The insurance industry in 2025 is showing remarkable strength and adaptability, anchored by solid financials, relentless innovation, and proactive responses to escalating climate risks and evolving consumer needs. Liberty Mutual exemplifies this resilience. During the second quarter, the company reported a net income of $1.845 billion, marking a significant increase from $717 million in 2024 and $2.870 billion for the first half of the year compared to $2.252 billion in the previous year. The combined ratio improved by 12.4 percentage points, reaching 87.2%, reflecting disciplined underwriting practices and a prudent investment strategy.

Assurant, too, delivered positive performance: quarterly profit rose 25%, fueled by robust growth in its global housing business. Net earned premiums from lender-placed homeowner, manufactured housing, and flood coverage reached $697.7 million, while net investment income also climbed.

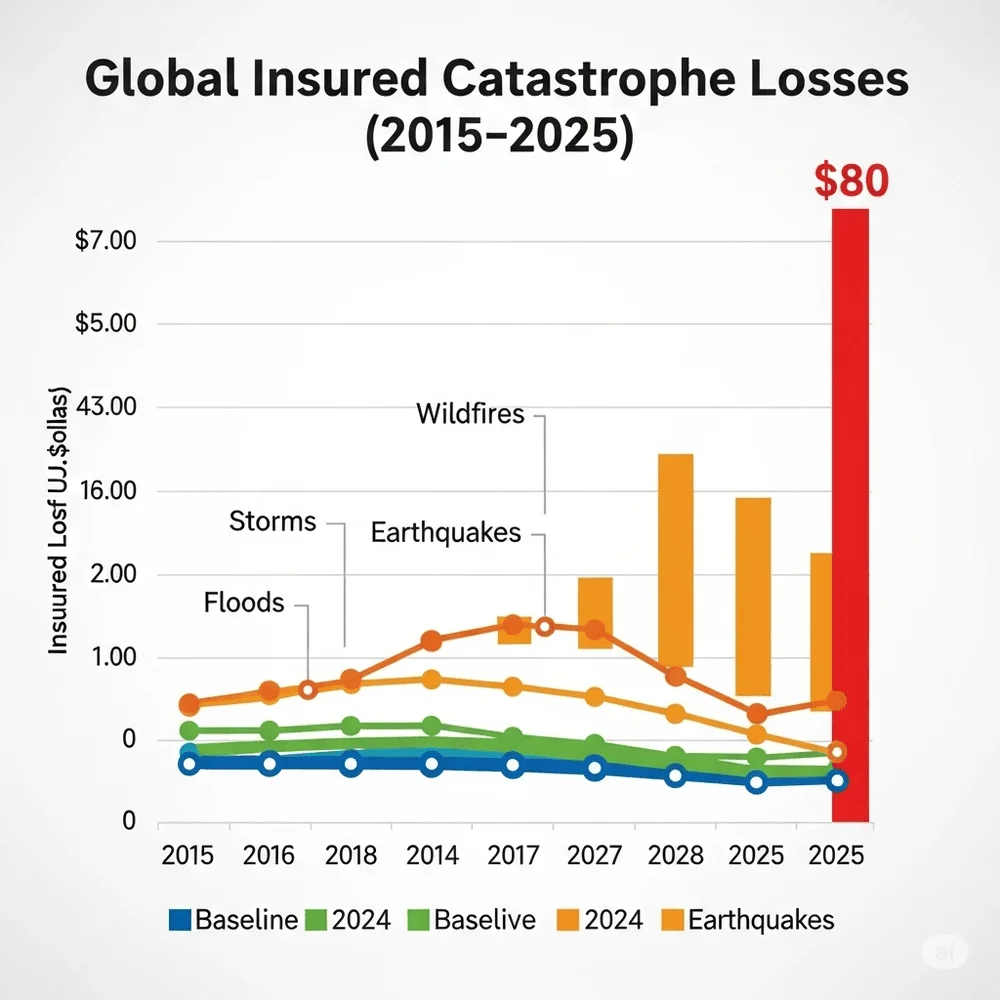

Yet, the industry continues to face mounting climate pressures. In the first half of 2025, insured losses from natural disasters worldwide totaled $80 billion, nearly double the average losses recorded over the past decade, mainly due to intense wildfires and major storms. Swiss Re warns that total insured losses could exceed $150 billion for the full year, signaling urgent challenges for risk modeling and pricing. In response, innovative tools such as parametric insurance, automated, trigger-based coverage are gaining ground. These models promise faster payouts in disasters and are attracting investors due to their low correlation with traditional markets.

On the technology frontier, the insurance sector is leveraging AI, blockchain, and data-driven platforms to reimagine operations. Digital transformation, embedded insurance, usage-based models, IoT, predictive analytics, and cybersecurity tools are redefining underwriting, claims, and customer engagement. Notably, a strategic insurtech corridor between India and Dubai is fostering sandboxes and scale, enabling cross-border innovations like real-time customer experiences and personalized policy bundling.

The industry’s outlook remains positive. IAIS’s mid‑year Global Insurance Market Report highlights robust solvency, liquidity, and profitability across major insurers, indicating resilient fundamentals even amid global economic headwinds. As insurers balance financial discipline with technological agility and climate adaptation, the path ahead is defined by both stability and progress.

Key Themes Driving the Insurance Industry in 2025:

| Key Theme | Insight |

| Financial Performance | Strong earnings and improved combined ratios like Liberty Mutual’s |

| Climate Risk | Catastrophe losses surging; parametric insurance gains traction |

| Innovation & Tech | AI, embedded models, and insurtech partnerships fueling modernization |

| Industry Outlook | Resilient capital positions amid uncertain global economic dynamics |

As the insurance industry navigates complex challenges and embraces cutting-edge technology, its continued resilience and innovation position it strongly for future growth and stability.