Every firm, regardless of size, needs to have an efficient financial management system. An essential tool in this process is the trial balance. This article will explain what a trial balance is, why it’s important, and how it works in plain English, whether you’re new to accounting or just want a better understanding.

What Is a Trial Balance?

Comparable to a financial checklist is a trial balance. It is a report that shows the balances of every account in the general ledger of your company at a given moment in time. These accounts comprise revenue (money earned), costs (money spent), equity (your investment), liabilities (money owed), and assets (what you own).

The main goal of a trial balance is to make sure that the total amount of debits and credits is equal. Every accounting transaction has an impact on a minimum of two accounts: one is credited, and the other is debited. Your books are deemed balanced if the total debits and credits equal one another.

Why Is a Trial Balance Important?

A trial balance is more than simply a report; it is crucial to maintaining the financial stability of your company. Let’s examine why it is important:

1. Error Detection

Every amount that is entered as a debit in your company’s books should have a corresponding credit. Purchasing office supplies with cash, for instance, results in a debit to the “Office Supplies” account and a credit to the “Cash” account. Your trial balance totals won’t match if you inadvertently enter only one side or different amounts.

Therefore, it is a warning indicator when your trial balance is out of balance. It alerts you to possible problems. This allows you to identify the error and correct it before generating your financial reports.

2. Financial Statement Preparation

Your trial balance can be thought of as an initial draft of your financial information. Make sure everything is correct before you prepare crucial reports like the income statement, which displays your revenues and losses, or the balance sheet, which displays your assets and liabilities.

You may verify that each account has been updated accurately with the use of the trial balance. It demonstrates whether your accounting entries have been accurately recorded, allowing you to confidently create final reports for your bank, investors, or company.

3. Snapshot of Financial Health

A trial balance can provide you with a brief overview of your financial situation at any time. The amount of cash on hand, the amount owed to suppliers, sales, and expenses are all visible.

It’s similar to checking your bank account balance, but for your whole company. This enables you to make informed decisions about increasing your investment, reducing expenses, or setting aside money for future requirements by assisting you in determining whether your company is performing well or need care.

4. Audit Tool

In order to examine the financial records of a company during an audit, auditors require a starting point. That beginning point is provided by the trial balance. It provides a comprehensive list of all accounts together with their balances to auditors.

Auditors can then verify that everything is correct by tracking down the entries and reviewing the papers. It gives auditors a thorough list of all accounts together with their balances.

Components of a Trial Balance

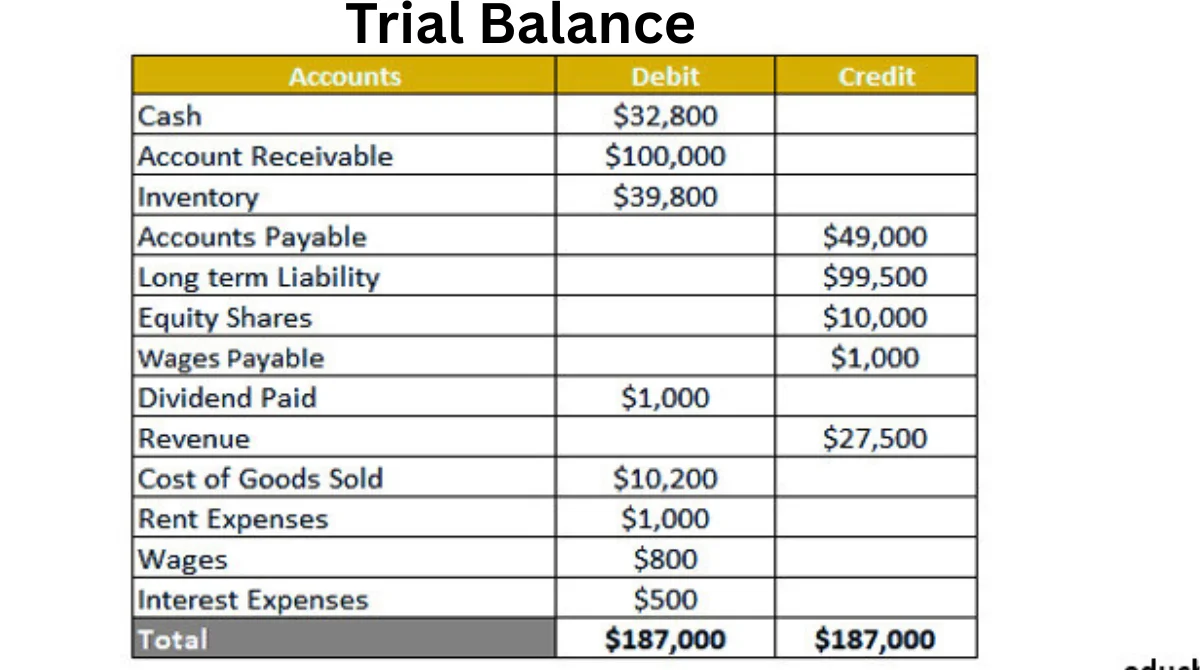

A standard trial balance includes:

- Account Name: The names of all the accounts, such as Cash, Sales, and Accounts Receivable.

- Debit Column: Sums that boost accounts for assets or expenses.

- Credit Column: Sums that boost income, equity, or liability accounts.

Each account’s balance is displayed in the appropriate column.To make sure they match, the total debits and credits are added up at the bottom.

How to Prepare a Trial Balance?

To ensure that everything adds up correctly, creating a trial balance is similar to compiling all of your financial transactions into a single, clear list. The steps you take are as follows:

1. List All Accounts

The first thing you should do is compile a list of all the account names that your business uses.

These originate from your general ledger, which functions similarly to a notebook or software log in which all of your financial transactions are kept.

Examples of accounts include:

- Cash

- Inventory

- Sales

- Rent Expense

- Accounts Payable

- Owner’s Equity

These accounts fall under a variety of headings, including revenue, expenses, equity, liabilities, and assets.

2. Determine Balances

Finding each account’s balance is the next step after obtaining the list of accounts. To accomplish this, you find the ultimate amount (referred to as the “ending balance”) by examining every transaction that has been documented in each account.

For example:

The balance is the sum remaining after all additions and deductions if there were a few deposits and withdrawals from your cash account.

Simply add up all of the rent payments for the time if your Rent Expense account only contains monthly rent payments.

3. Enter Balances

The balance of each account is then entered into the trial balance sheet. Depending on the type of account, each balance appears in either the credit or debit column.

Here’s a simple rule to remember:

- Debits: Assets and Expenses

- Credits: Liabilities, Equity, and Revenue

For example:

- Cash (Asset) → Debit

- Sales (Revenue) → Credit

- Rent (Expense) → Debit

- Accounts Payable (Liability) → Credit

This step entails placing the numbers in the correct columns so that the math works.

4. Total the Columns

The debit and credit columns are added together after all balances have been input. Both totals should equal one another in a properly designed trial balance.

Why? because there is a corresponding credit for each debit in double-entry accounting. Therefore, assuming everything was recorded accurately, the totals must match.

Types of Trial Balances

Trial balances come in three primary varieties:

- Unadjusted Trial Balance: Created at the conclusion of an accounting period prior to any adjustments being made.

- Adjusted Trial Balance: This is created following the completion of correcting inputs and shows correct account balances.

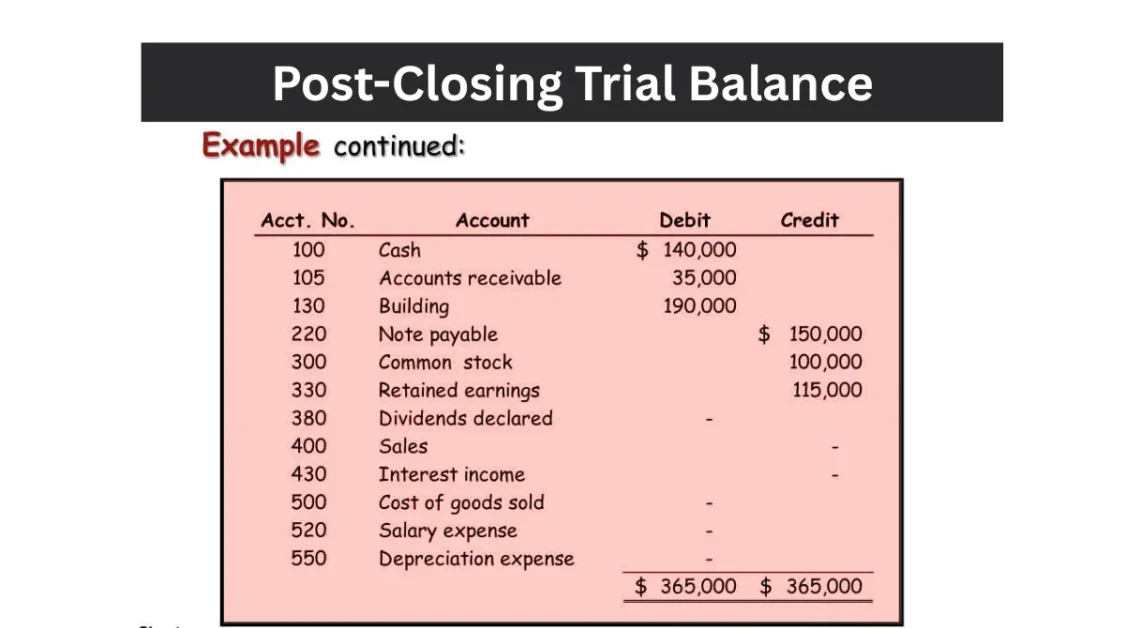

- Post-Closing Trial Balance: This balance sheet account-only balance is created following closing entries.

Limitations of a Trial Balance

Despite its benefits, a trial balance has drawbacks.

- Doesn’t Detect All Errors: The trial balance will still balance if a transaction is recorded with the right amount but in the incorrect account.

- Missed Transactions: A transaction will not show up in the trial balance if it is entirely overlooked.

- Correcting Errors: The trial balance totals won’t be impacted if two errors cancel each other out. Consequently, even though a balanced trial balance implies accuracy, it is not infallible.

Real-Life Example

Let’s say you run a little bookshop. Every month at the conclusion, a trial balance is created.You include the balances of all of your accounts, including cash, inventory, sales, rent expenses, etc. You discover that the total debits and credits are equal after entering all of the balances in the appropriate columns. You can now start creating your financial statements since this shows that your books are balanced.

Common Errors Detected by a Trial Balance

A trial balance can assist in identifying the following mistakes:

- Single-Sided Entries: These are transactions that just include the credit or debit portion.

- Transposition errors: Occur when a number’s digits are switched (for example, recording $540 instead of $450).

- Calculation errors: Inaccuracies in account balance totals.

Accurate financial records can be maintained by spotting these mistakes early.

Trial Balance vs. Balance Sheet

An internal report called a trial balance shows the balances of all ledger accounts, both credit and debit, in order to determine whether total debits and total credits are equal. It assists in identifying simple mistakes such as one-sided input or incorrect calculations. In contrast, a balance sheet is a formal financial document that shows a company’s equity, liabilities, and assets as of a specific date. External stakeholders utilize it to see the company’s financial status. The balance sheet is a finished document used in financial reporting and decision-making, whereas the trial balance is mostly used for internal accuracy checks. In the accounting cycle, both are essential.

The Role of Technology

Modern accounting software has significantly simplified the process of producing a trial balance.In order to maintain correct and up-to-date balances, these technologies automatically update ledger accounts whenever transactions are logged. This reduces the possibility of human calculation errors and saves time by enabling the trial balance to be generated with a few clicks. It is still crucial for accountants and business owners to comprehend how the trial balance operates, even with this automation. It is easier to precisely evaluate financial data, spot inconsistencies, and make wise judgments when one has a firm understanding of the underlying process. Efficiency is increased by technology, but fundamental accounting knowledge is still essential for evaluating data and guaranteeing the accuracy of financial reporting.

Conclusion

An essential component of accounting that aids in maintaining the accuracy and organization of your financial records is a trial balance. You may promptly identify frequent issues, such as missing entries or calculation errors, before they affect your financial statements by compiling it on a regular basis. It guarantees that your debits and credits line up and provides you with a clear picture of your accounts. It’s a crucial tool that helps small business owners make better decisions and gets them ready for seamless financial reporting. Knowing how to use a trial balance can help you gain more confidence and control over your company’s finances, even if you’re just starting out in accounting. It’s a straightforward yet effective step toward better money management, to put it briefly.

Related Topic: Is Destiny Mastercard The Right Credit Card for Building Credit?