In the world of money, your credit score is a very important number. It can decide if you get approved for a loan, how much interest you’ll pay, or even if you can rent a house. That’s why more and more people are looking for ways to understand and improve their credit score. One of the best tools available today is Gomyfinance.com Credit Score service. This free platform helps people check and track their credit score easily. Whether you’re new to credit or trying to improve your score, Gomyfinance.com gives you the right tools and advice to help you move forward.

What is a Credit Score?

A credit score is a three-digit number that shows how well you manage borrowed money. It works like a financial report card and helps lenders decide if they should give you a loan or credit card. This number is based on your payment history, debt level, credit age, and how often you apply for new credit. The score usually ranges from 300 to 850. A higher score means you’re seen as a trustworthy borrower and can get better loan offers and lower interest rates, while a lower score might make it harder to borrow or result in higher costs.

Credit Score Ranges:

- 300–579 – Poor: You might have trouble getting loans or credit cards.

- 580–669 – Fair: You can get loans, but with higher interest rates.

- 670–739 – Good: You’ll likely get approved with better rates.

- 740–799 – Very Good: You’ll enjoy even better interest rates.

- 800–850 – Excellent: You’ll get the best loan terms and lowest rates.

Your score is calculated based on things like your payment history, how much debt you have, the age of your accounts, and whether you’ve applied for new credit recently.

Why Gomyfinance.com Credit Score Matters?

Using Gomyfinance.com Credit Score services helps you take charge of your financial situation in a simple and free way. When you sign up, you can check your credit score anytime without paying a fee. This is especially helpful if you’re planning something big like applying for a credit card, buying a home, or getting a car loan all of which require a good credit score.

But Gomyfinance.com does more than just show your score. It also breaks down the reasons behind it. You’ll see what’s helping or hurting your score and get practical steps you can follow to improve it over time.

Features of Gomyfinance.com Credit Score

1. Free Credit Score Check

Gomyfinance.com allows you to view your credit score without charging you anything. There are no hidden fees, monthly payments, or subscriptions. This feature is great for anyone who wants to keep track of their credit without spending money. It encourages more people to stay informed about their financial health.

2. Real-Time Credit Monitoring

When you sign up, the platform starts watching your credit report around the clock. If someone tries to open a new credit card or loan in your name, or if there’s a major change in your credit file, you’ll get an alert immediately. This helps protect you from fraud and identity theft.

3. Personalized Credit Tips

Gomyfinance.com doesn’t just show your score it gives you helpful advice tailored to your credit habits. For example, if you’re using too much of your credit limit, it will suggest reducing your balances. If you’ve missed payments, it will guide you on how to fix that. These tips are simple and practical, making it easier for you to improve your score.

4. Daily Updates and Alerts

You won’t be left in the dark. The system sends daily alerts and updates about your credit activity, so you’re always aware of what’s going on with your credit file. If anything unusual happens, like a hard inquiry or a new account, you’ll know right away.

5. Simple and Easy-to-Use Dashboard

The platform is designed for everyone, even those who aren’t tech-savvy. The dashboard is clean and easy to understand. You can quickly find your credit score, read tips, and view any recent changes without getting confused. It’s user-friendly and helpful at every step.

In short, Gomyfinance.com Credit Score makes it easy for anyone to understand, track, and improve their credit without stress or confusion.

Why You Should Check Your Credit Score Regularly?

Checking your credit score regularly is a smart habit, not just something you do when you’re applying for a loan. Many people only look at their score when they really need it, like when buying a house or car but by then, it might be too late to fix any problems.

Using Gomyfinance.com Credit Score tools to check your score often helps you stay ahead. For example, if there’s a mistake in your credit report, like a wrong payment or account you didn’t open, you can catch it early and fix it. You’ll also learn how your everyday actions, like paying bills on time or using credit cards impact your score. This helps you make better decisions before applying for loans or credit cards.

Regular checks also protect you from identity theft. If someone tries to misuse your personal info, Gomyfinance.com can alert you quickly so you can take action before real damage is done. In short, checking your score often gives you control, confidence, and peace of mind.

How to Improve Your Credit Score Using Gomyfinance.com?

Improving your credit score may seem challenging, but with consistency and the right tools, it’s completely achievable. Gomyfinance.com Credit Score offers practical steps that can help you boost your score. Here’s how:

1. Pay Your Bills On Time

One of the most crucial factors affecting your credit score is your payment history. Late payments can significantly damage your score, so it’s important to stay on top of due dates. Setting up payment reminders or enrolling in auto-pay through your bank ensures you never miss a payment. The more you pay on time, the better your score will look.

2. Lower Your Credit Card Balances

Your credit utilization ratio is the percentage of your available credit that you’re using. A high ratio can hurt your score, so it’s a good idea to keep your balance under 30%. For example, if your card’s credit limit is $1,000, try not to use more than $300. Paying down your balances not only improves your utilization ratio but also shows lenders you’re managing your credit responsibly.

3. Don’t Apply for Too Many Loans at Once

When you apply for a new loan or credit card, a hard inquiry is made on your credit report. While a single inquiry won’t hurt too much, applying for multiple loans in a short time can lower your score. Lenders may see it as a sign that you’re financially stressed. To avoid this, apply for credit only when necessary.

4. Keep Old Accounts Open

The length of your credit history makes up part of your credit score. Older accounts are helpful because they show lenders that you’ve been managing credit for a long time. If you have old accounts with no annual fee, it’s best to keep them open, even if you don’t use them often. This helps maintain a longer credit history, which can positively impact your score.

5. Use a Mix of Credit Types

Lenders like to see that you can manage different types of credit, such as credit cards, car loans, and personal loans. This shows that you can handle various forms of debt. However, don’t open new accounts just for the sake of improving your credit mix. Only take on new credit if it fits with your financial needs and goals.

By following these simple steps and using Gomyfinance.com Credit Score tools, you can gradually improve your score and enjoy better financial opportunities. It takes time and consistency, but the results are worth it!

Common Myths About Credit Scores

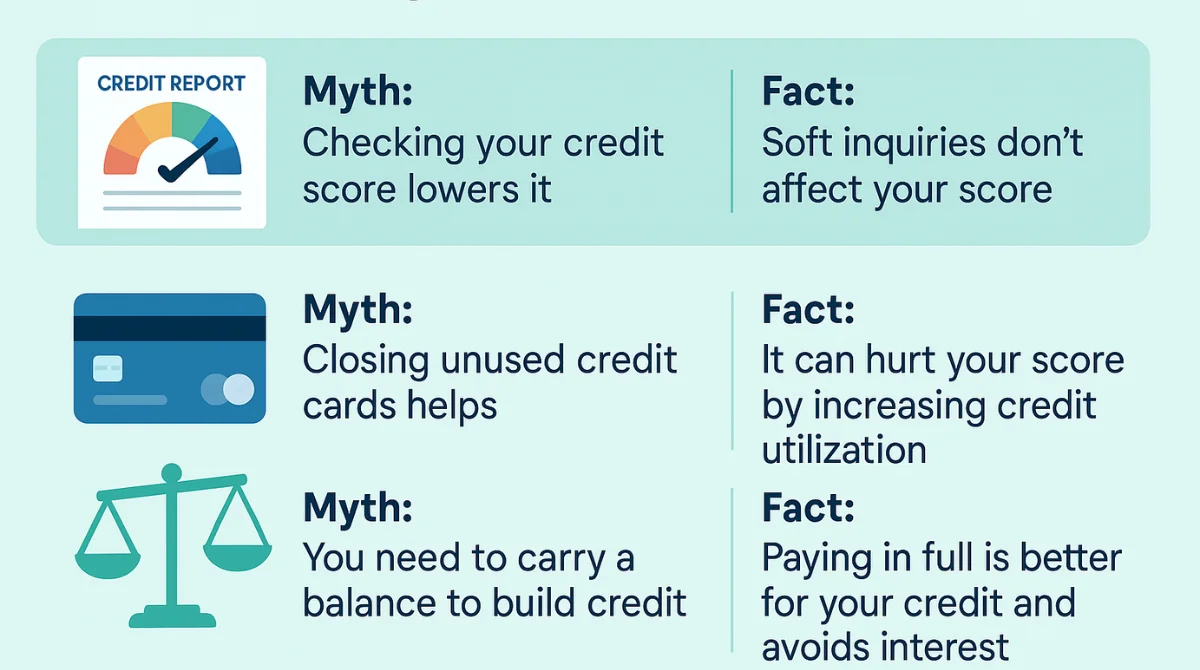

There are many misconceptions about credit scores that can lead people to make decisions that actually hurt their financial health. Let’s clear up some of the most common myths:

- Myth: Checking your credit score will lower it.

Fact: When you check your own credit score, it’s called a “soft inquiry.” This has no impact on your score. It’s only when a lender checks your score to make a lending decision that it’s a “hard inquiry,” which can slightly lower your score. - Myth: Closing unused credit cards improves your score.

Fact: Closing old credit cards may seem like a good idea, but it can actually hurt your score. When you close a card, it reduces your total available credit, which can increase your credit utilization ratio. This may cause your score to drop, especially if you have high balances on other cards. - Myth: You need to carry a balance to build credit.

Fact: It’s a common myth that carrying a balance helps build credit. In reality, paying off your balance in full every month is the best way to build credit without paying interest. It shows that you can manage credit responsibly while keeping your debt levels low.

Gomyfinance.com Credit Score Tools vs. Other Services

There are several platforms available to track your credit score, such as Credit Karma and Experian. However, Gomyfinance.com offers some unique benefits:

- Truly Free: Unlike some services that charge fees or require a paid subscription for premium features, Gomyfinance.com offers completely free credit score access.

- Easy Signup: Signing up is quick and easy, requiring just basic information, so you can get started without any hassle.

- Helpful Insights: The platform doesn’t just show you your credit score – it provides clear explanations about what’s affecting it and offers tips on how to improve it.

- Security First: Gomyfinance.com uses encryption to protect your personal data, ensuring that your information stays safe.

- Alerts You Can Trust: With real-time updates and notifications, you can stay on top of changes to your credit report, helping you react quickly to any potential issues.

How to Get Started with Gomyfinance.com Credit Score?

Getting started with Gomyfinance.com is simple. Here’s how:

- Visit the Website: Go to the Gomyfinance.com website.

- Create an Account: Sign up by providing your email address and verifying your identity to ensure your data is secure.

- View Your Credit Score: Once you’ve signed up, you can immediately check your credit score and see where you stand.

- Follow the Tips: Gomyfinance.com will provide you with personalized advice to improve your score based on your credit situation.

- Check Regularly: Make it a habit to review your score every month to stay informed and track your progress.

Real-Life Example: How Gomyfinance.com Helped Sarah

Sarah, a first-time car buyer, was denied a loan because of her low credit score. She signed up for Gomyfinance.com and discovered that her score was lower than she expected, mainly due to high credit card usage and a missed payment she wasn’t aware of.

Thanks to the advice she received on the platform, Sarah was able to pay down her credit card debt and correct the mistake on her credit report. Six months later, her credit score improved from 580 to 710. With her improved score, Sarah was approved for the car loan she wanted, and she secured a much better interest rate, saving her money in the long run.

Conclusion

In today’s world, understanding and maintaining a good credit score is crucial for making significant financial decisions. Gomyfinance.com Credit Score service offers a free, simple, and effective way to monitor and improve your credit score. With features like real-time monitoring, personalized tips, and easy access to your credit score, Gomyfinance.com helps you take control of your financial future. Whether you’re planning to apply for a loan, buy a home, or secure a credit card, knowing your score and how to improve it can lead to better financial opportunities. By using the tools and advice provided by Gomyfinance.com, you can work towards improving your credit score and achieve your financial goals with confidence.

Related Topic: Is Destiny Mastercard The Right Credit Card for Building Credit?