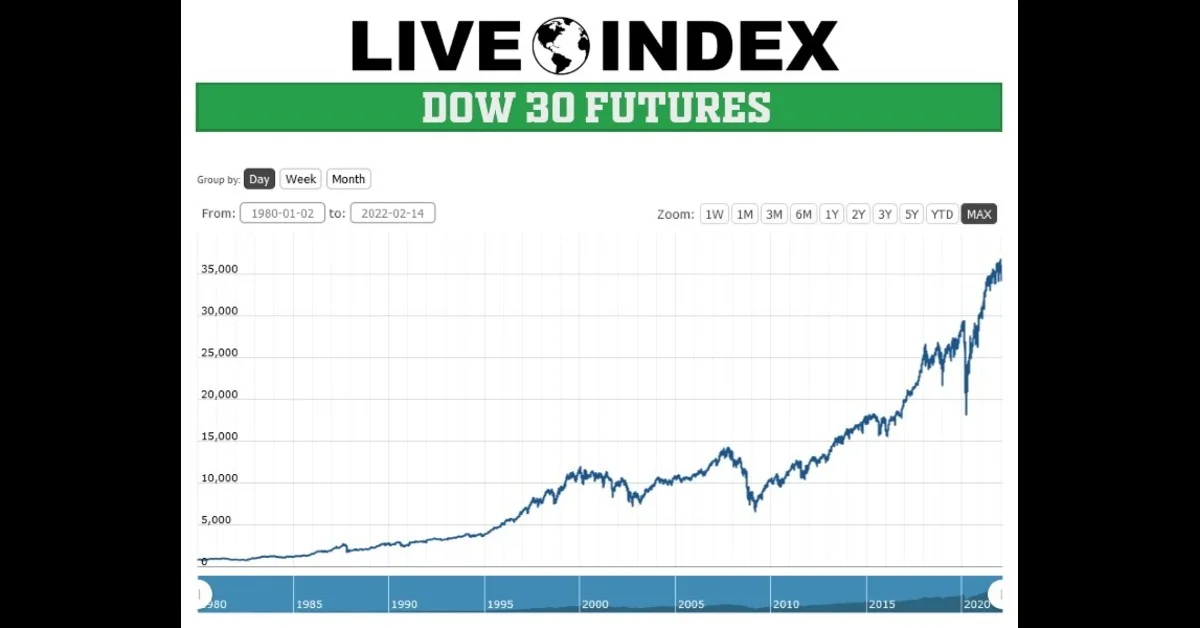

Dow Jones futures fell sharply on Friday, the worst weekly drop since April, as the Dow lost about 1.2%, the S&P 500 shed 1.6%, and the Nasdaq plunged 2.2%, amid escalating tariff tensions and disappointing jobs data. Investors reacted to sweeping new tariffs announced by President Trump, imposing baseline duties on global imports along with elevated rates for the EU, Canada, and others, raising trade volatility across markets.

On Sunday evening, Dow futures rebounded modestly, climbing roughly 120 points (~0.3%), with S&P and Nasdaq‑100 futures up about 0.4% as traders assessed broader economic and political developments.

Futures trading started in August in a relatively cautious tone. Dow Jones futures dipped just 27 points (<0.1%) on the open; S&P and Nasdaq futures moved down by a similar margin, with markets bracing for tariffs set to take effect August 7 and awaiting upcoming earnings and Fed signals.

- Asia‑Pacific markets responded with mixed performance. Japan’s Nikkei slid 1.6%, Australia’s ASX dropped 0.2%, while Hong Kong’s Hang Seng and Korea’s Kospi ended slightly higher, reflecting global uncertainty.

- A weak U.S. jobs report revealed just 73,000 jobs added in July, fueling recession fears and boosting speculation of a Fed rate cut in September.

Immediate drivers affecting Dow futures include the tariff escalation and pending major earnings. Companies like Amazon and Apple experienced heightened volatility. Amazon shares tumbled over 8% after earnings disappointed, while Apple rose slightly despite warning of $1.1 billion in increased costs due to tariffs.

Looking ahead, traders are focused on earnings from AI‑linked and industrial names, including Palantir, AMD, Shopify, Disney, Uber, and Caterpillar. These reports may clarify whether resilient tech fundamentals can offset broader economic headwinds. Treasury yields fell sharply as bond markets priced in rate cuts, while oil prices dipped following OPEC+’s modest output increase decision, adding to an unsettled environment.

Expect volatility to remain elevated as markets digest tariff policy shifts, economic data, and earnings results. Dow Jones Live Futures show signs of cautious stabilization, but any surprises could spark renewed swings before the September Fed policy meeting.

Dow futures at last update (Delayed data):

| Contract / Underlying | Last (~Sunday night) | Change |

| Dow Jones mini futures | ~43,870 | +120 points (+0.3%) |

The broader backdrop: traders must weigh trade policy risks, recession signals from labor data, and critical earnings in sectors like tech, consumer, and industry.