Introduction to the Nikkei 225

The Nikkei 225, often referred to simply as the Nikkei, is a prominent stock market index that represents the performance of 225 major publicly traded companies in Japan. Established in 1950 by the Nihon Keizai Shimbun (The Nikkei), it is one of the oldest and most widely followed indices in Asia . Unlike market-capitalization-weighted indices, the Nikkei 225 is a price-weighted index, meaning that stocks with higher prices have a more significant impact on the index’s movements.

This index encompasses a diverse range of sectors, including technology, automotive, finance, and consumer goods, providing a comprehensive snapshot of Japan’s economic landscape. Companies like Toyota, Sony, and SoftBank are among its constituents, reflecting the global reach and influence of Japanese enterprises.

Understanding FintechZoom’s Role

FintechZoom is a leading platform that offers real-time financial news, analysis, and insights across various markets, including the Nikkei 225. By providing up-to-date information and expert commentary, FintechZoom helps investors and traders make informed decisions regarding Japanese equities.

Key Features of FintechZoom’s Nikkei 225 Coverage

1. Real-Time Data Updates

FintechZoom provides live updates on the Nikkei 225, allowing users to track the index’s performance throughout the trading day. This feature is crucial for investors looking to capitalize on short-term market movements.

2. Comprehensive Market Analysis

The platform offers in-depth analysis of market trends, economic indicators, and geopolitical events that influence the Nikkei 225. This helps users understand the factors driving market changes and anticipate future movements.

3. User-Friendly Interface

FintechZoom’s website is designed with user experience in mind, featuring intuitive navigation and clear visualizations of market data. This makes it accessible to both novice and experienced investors.

4. Mobile Accessibility

Recognizing the need for on-the-go information, FintechZoom ensures that its platform is mobile-friendly, enabling users to access Nikkei 225 updates from their smartphones and tablets.

Factors Influencing the Nikkei 225

Several elements can impact the performance of the Nikkei 225:

- Currency Fluctuations: The value of the Japanese yen plays a significant role. A stronger yen can reduce the profitability of export-driven companies, leading to declines in their stock prices. Conversely, a weaker yen can boost exports and positively affect the index.

- Monetary Policy: Decisions by the Bank of Japan, such as interest rate changes, can influence investor sentiment and market liquidity. For instance, a rate hike might lead to market volatility as investors adjust their portfolios in response.

- Global Events: International developments, such as geopolitical tensions or global economic shifts, can have ripple effects on the Nikkei 225. Investors often react to these events by rebalancing their investments, which can lead to significant market movements.

Investment Strategies for the Nikkei 225

Investors can approach the Nikkei 225 with various strategies:

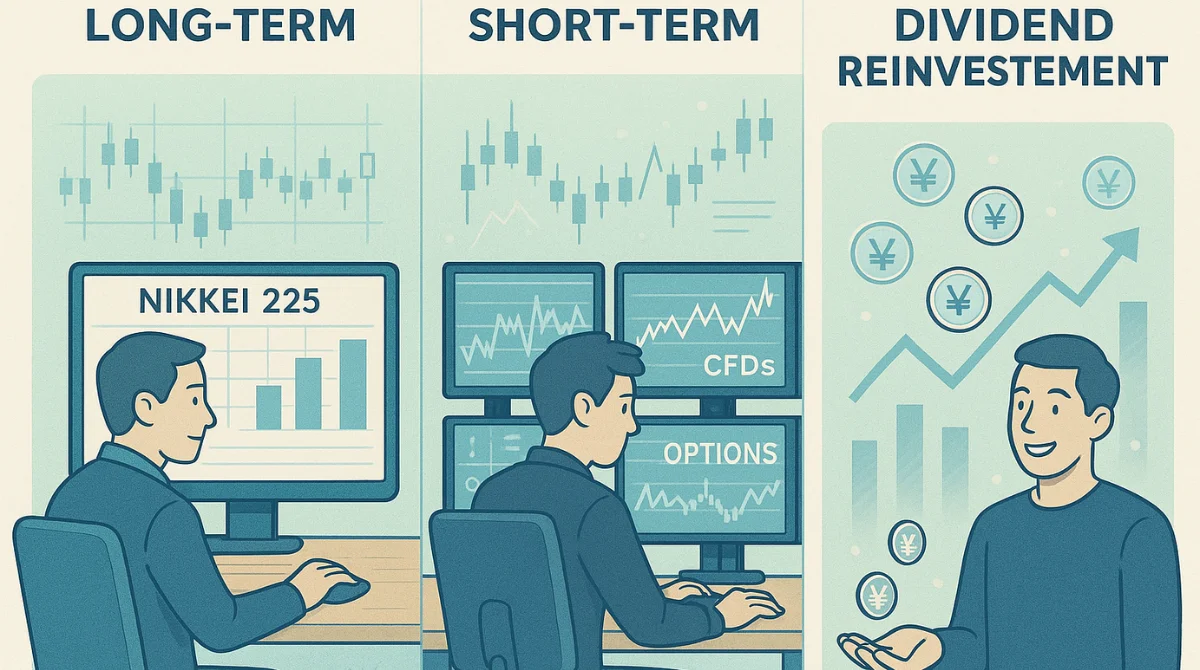

1. Long-Term Investment

For those seeking steady growth, investing in Exchange-Traded Funds (ETFs) that track the Nikkei 225 can be an effective strategy. These funds offer diversification and are less susceptible to the volatility of individual stocks.

2. Short-Term Trading

Traders looking to capitalize on short-term price movements may consider instruments like Contracts for Difference (CFDs) or options. These allow for leveraged positions but come with increased risk.

3. Dividend Reinvestment

Given the emphasis on corporate governance reforms in Japan, many companies within the Nikkei 225 offer attractive dividend yields. Reinvesting these dividends can enhance long-term returns and contribute to portfolio growth.

Major Companies That Power the Nikkei 225

The Nikkei 225 includes 225 of Japan’s most influential and well-known companies. These businesses come from different sectors like technology, automobiles, finance, and consumer goods. Here are some of the top companies that play a big role in shaping the performance of this index:

1. Toyota Motor Corporation

Toyota is one of the world’s largest car manufacturers. Known for its reliability and innovation, Toyota is a major player not just in Japan, but globally. Its stock has a significant influence on the Nikkei 225 due to its size and global reach.

2. Sony Group Corporation

Sony is famous for electronics, gaming (like PlayStation), and entertainment. It’s a strong name in tech and media. Any change in Sony’s stock price can impact the Nikkei index, especially because of its global brand recognition.

3. SoftBank Group

SoftBank is a giant in the telecommunications and investment sectors. It’s known for funding major tech startups around the world. Since it holds large stakes in global companies, its financial moves can cause noticeable shifts in the Nikkei 225.

4. Fast Retailing Co., Ltd.

This company owns Uniqlo, a popular clothing brand worldwide. As a leader in the fashion retail sector, its performance reflects consumer trends. Strong sales or profits from Fast Retailing can push the Nikkei higher.

5. Keyence Corporation

Keyence makes factory automation equipment and sensors. It’s a tech-driven company that serves manufacturers worldwide. As Japan focuses on smart manufacturing, Keyence’s success is a sign of industrial growth, and it heavily influences the index.

6. Mitsubishi UFJ Financial Group

This is one of Japan’s biggest banks. Its performance shows the health of Japan’s financial system. When the bank performs well, it usually means good news for the economy and the stock market.

These companies are leaders in their fields and their stock prices carry a lot of weight in the Nikkei 225. Understanding who these companies are can help investors follow the index more closely and make smarter decisions based on how these giants perform.

Utilizing FintechZoom for Investment Decisions

If you’re interested in investing in the Nikkei 225, FintechZoom can be a really helpful tool. It provides several useful features to help you make smart choices when buying or selling stocks. Here’s how you can use it effectively:

Set Alerts

FintechZoom allows you to set custom alerts based on price levels or percentage changes. This means you can tell the system, “Let me know when the Nikkei 225 goes above a certain point,” or “Alert me if a specific company’s stock drops by 5%.” This way, you won’t have to constantly watch the market. You’ll get a notification when something important happens, helping you react quickly and make better decisions.

Analyze Historical Data

Another great feature on FintechZoom is access to past data. You can look at how the Nikkei 225 or individual companies have performed over time—days, months, or even years. This can help you spot patterns. For example, if the index usually rises in a particular season or drops after certain events, you can use that information to plan your investments. It’s like learning from history to improve your future decisions.

Stay Updated with News

FintechZoom also shares the latest financial news and expert analysis. Since the market is influenced by things like government decisions, global events, or even natural disasters, keeping up with the news helps you understand what might happen next. By reading updates and expert opinions, you’ll be more informed and confident about where to invest or when to hold off.

In short, FintechZoom gives you the tools to stay alert, learn from the past, and stay informed in the present. All of this helps you make smarter, more timely investment choices—especially when you’re dealing with something as important and fast-moving as the Nikkei 225.

How to Use FintechZoom to Track the Nikkei 225?

FintechZoom makes it easy for both beginners and experienced investors to follow the Nikkei 225. If you’re new to the platform or just want to get the most out of it, here’s a simple guide on how to find and use the Nikkei 225 data:

Step 1: Go to FintechZoom.com

Open your browser and visit FintechZoom.com. You’ll find a clean, user-friendly homepage that lists major stock markets, financial news, and trending updates.

Step 2: Use the Search Bar

At the top of the homepage, you’ll see a search bar. Type “Nikkei 225” into it and press enter. This will bring up the latest news, market analysis, and the real-time performance of the index.

Step 3: View Live Index Data

Once you’re on the Nikkei 225 page, you’ll see the live index value along with a graph showing how it has moved throughout the day. This live data helps you understand how the index is performing in real time.

Step 4: Read Market Insights

Scroll down the page to read expert analysis and news updates that explain what’s affecting the Nikkei 225. This includes economic news from Japan, company earnings reports, or global events that impact investor behavior.

Step 5: Explore Related Stocks and Companies

FintechZoom often links related companies that are part of the Nikkei 225. You can click on these names to check how individual stocks are doing, and see how much they contribute to the overall index.

Step 6: Use Tools and Widgets

On many FintechZoom pages, you’ll also find charts, graphs, and tools that let you switch between timeframes (1 day, 1 week, 1 month, etc.). This gives you a better view of how the index has been trending over time.

FAQs

Q1: What is the Nikkei 225?

The Nikkei 225 is a major Japanese stock market index made up of 225 top companies. It includes leaders from various industries and shows how well Japan’s economy is doing. Investors and analysts use it to understand market trends and global economic influence.

Q2: How does FintechZoom assist investors?

FintechZoom helps investors by offering real-time updates, expert opinions, and in-depth market data. It simplifies complex financial information and gives users tools to analyze trends, monitor performance, and make smart investment decisions, especially for markets like the Nikkei 225.

Q3: Why is the Nikkei 225 important?

The Nikkei 225 is important because it shows how Japan’s top companies are doing. Since Japan has a big role in the global economy, movements in this index can affect international markets and give signals about worldwide economic conditions.

Q4: Can I invest in the Nikkei 225 directly?

You can’t buy the Nikkei 225 itself, but you can invest in it through financial products like Exchange-Traded Funds (ETFs) or index funds. These mimic the index’s performance and allow you to benefit from the movements of Japan’s leading companies.

Q5: How often is the Nikkei 225 updated?

The Nikkei 225 is updated every five seconds during Tokyo Stock Exchange trading hours. This frequent update helps investors see real-time changes and make faster decisions based on the most current data available in the market.

Conclusion

The Nikkei 225 serves as a vital indicator of Japan’s economic health and offers valuable insights for investors worldwide. Platforms like FintechZoom enhance the accessibility and understanding of this index by providing real-time data, comprehensive analysis, and user-friendly tools. By leveraging these resources, investors can make informed decisions and navigate the complexities of the Japanese stock market with confidence.

Related Topic: