Are you tired of working hard but not seeing long-term financial growth? If you’re looking for a smarter, more sustainable way to grow your income, it’s time to explore passive income. Whether you’re a full-time employee, stay-at-home parent or side hustler, passive income can offer the financial freedom and peace of mind we all strive for.

What Is Passive Income?

Passive income is money earned from activities or investments that don’t need daily attention once set up. Unlike your job, where you’re paid only when you work, passive income lets your money or efforts continue generating income in the background.

It’s not magic and it’s not “easy money.” But with a bit of planning, you can build reliable income streams that support your long-term goals.

Why Focus on Passive Income?

Here’s why passive income is such a powerful financial tool:

- More freedom: Spend more time with family, travel or explore hobbies.

- Diversified income: You’re not relying on just one paycheck.

- Faster wealth growth: Reinvest your earnings and watch your income multiply.

- Better retirement planning: Passive income continues even when you stop working.

- Less stress: Financial stability brings peace of mind.

When you build wealth with passive income models, you’re setting yourself up for long-term success.

10 Best Passive Income Models to Start in 2025

These income streams range from beginner-friendly to advanced, with both low and high investment options. Choose what fits your lifestyle and goals.

1. Dividend Stocks, Earn While You Hold

Put money into businesses that regularly reward investors by sharing a portion of their earnings.

1.How it works

Buy stocks in companies known for giving out profits every three months through dividend payments. Over time, you can reinvest those dividends and grow your wealth without selling anything.

2. Example

Investing $5,000 in a stock that pays 5% annually gives you $250 passive income per year.

3. Getting started

Use platforms like Vanguard or Fidelity. Focus on stable companies known as “dividend aristocrats.”

4. Why it works?

- Low maintenance

- Scalable

- Long-term wealth growth

Great for people with some capital to invest.

2. Rental Property or REITs, Real Estate Riches

Real estate is one of the most trusted passive income builders.

- Option A: Buy property and rent it out.

- Option B: Invest in REITs (Real Estate Investment Trusts) through stock apps.

1. Why it works?

- Monthly rental income

- Property value can increase

- Tax benefits

Tip: Use a property manager to handle daily tasks if you’re busy.

2. Real example

My friend Arif bought a small two-bedroom house and rents it out for $800/month. After mortgage and expenses, he still clears $300 monthly, a true passive win.

3. High-Yield Savings Accounts & CDs

This is the simplest passive income model for beginners.

1. How it works?

You store money in a savings account or Certificate of Deposit that pays interest over time.

2. Why it works?

- No risk

- Completely hands-off

- Great for emergency funds

Downside: Low returns, usually between 3–4%.

Best for: Safety-focused earners or those saving for short-term goals.

4. Create and Sell Digital Products

One of the fastest-growing passive income streams.

1. Examples

- E-books on Amazon

- Online courses on Udemy or Teachable

- Canva templates or planners on Etsy

2. Why do people love this model?

- Low startup cost

- Unlimited earning potential

- You create once and sell forever

3. Success story

Sarah, a part-time teacher, created a $12 printable planner on Etsy. It now sells 100+ copies per month without any new updates.

5. Affiliate Marketing: Recommend and Earn

Use your blog, Instagram, YouTube or TikTok to promote products and earn commissions.

1. How it works?

You share affiliate links. Earn a small commission each time someone makes a purchase using your unique referral link.

2. Why it’s effective?

- No need to handle products

- Passive after content is created

- Can be scaled globally

3. Tools to use

Sign up for affiliate programs like Amazon Associates, ShareASale or Impact to promote products and earn from each sale.

Tip: Always recommend products you trust.

6. YouTube Monetization

YouTube content can keep earning money for years, even long after you upload.

1. Ways to earn

- Ads through Google AdSense

- Sponsorship deals

- Affiliate links in video descriptions

2. Pro tip

- Focus on evergreen content like how-to guides or tutorials. One good video can generate income for years.

- Try a focused blog topic like “Budget tips for college students” or “Simple meals with only 5 ingredients.”

7. Print-on-Demand Merchandise

Design items like T-shirts, mugs and tote bags and sell through platforms like:

- Printful

- Redbubble

- Merch by Amazon

1. Why this works?

- No inventory

- Design once, sell forever

- Scalable with trends

Bonus: Great for artists or those with clever ideas.

8. Peer-to-Peer Lending

Lend your money to others and earn interest.

1. Top platforms

- LendingClub

- Prosper

- Mintos

2. Things to know

- Average returns: 5–8%

- Higher risk than banks, but better returns

- You can spread your money across many small loans

9. Royalties from Creative Work

If you have a talent for writing, photography or music, you can earn royalties for years.

1. Examples

- Sell stock photos on Shutterstock

- Publish a song on Spotify

- License artwork or templates

Pro tip: Upload to multiple platforms for better exposure.

10. Invest in Small Businesses (Silent Partnerships)

Help grow small businesses by investing in them as a quiet financial backer without daily involvement.

1. How it works?

You provide capital. The business runs daily operations. You earn a cut of the profit.

2. Low-cost entry

Try platforms like Republic or SeedInvest to invest in startups with as little as $100.

How to Choose the Right Passive Income Model

Consider the following before jumping in:

- Time available: Can you spare time now to build something?

- Money to invest: Some models need capital, others need creativity.

- Risk tolerance: How comfortable do you feel taking financial risks when making investment decisions?

- Your interests: You’ll stick longer with models that excite you.

Start small, then scale. You don’t need 10 models; you just need one good one that fits you.

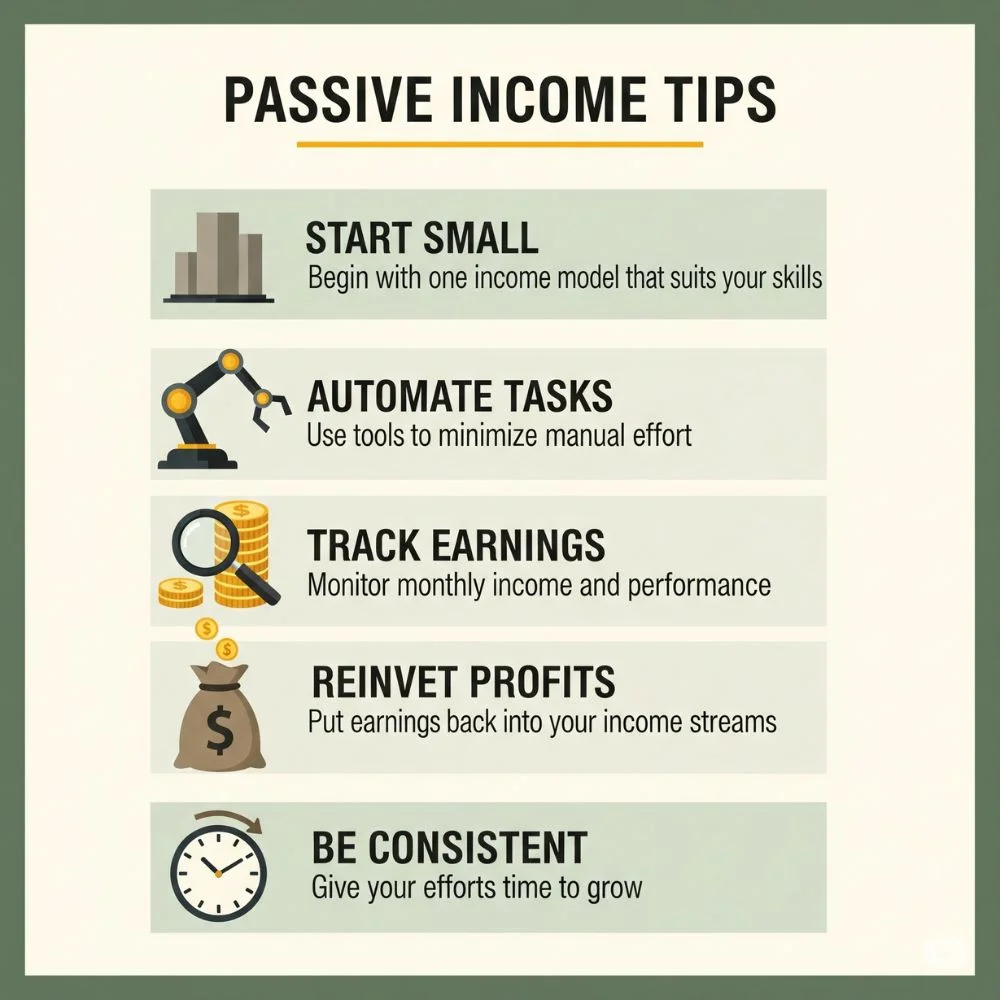

Smart Tips for Long-Term Success

To build wealth with these passive income models, keep these tips in mind:

- Start with one model that fits your skills

- Automate as much as possible

- Track income and performance monthly

- Reinvest profits into new or existing income streams

- Don’t give up, most passive income takes time to grow

Final Thoughts

The journey to wealth doesn’t need to be complicated. By building even one passive income stream, you start gaining control of your time, finances and freedom.

Ready to start? Pick one passive income model today, whether it’s writing a short eBook, investing in a REIT or filming a YouTube video. Set aside just 30 minutes today to take your first real step toward financial freedom.

Remember: The best time to start was yesterday. The second-best time is right now.