Turnover in business means the total income a company makes by selling its products or services within a certain time frame. It’s often called revenue, sales or gross income. It doesn’t include things like interest income or money from selling assets it’s purely from selling what your business offers.

Why Turnover in Business Matters?

Turnover is like the heartbeat of your business it tells you how well your company is selling. Understanding turnover helps in:

- Measuring market demand: High turnover shows strong customer interest.

- Tracking growth: Comparing turnover over time reveals whether your business is expanding or slowing.

- Planning finances: Investors, banks and partners look at turnover to assess stability and scale.

- Budgeting: It gives a clear picture of how much money is coming in before spending.

Simply put, turnover shows how much money is flowing in, which helps you plan what comes next.

How to Calculate Turnover?

Calculating turnover is easy. Just use this basic formula:

Turnover = Sales Revenue – Discounts – Returns – Sales Taxes

For example, if you sold 1,000 items at $50 each, but gave $2,000 in discounts and accepted $1,000 in returns, turnover is:

- Gross sales = 1,000 × $50 = $50,000

- Less discounts/returns = $3,000

- Turnover = $47,000

This figure shows the actual money your business earned from its core activity.

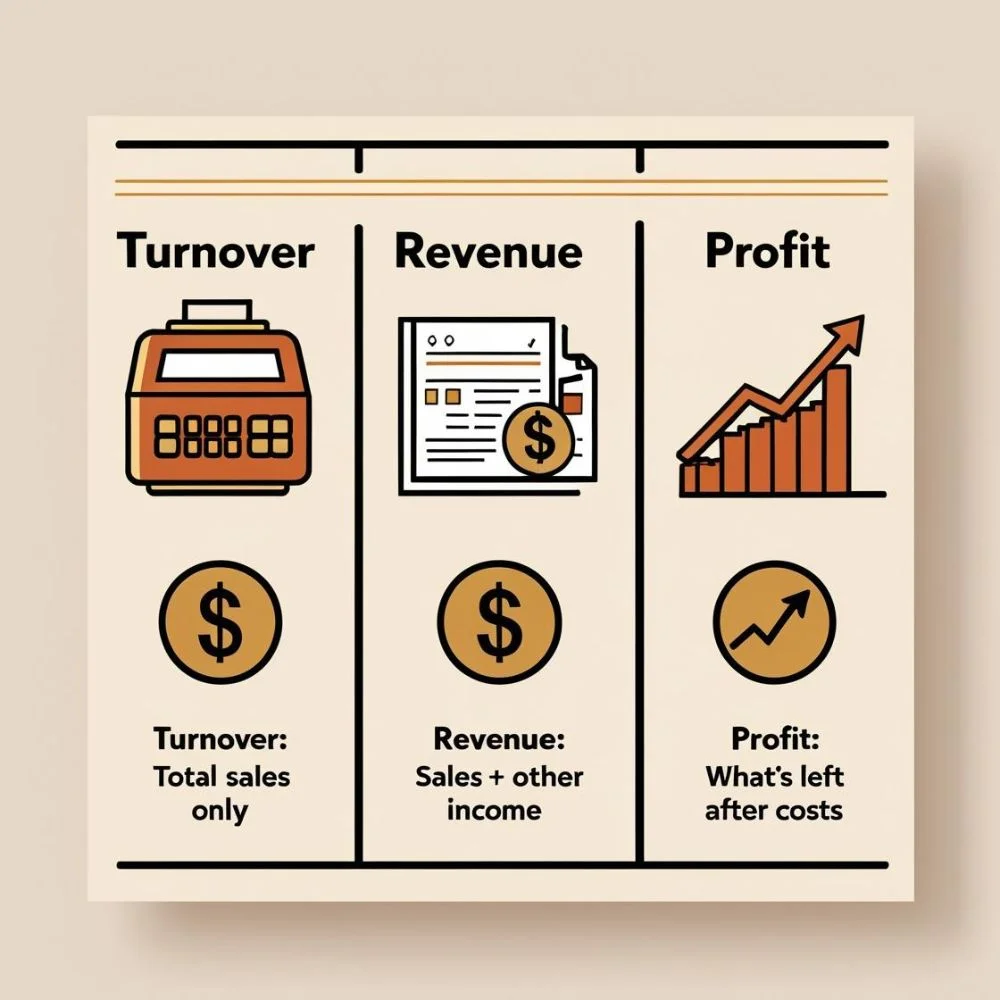

Turnover vs Revenue vs Profit

People often confuse these terms, but they each have different meanings.

- Turnover (Revenue): Total sales income before taking out any costs.

- Gross Profit: Turnover minus the direct cost of making products or services known as Cost of Goods Sold (COGS).

- Net Profit: What’s left after deducting all expenses like rent, salaries, utilities, taxes.

In short

- Turnover tells how much you made.

- Profit tells what you kept.

High turnover is good, but if your costs are too high, profit may still be low.

Types of Turnovers in Business

Turnover isn’t only about sales. Here are other types:

1. Inventory Turnover

- Shows how often you sell and replace stock.

- Formula: COGS ÷ Average Inventory.

2. Accounts Receivable Turnover

- Measures how quickly customers pay their bills.

- Formula: Credit Sales ÷ Average Receivables.

3. Asset Turnover

- Shows how well your business uses its assets to generate income from sales.

- Formula: Revenue ÷ Average Total Assets.

4. Employee Turnover (Staff Turnover)

- How often employees leave and are replaced.

- Formula: (Number of Leavers ÷ Average Staff) × 100%.

Each type gives different insights into how parts of your business are performing.

How to Use Turnover Data?

Knowing turnover is useful in many ways:

- Bank loans or funding: Lenders often ask for turnover figures to assess credit risk.

- Insurance quotes: Some premiums depend on turnover.

- Compliance: Tax forms and annual reports usually require turnover data.

- Analyzing performance: Comparing turnover over several periods reveals trends.

You can see where your business is strong and where it needs attention by looking at turnover in detail.

What Turnover Tells You?

Turnover numbers tell stories:

- High turnover, low profit may indicate slim margins or high costs.

- Moderate turnover, high profit may mean you’re efficient or your product commands premium pricing.

- Slowing turnover could signal a drop in demand or strong competition.

- Inventory turnover low might mean stock is sitting unsold consider discounts or marketing efforts.

- Receivables turnover slow means you’re not collecting cash fast enough tighten your credit policies.

By comparing turnover to costs, assets and staff levels, you get a fuller picture of your business health.

Turnover Ratios to Watch

These ratios use turnover to check efficiency:

- Inventory Turnover Ratio = COGS ÷ Average Inventory

- A higher ratio means you sell stock quickly.

- Receivables turnover ratio is found by dividing total credit sales by the average amount customers owe you.

- A higher number means faster customer payments.

- To get the asset turnover ratio, divide your total revenue by your average assets over the same period.

- The higher, the more efficient your assets are at generating sales.

Use these ratios regularly to monitor key areas of your business.

Tips to Boost Your Turnover

Getting higher turnover isn’t only about selling more it’s also about efficiency:

- Improve marketing: Attract more customers through ads, social media or word of mouth.

- Offer bundle deals or discounts: Encourage larger or repeat purchases.

- Manage inventory smartly: Avoid excess stock and sell slow-moving items.

- Encourage faster payments by giving small discounts for early payment and sending follow-up messages to those who delay.

- Utilize assets more: Rent out unused space or equipment when not in use.

Each step helps increase turnover meaningfully and sustainably.

Sample Turnover Scenario

Imagine a small online store:

- Yearly sales: $200,000

- Discounts & returns: $10,000

- Turnover: $190,000

If COGS (cost to buy or make products) = $120,000, then

- Gross profit = $70,000

- After paying $40,000 in rent, wages and other costs:

- Net profit = $30,000

Turnover shows $190,000 came in, but profit shows only $30,000 was left to grow the business or reward the owner.

Common Questions

1. Can turnover include extra income like interest?

Usually, no. Turnover focuses on core sales only. Other income appears separately in financial statements.

2. Why does turnover matter more than profit sometimes?

Turnover reflects business size and activity. Even if profit is low or zero, high turnover can attract investors or lenders.

3. Is turnover the same in every country?

Mostly yes it means total sales before costs. However, tax rules may adjust what counts (e.g., VAT or sales taxes).

Key Takeaways

- Turnover is the total amount earned from sales before subtracting any business expenses also known as the top line of your income.

- It helps in planning, funding and tracking growth.

- Comparing turnover to costs gives you profit, which shows true business strength.

- Other types of turnover (inventory, receivables, assets, staff) reveal deeper efficiency issues.

- Use turnover ratios and smart tactics (marketing, inventory, credit policies) to grow wisely.

Conclusion

Understanding business turnover is essential, it’s the foundation of financial planning and performance tracking. It shows how much your business sells, how efficient you are in selling and where improvements are needed.

By tracking turnover and related ratios and making smart changes to operations, credit policies and marketing, you can not only increase sales but also turn those sales into profit. A growing turnover, when paired with better efficiency, means better business health and more opportunity for success.