accountability.

Why Was SOX Created?

Before SOX, companies had few rules for financial reporting, which allowed some to manipulate numbers, hide losses, or show fake profits. This led to investor losses, job cuts, and a loss of public trust. SOX was introduced to prevent such practices by requiring transparent, accurate, and honest financial reporting.

What Does SOX Cover?

The Sarbanes-Oxley Act has many sections, but its main focus is to improve how companies report financial information. Here are the key things SOX requires:

- Companies must keep accurate records of their financial activity.

- They must create and maintain internal checks (called internal controls) to catch errors or fraud.

- Company leaders, such as the CEO and CFO, must personally verify the financial reports.

- Financial information must be shared on time and reported honestly.

- Employees who report illegal actions inside the company, called whistleblowers, must be protected.

These rules help make the financial system more trustworthy.

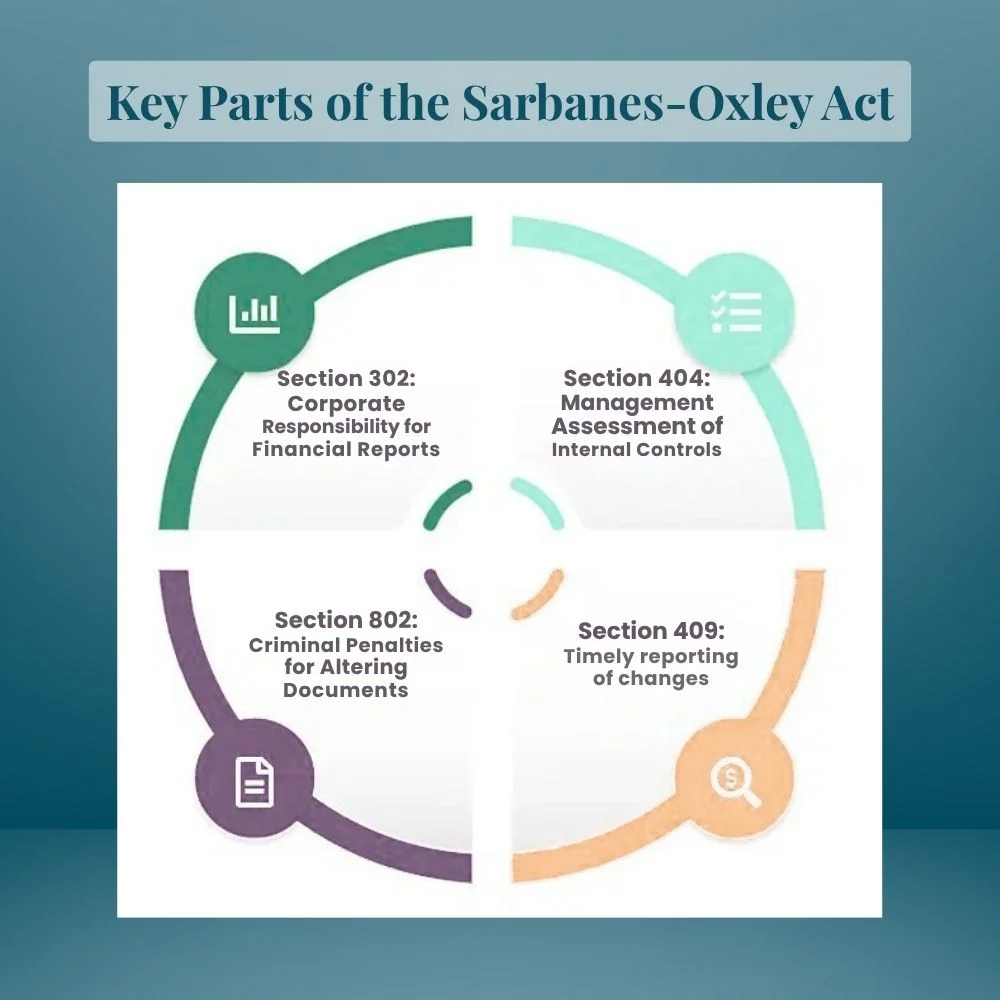

Main Parts of the SOX Law

Although the Sarbanes-Oxley Act includes numerous sections, certain parts stand out as particularly significant. Here’s a look at the most well-known ones, explained in a simple way:

Section 302: Responsibility of Company Leaders

This section says that top executives, like the CEO and CFO, must sign off on financial reports. They are legally responsible for the information shared with the public. If the reports are false, they can face legal punishment.

Section 404: Internal Control Reports

This is one of the most important and also the most difficult parts of SOX. It says that companies must create and test internal systems that check the accuracy of their financial reports. Each year, they must show proof that these systems are working well.

Section 409: Timely Reporting of Changes

Companies must inform the public quickly when something major happens that could affect their finances. This way, investors are kept updated and can make better decisions.

Section 802: Punishment for Destroying Records

This section outlines what happens if someone tries to delete or hide important documents. If they do, they can face fines or even jail time.

How It Protects Investors?

The Sarbanes-Oxley Act protects investors by making sure companies are truthful and transparent about their financial performance. It helps prevent fraud and misleading reports that could lead to major financial losses for shareholders.

Key ways SOX protects investors include:

- Verified Financial Reports: Company leaders must personally certify that financial statements are accurate, reducing the risk of false information.

- Stronger Internal Controls: SOX requires companies to create internal systems that catch errors or dishonest practices before they reach investors.

- Timely Disclosures: Investors are quickly informed of major events that may affect a company’s financial health, allowing them to make better decisions.

- Whistleblower Protection: Employees who report fraud are legally protected, which helps uncover problems early and keeps companies honest.

- Harsher Penalties: Executives who intentionally mislead investors can face serious legal action, making fraud less likely.

These rules help create a safer and more trustworthy environment for anyone investing in public companies.

Who Needs to Follow SOX?

SOX applies mainly to public companies in the United States. These are businesses whose shares are traded on stock markets such as NASDAQ or the New York Stock Exchange (NYSE).It also includes:

- Accounting firms that check public companies’ financial records

- Employees and executives in public companies

- Foreign companies that are listed on U.S. stock exchanges

Private companies do not have to follow SOX, but some choose to follow parts of it to show they are trustworthy.

How SOX Helps Everyone?

SOX was made to protect people, and it has done just that. Here are a few ways it helps:

- Improves Trust: Investors feel more confident knowing that financial reports are accurate.

- Prevents Fraud: The risk of being caught and punished keeps companies honest.

- Protects Whistleblowers: Employees can report illegal activities without fear.

- Creates Safer Workplaces: When finances are in order, companies are more stable. Companies must hold on to records for several years, which helps in audits and investigations.

Challenges of SOX Compliance

While SOX has many benefits, it can also be hard for companies to follow. Setting up systems and controls costs time and money. Small businesses may not have the staff or budget to manage everything SOX requires. Some of the main challenges include:

- The high cost of meeting Section 404 requirements

- The need to train employees

- Staying updated with rules and standards

- Regular checks and audits to stay compliant

Despite its difficulties, the advantages usually surpass the challenges.

Using Technology for Compliance

Thanks to modern tools and software, many companies use technology to make SOX compliance easier. This includes:

- Automated tracking systems for financial data

- Secure cloud storage for saving records

- Audit management tools

- Real-time monitoring of internal controls

These tools streamline processes and minimize the risk of human mistakes.

What Happens If Companies Break Sarbanes-Oxley Act (SOX) Rules?

If a company doesn’t follow Sarbanes-Oxley Act (SOX) rules, there are serious consequences. These can include:

- Large fines

- Criminal charges for executives

- Loss of investor trust

- Reputation damage

- Stock value drop

SOX ensures that breaking the rules comes with real penalties to keep companies in check.

Real-Life Impact of Sarbanes-Oxley Act (SOX)

After SOX was introduced, companies became much more careful. Here are a few examples:

- The creation of SOX was largely driven by the corporate scandals involving Enron and WorldCom. Their leaders were punished, and the companies went bankrupt.

- After SOX, many companies changed how they reported finances and worked harder to avoid mistakes.

- The law also led to the creation of the Public Company Accounting Oversight Board (PCAOB), which watches over auditors.

Tips for Staying Compliant

For companies trying to stay within SOX rules, here are a few simple tips:

- Stay organized: Keep all records up to date and easy to access.

- Check systems regularly: Make sure internal controls are working.

- Train your team: Everyone should know what to do and what not to do.

- Leverage reliable software: Efficient tools can help streamline tasks and minimize mistakes.

- Get help: Experts and auditors can guide the process.

Final Thoughts

The Sarbanes-Oxley Act (SOX) plays a major role in protecting people’s money and restoring trust in the financial world. Although it adds responsibility to companies, it also improves their systems and helps prevent major scandals. SOX reminds businesses that they must be honest, transparent, and accountable in all financial dealings.

Whether you are a business owner, an investor, or someone interested in how companies operate, knowing about Sarbanes-Oxley Act (SOX) gives you a better understanding of how modern businesses stay responsible and ethical