India is one of the fastest growing economies in the world and with that growth comes an ever increasing demand for energy. To meet this need, the country must continuously build and upgrade its energy infrastructure like power plants, transmission networks and renewable energy sources. Behind this transformation stands a crucial player, Power Finance Corporation Limited, represented in the stock market by the ticker BOM 532810.

What Is BOM 532810?

BOM 532810 is the stock symbol for Power Finance Corporation Limited (PFC), a government owned financial institution Power Finance Corporation (PFC) extends financial support to a wide range of power sector initiatives throughout India. It plays a vital role in funding projects related to:

- Transmission infrastructure (power grids and lines)

- Distribution networks (local supply chains)

- Clean and green energy initiatives

- Electricity generation across multiple sources, including thermal, hydroelectric, nuclear, and renewable energy.

By funding these projects, PFC helps ensure that millions of people have access to reliable and affordable electricity.

The Importance of Power Finance Corporation

Power Finance Corporation was established in 1986 and is under the Ministry of Power. Over the years, it has grown into a vital financial backbone of India’s energy sector. Here’s why it matters:

- Huge Lending Portfolio: PFC has a large loan book worth several lakh crore rupees, mainly focused on energy and infrastructure.

- Nationwide Reach: The company funds projects in every part of India, from urban grids to rural electrification.

- Government Backing: Being a public sector enterprise means PFC enjoys strong support from the Indian government, which helps reduce risks for investors.

This strategic role makes BOM 532810 a key stock when talking about energy investment in India.

How BOM 532810 Supports Energy Infrastructure?

India’s energy needs are growing due to urbanization, industrialization and increasing digitalization. To keep up with this demand, a robust energy infrastructure is necessary. PFC contributes in the following ways:

1. Financing Large Power Projects

PFC provides long term loans to state electricity boards, power generation companies and private energy firms. These loans help build:

- Thermal power plants (coal based)

- Hydroelectric dams

- Nuclear power stations

- Renewable energy farms (solar, wind, biomass)

By giving low interest loans with flexible terms, PFC helps kickstart and complete massive energy projects that otherwise would face funding issues.

2. Supporting Renewable Energy Initiatives

India has set a target to fulfill 50% of its energy requirements using non fossil fuel sources by the year 2030. PFC is actively supporting this goal by:

- Financing solar and wind energy projects

- Investing in green bonds

- Funding hybrid energy parks

- Partnering with global institutions for climate-friendly lending

This makes BOM 532810 a green stock to watch as the world shifts toward sustainability.

3. Upgrading Transmission & Distribution

Electricity is useless if it cannot reach homes and businesses. PFC also funds the improvement of:

- Power transmission lines

- Substations and transformers

- Smart metering systems

- Loss reduction programs in distribution

Such projects reduce electricity loss during transmission and help power reach remote and underserved areas.

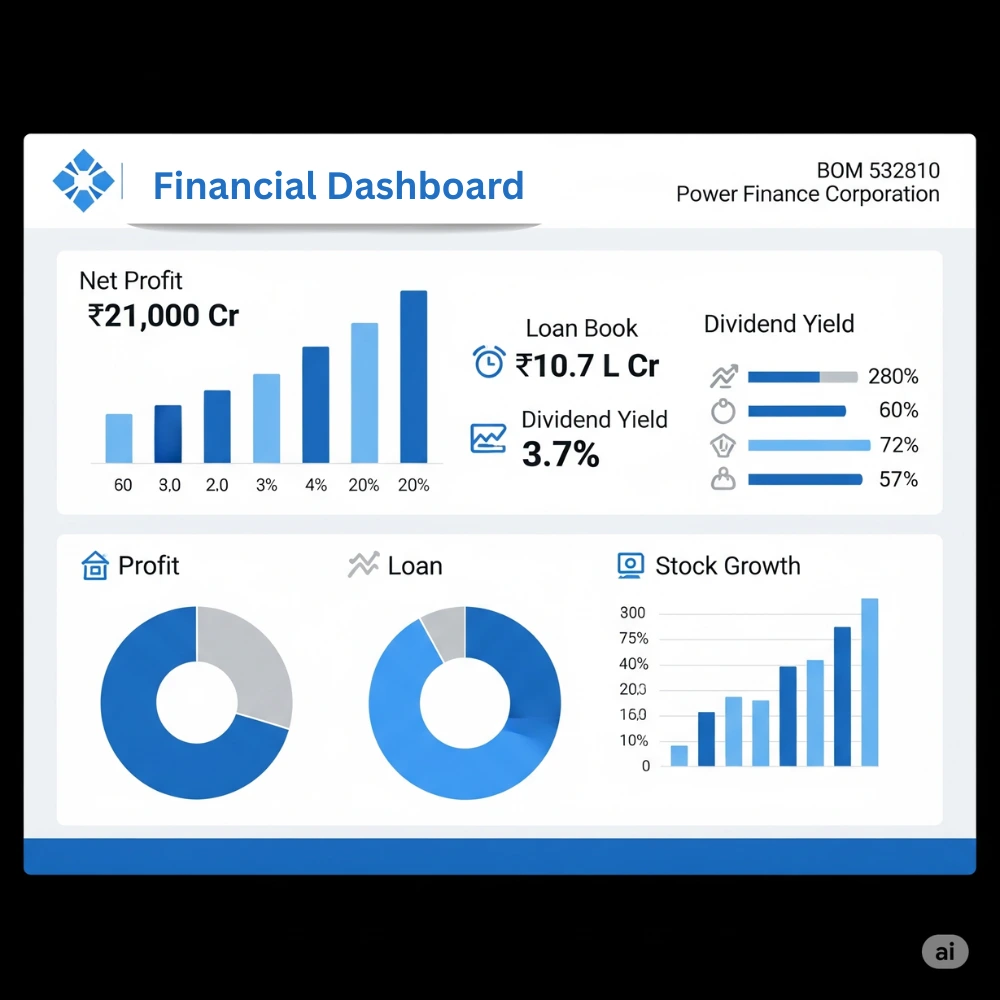

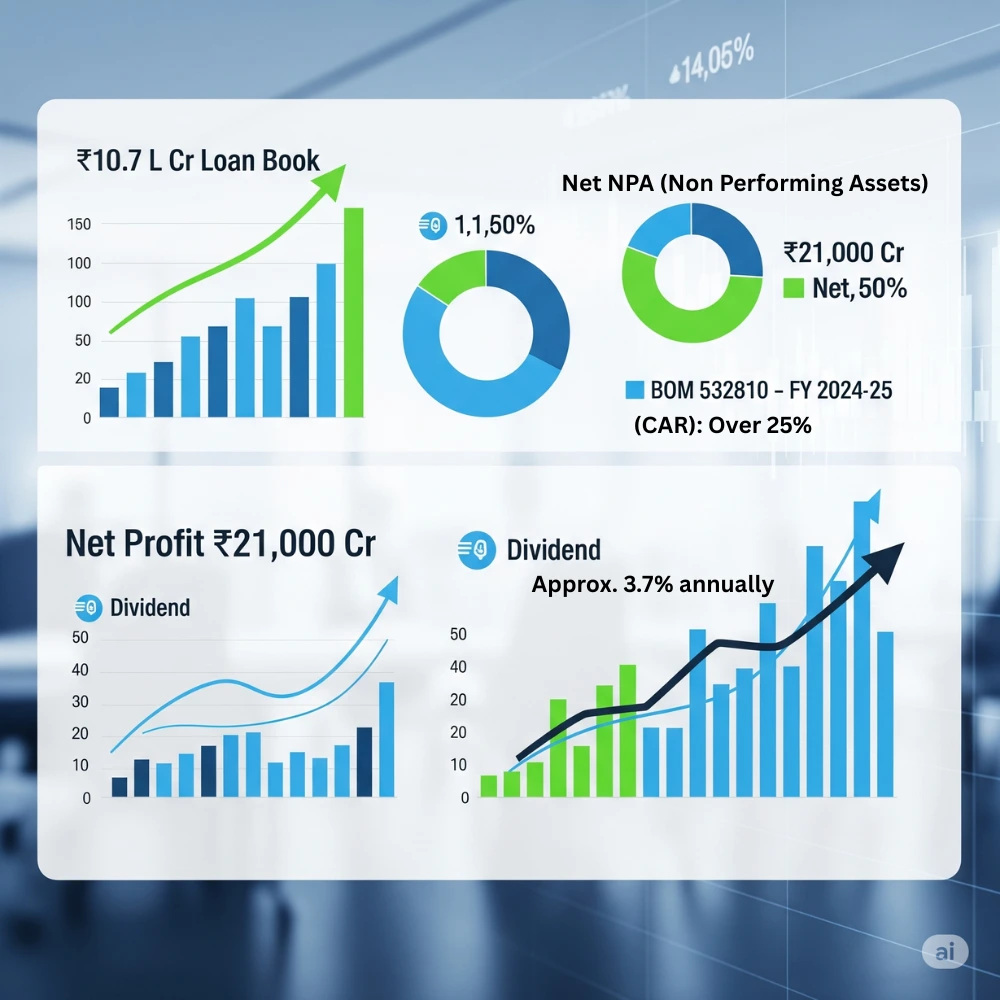

Financial Overview (as of FY 2024-25)

- Loan Book Size: Over ₹10.7 lakh crore

- Net Profit: Crossed ₹21,000 crore annually

- Net NPA (Non Performing Assets): Below 1%, showing strong asset quality

- Capital Adequacy Ratio (CAR): Over 25%, indicating financial resilience

- Dividend Yield: Approx. 3.7% annually

This performance makes BOM 532810 a strong and stable dividend paying stock with low volatility in comparison to many private NBFCs.

Why Investors Should Care About BOM 532810?

If you’re an investor interested in infrastructure, sustainable development, or long-term value, BOM 532810 offers several benefits:

- Stability: As a government-backed institution, PFC is considered more stable compared to private finance companies. Government support can help during economic downturns.

- Growth Potential: With India’s energy demand expected to double in the next 20 years, PFC’s loan portfolio will only expand and bringing opportunities for future growth.

- Dividend Income: PFC pays out regular dividends, which is good news for those looking to earn passive income from their investments.

- ESG Appeal: PFC’s involvement in green energy projects adds environmental credibility to its portfolio which attractive for investors following Environmental, Social and Governance (ESG) principles.

Major Milestones & Achievements

- Acquisition of REC Limited: In 2019, PFC acquired a majority stake in Rural Electrification Corporation (REC), making it one of India’s largest NBFC groups in infrastructure finance.

- Green Bond Issuance: PFC issued green bonds internationally to fund clean energy projects. This has attracted ESG-focused investors from Europe and Asia.

- Digital Transformation: PFC is modernizing loan tracking, project evaluation and risk analytics through advanced digital tools and AI-based systems.

- Maharatna Status: In 2021, PFC was upgraded from “Navratna” to “Maharatna”, providing it greater financial autonomy and decision-making freedom.

Challenges Faced by BOM 532810

While PFC is a strong player, it is not without challenges. Some of these include:

- Rising Interest Rates: Higher borrowing costs may affect the demand for new loans

- Currency Fluctuations: As PFC borrows internationally, forex rate changes may impact earnings

- Sector Concentration: A large part of its loans are focused on a single sector power making it sensitive to changes in government policies and demand shifts

However, the company’s strong risk management systems and government support help it navigate these challenges effectively.

Power Finance Corporation (BOM 532810) Snapshot Table

| Category | Details |

|---|---|

| Stock Ticker | BOM 532810 (BSE) ,PFC (NSE) |

| Full Name | Power Finance Corporation Limited |

| Established | 1986 |

| Ownership | Government of India (under Ministry of Power) |

| Industry | Financial Services , Infrastructure & Power Sector |

| Classification | Maharatna Public Sector Undertaking (PSU) |

| Market Capitalization | Approx. ₹1.35 Trillion (as of FY 2025) |

| Core Function | Financing power projects (generation, transmission, distribution, renewables) |

| Loan Book Size | ₹10.7 Lakh Crore+ |

| Net Profit (Annual) | ₹21,000+ Crore |

| Dividend Yield | ~3.7% |

| Net NPA (Asset Quality) | < 1% |

| Capital Adequacy Ratio (CAR) | ~25% |

| Recent Achievement | Acquisition of REC Ltd. Created one of India’s largest infra finance groups |

| Green Initiatives | Green bonds, renewable energy loans, hybrid solar-wind parks |

| Strategic Focus | Rural electrification, clean energy financing, smart grid upgrades |

| Risk Factors | Sector concentration, interest rates, currency fluctuations |

| ESG Relevance | Actively financing climate aligned, sustainable projects |

Future Outlook for BOM 532810

Looking ahead, BOM 532810 is well positioned to remain a cornerstone of India’s energy journey. Key future drivers include:

- Expansion into electric vehicle infrastructure financing

- Greater focus on rooftop solar and smart energy solutions

- Partnerships with global climate finance bodies

- Continued digital transformation in loan processing and tracking

These strategic moves can make BOM 532810 even more attractive to both retail and institutional investors.

Final Thoughts

BOM 532810 is more than just a stock code also it represents Power Finance Corporation’s pivotal role in powering India. From financing massive thermal plants to supporting clean solar energy, PFC is at the heart of the country’s development. As India’s energy landscape continues to evolve, PFC’s influence will only grow stronger.

For investors, policymakers and energy planners alike, understanding BOM 532810 is essential to understanding how India will meet its future power needs.