Palo Alto Networks delivered a strong fiscal Q4 2025 performance, exceeding Wall Street expectations and setting a positive tone for the year ahead. Palo Alto Networks posted revenue of $2.54 billion, marking a 16% growth from the same quarter last year. Non-GAAP earnings per share reached $0.95, up 27% year-over-year and surpassing the anticipated $0.89.

GAAP net income dropped 29% to $253.8 million, primarily due to higher operating costs and a one-off tax adjustment. Analysts noted that while net income fell under GAAP measures, the company’s operational performance and revenue growth signal robust business health and a growing footprint in the cybersecurity market.

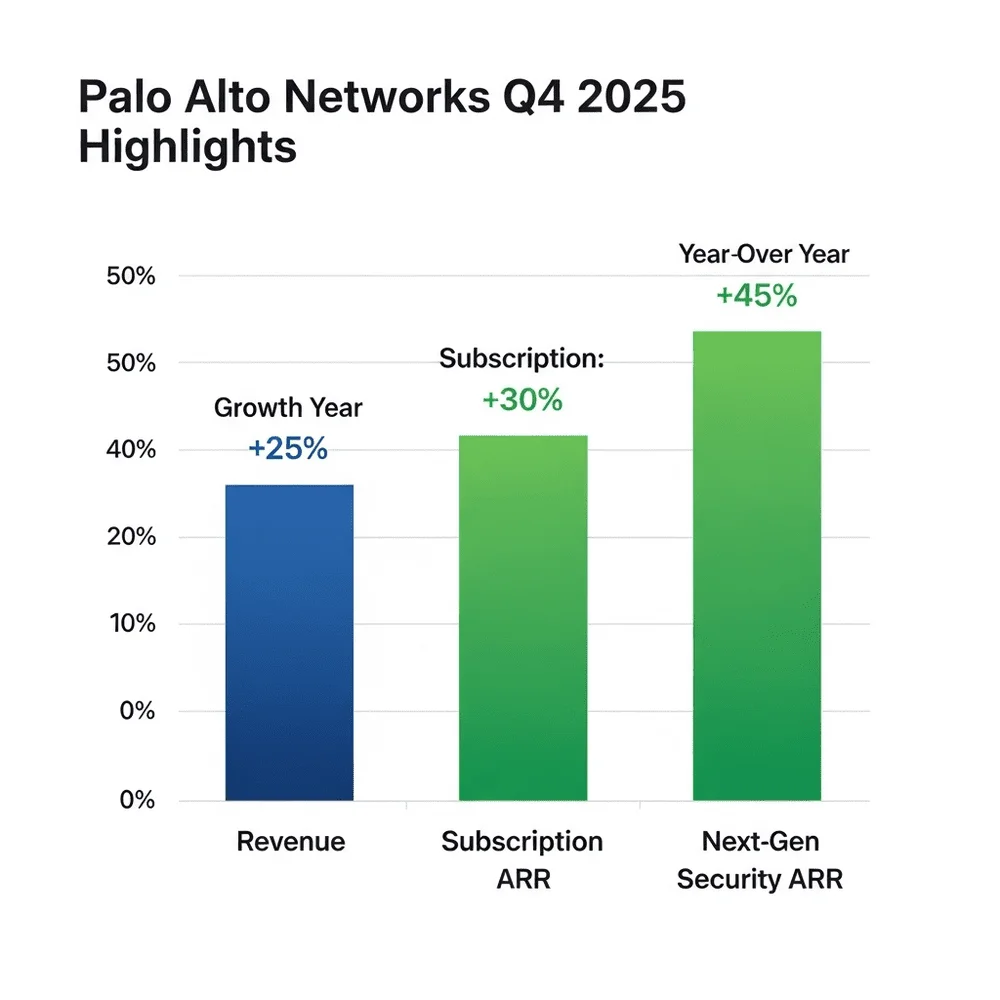

A key highlight was the growth in subscription-based cloud services, with annual recurring revenue (ARR) reaching $5.6 billion, a 32% increase from the previous year. Within this, next-generation security ARR climbed 43% to $4.2 billion, reflecting strong market demand for Palo Alto Networks’ advanced security solutions. Such growth highlights the rising significance of cloud-native solutions and AI-powered security technologies

Here’s a snapshot of the fiscal Q4 results:

| Metric | Q4 FY2025 | Q4 FY2024 | YoY Change |

| Revenue | $2.54B | $2.19B | +16% |

| Non-GAAP EPS | $0.95 | $0.75 | +27% |

| GAAP Net Income | $253.8M | $357.7M | -29% |

| Subscription ARR | $5.6B | N/A | +32% |

| Next-Gen Security ARR | $4.2B | N/A | +43% |

| Remaining Performance Obligations (RPO) | $18.65B | N/A | +23% |

Looking ahead, Palo Alto Networks provided an optimistic outlook for fiscal 2026. The company projected revenue between $10.47 billion and $10.52 billion and adjusted EPS between $3.75 and $3.85. The company expects RPO to grow to $18.65 billion, indicating continued demand for its subscription and cloud services.

Strategically, the company is expanding its portfolio through acquisitions. The $25 billion acquisition of CyberArk aims to strengthen identity security capabilities. Meanwhile, the introduction of AI-powered platforms like Cortex Cloud and Prisma AIRS positions Palo Alto Networks as a leader in next-generation cybersecurity innovation.

Despite an initial 10% dip in stock price following the acquisition announcement, investor sentiment rebounded with a 5% gain in after-hours trading. This rebound was fueled by robust quarterly results and a confident fiscal outlook. Analysts also highlighted that the company’s investments in AI and cybersecurity innovation could drive sustained revenue growth over the next several years.

Overall, the Q4 2025 earnings reinforce Palo Alto Networks’ leadership in cybersecurity. Strong financial performance, subscription growth, ARR expansion, and strategic investments signal a positive trajectory for the company in an increasingly digital and security-conscious global economy.

Related News: Palo Alto Eyes $20B CyberArk Deal to Expand Identity Security