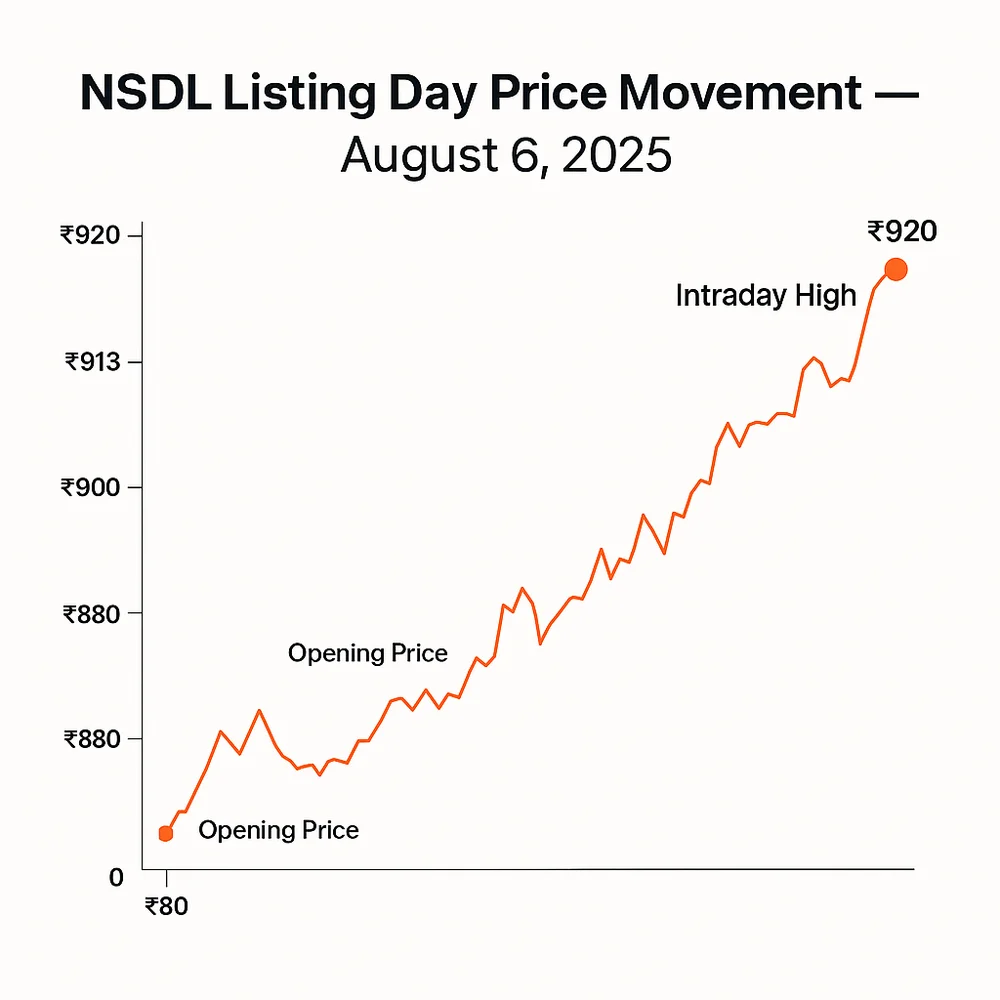

NSDL shares commenced trading today on the Bombay Stock Exchange, opening at ₹880 per share, marking a notable 10% premium over its IPO price of ₹800. This robust entry indicates strong investor conviction, and within just an hour, the stock climbed to ₹912–₹913, recording gains of around 3–3.7%. Later in the session, the stock climbed further to reach an intraday peak of ₹920, reflecting a gain of approximately 4.5% over the listing price.

The IPO drew an overwhelming response in the primary market, garnering a subscription multiple of approximately 41.01× overall. Demand was especially strong among Qualified Institutional Buyers (~104×), Non‑Institutional Investors (~35×), and retail investors (~7.7×). Despite grey market premiums hovering between ₹125–₹127, suggesting gains of up to 15–16% the final listing was a bit below those expectations, although still commendable at a 10% premium.

Market analysts responded with measured enthusiasm. Given NSDL’s commanding presence in India’s financial market infrastructure, supported by recurring revenues and strong tech systems, experts recommend a balanced strategy to book partial profits to lock in near-term gains, but stay invested for long-term appreciation. They also advise setting a stop‑loss around ₹850 to manage risk in possible market volatility.

Key figures at a glance:

| Metric | Value |

| Listing price | ₹880 (10% above ₹800 IPO price) |

| Intraday high | ₹920 (~4.5% above listing price) |

| Peak early trading | ₹912–₹913 (~3–3.7% gain) |

| IPO subscription | ~41.01× overall |

| Grey market premium (GMP) | ₹125–₹127 (~15–16%) |

| IPO size | ₹4,011–₹4,012 crore (entirely OFS) |

| Suggested stop‑loss | ₹850 |

This debut should be seen less as a short‑term speculative move and more as a validation of NSDL’s structural strengths. While it didn’t match the most aggressive GMP forecasts fully, it delivered respectable returns and demonstrated strong institutional performance. With NSDL holding a vast share of India’s securities depository market and commanding critical infrastructure status, it is well-positioned to benefit from ongoing growth in capital market activity.

Overall, the listing portrayed NSDL as a durable, long-horizon investment rather than a quick trade, especially suited for those looking to participate in India’s evolving financial infrastructure story.