Saving money is one of the smartest financial habits you can develop. But where you keep your money matters. In 2025, high-yield savings accounts have become a favorite for people looking to grow their cash without risk. With rising interest rates, competitive offers, and smart digital tools, these accounts make your money work harder for you.

What is a High-Yield Savings Account?

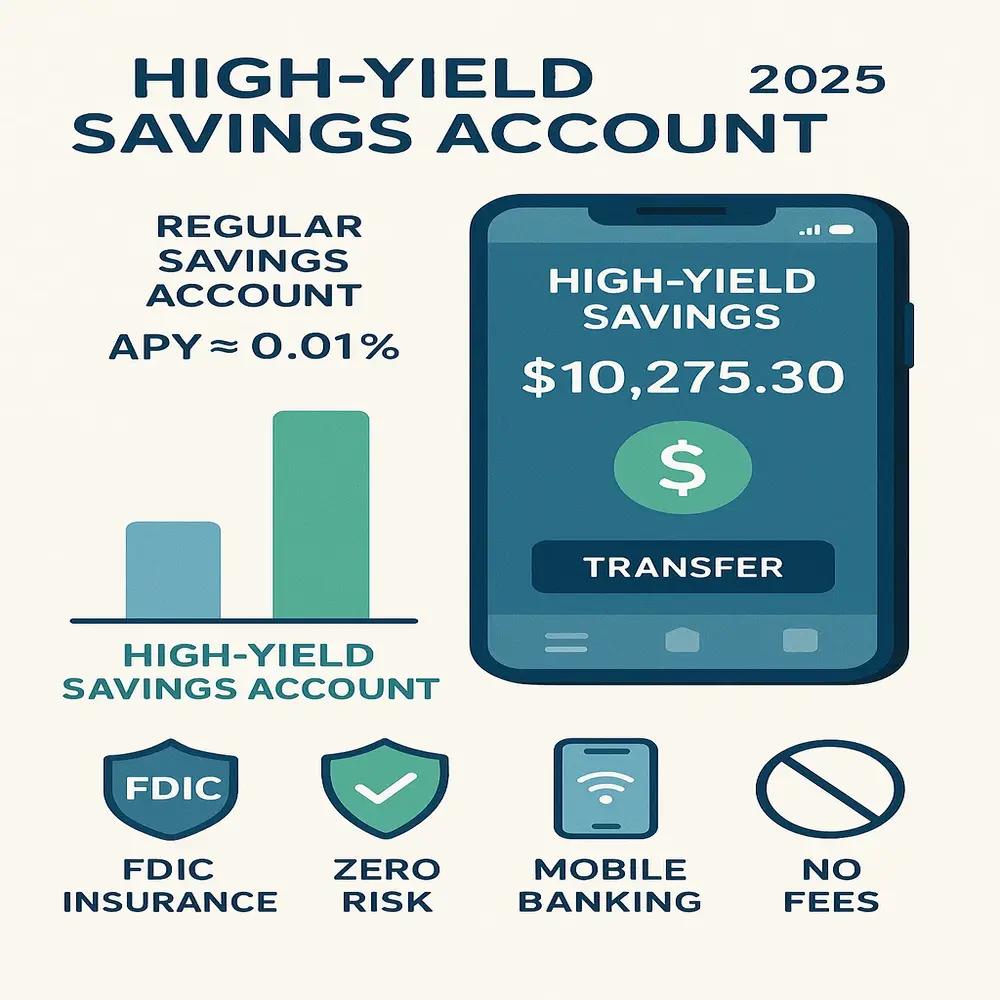

A high-yield savings account is a type of bank account that pays a much higher interest rate than a regular savings account. While traditional savings accounts may offer just 0.01% to 0.10% APY (Annual Percentage Yield), high-yield accounts in 2025 offer rates as high as 5.50%.

These accounts are mainly offered by online banks, credit unions, or fintech companies that don’t carry the overhead costs of physical branches. That means they can pass their savings to you in the form of higher interest.

Benefits:

- Earn more interest with zero risk

- FDIC or NCUA insured up to $250,000

- Full access via mobile or online banking

- No or very low fees

- Ideal for emergency funds or short-term goals

Why Choose a High-Yield Savings Account in 2025?

With inflation and rising living expenses, growing your money safely is more important than ever. Here’s why these accounts are becoming a top choice:

- Higher APYs: Rates in 2025 range between 4.25% and 5.50%, far above what regular savings accounts offer.

- No monthly fees: Many options don’t charge you just for having the account.

- Digital-first convenience: Manage everything from your phone or computer, 24/7.

- Safe and insured: FDIC or NCUA protection gives you peace of mind.

Whether you’re saving for a vacation, an emergency, tuition, or just want better returns, a high-yield savings account can help your money grow faster without any stress.

Key Features to Compare in 2025

Not all high-yield savings accounts are the same. Here are the main things you should compare:

- APY (Annual Percentage Yield): This determines how fast your money grows. Go for the highest APY available with minimal restrictions.

- Minimum Balance: Some accounts require a balance to earn the advertised rate.

- Fees: Avoid accounts with monthly maintenance or hidden fees.

- Ease of Access: Can you use a mobile app? Are transfers quick and easy?

- Deposit & Withdrawal Options: Look for mobile check deposit, direct deposit, and flexible withdrawal policies.

- Customer Support: Reliable service is a big plus, especially if anything goes wrong.

Best High-Yield Savings Accounts in 2025

After comparing interest rates, fees, features, and customer reviews, here are the top high-yield savings accounts available this year:

1. SoFi High-Yield Savings

- APY: Up to 5.30% (with direct deposit)

- Fees: No monthly charges

- Why it’s great: High APY, cash-back perks, and a smooth mobile-first experience

2. Synchrony Bank High-Yield Savings

- APY: 5.00%

- Fees: No monthly maintenance fees

- Why it’s great: Offers ATM access, daily compounding interest, and a simple app interface

3. Marcus by Goldman Sachs

- APY: 4.75%

- Fees: No fees or minimum deposit

- Why it’s great: Trusted brand, strong interest rate, fast ACH transfers

4. Ally Bank Online Savings

- APY: 4.50%

- Fees: $0 monthly fees, no minimums

- Why it’s great: User-friendly app, automatic savings tools, great customer support

5. American Express® High-Yield Savings

- APY: 4.30%

- Fees: No fees

- Why it’s great: Strong security, easy-to-use platform, well-known brand

6. Discover Online Savings

- APY: 4.25%

- Fees: None

- Why it’s great: Award-winning support and excellent budgeting tools

7. Capital One 360 Performance Savings

- APY: 4.30%

- Fees: No monthly fees or minimums

- Why it’s great: Great for those already using Capital One, easy integration

How to Open a High-Yield Savings Account?

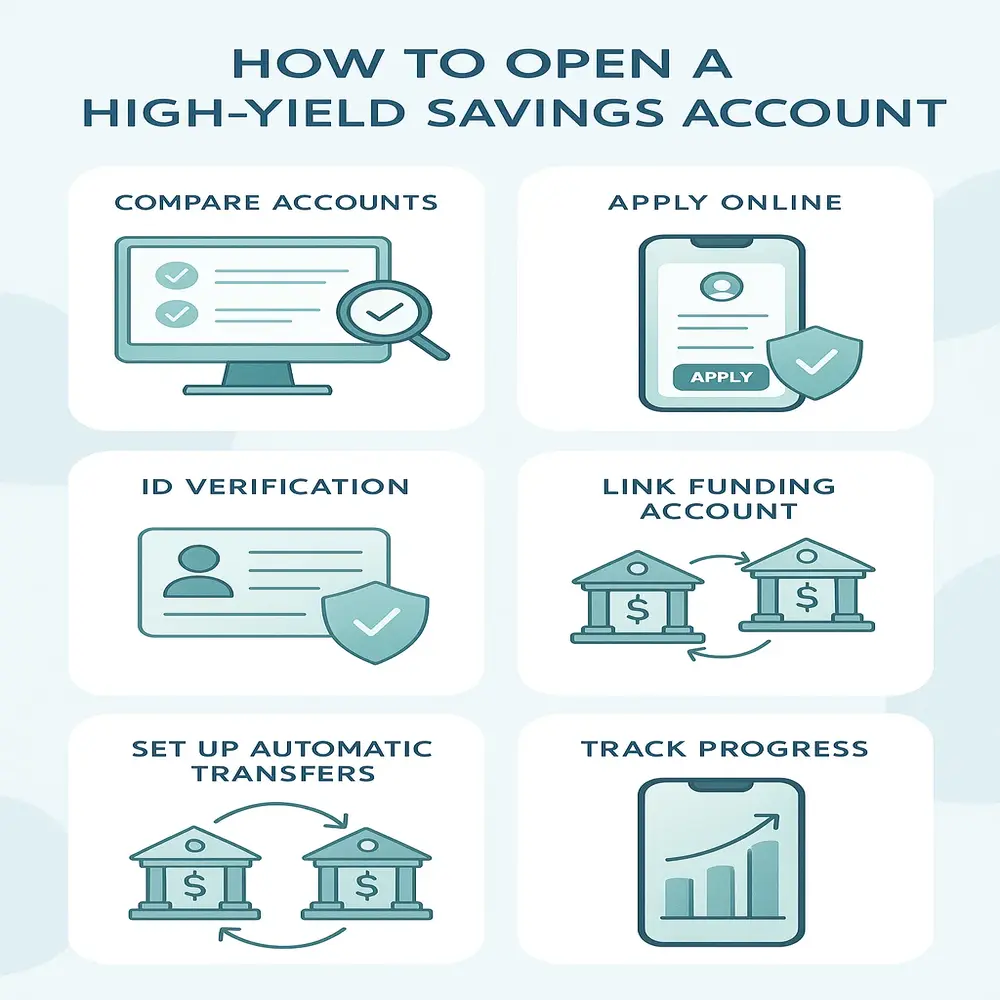

Opening a high-yield savings account in 2025 is quick and easy. Most banks let you apply completely online.

Steps to Open:

- Compare Accounts: Use online comparison tools or reviews like this one.

- Apply Online: Visit the bank’s website or app. You’ll need:

- Valid government-issued ID

- Social Security number

- Basic personal info

- Fund the Account: Link an existing account and transfer money.

- Set Up Automatic Transfers: Schedule regular deposits weekly or monthly.

- Track Progress: Use the bank’s mobile app to monitor your balance and interest growth.

Tips to Maximize Your Savings

Getting a high APY is just the beginning. Here are ways to supercharge your savings:

- Automate your savings: Consistent deposits grow your account over time.

- Avoid unnecessary withdrawals: Let your money grow uninterrupted.

- Use Roundup features: Some banks let you save spare change from purchases.

- Take advantage of budgeting tools: Set goals and monitor your progress.

- Compare APYs regularly: Interest rates change; switch if better rates appear.

Are Online Banks Safe in 2025?

Yes, as long as they are FDIC or NCUA insured, your deposits are protected up to $250,000. Most online banks offer enhanced digital security, like:

- Two-factor authentication

- Biometric login

- Real-time fraud alerts

- Strong data encryption

Just make sure the bank clearly states its federal insurance coverage and read customer reviews before signing up.

Who Should Open a High-Yield Savings Account?

High-yield savings accounts are perfect for:

- Students saving for tuition or living expenses

- Workers building an emergency fund

- Families planning a vacation or home purchase

- Retirees looking for a safe place to park extra funds

- Anyone tired of earning next to nothing from traditional banks

Potential Drawbacks to Watch For

While high-yield savings accounts are safe, here are a few things to keep in mind:

- Variable APYs: Interest rates may go up or down depending on the market.

- Withdrawal Limits: Some accounts may limit monthly transactions.

- No Physical Branches: Online banks may not offer face-to-face service.

- Inactive Account Fees: Rare, but check the fine print for inactivity penalties.

Final Thoughts

In 2025, high-yield savings accounts are a smart, low-risk way to grow your money. With higher interest rates, no fees, and easy online access, there’s no reason to settle for low returns. Take a few minutes to compare options and start earning more. Your future self will thank you.

Related Topic: BNS Savings Accelerator: Easy Auto-Saving Tool