In the world of banking and financial services, security and accuracy are top priorities. One of the technologies that help make this possible is MICR, which stands for Magnetic Ink Character Recognition. It might sound complex, but the idea is quite simple. MICR is a printing technology that uses magnetic ink to print special characters on checks and other financial documents. These characters can be easily read by both humans and machines, which helps banks process large numbers of checks quickly and securely.

What is MICR?

MICR is a method used for printing numbers and symbols that can be read using a machine. These numbers are typically printed at the bottom of checks. You may have seen a line of strange-looking numbers and symbols on checks that’s MICR. The special thing about these characters is that they are printed using magnetic ink or toner, which makes them readable by special machines used in banks.

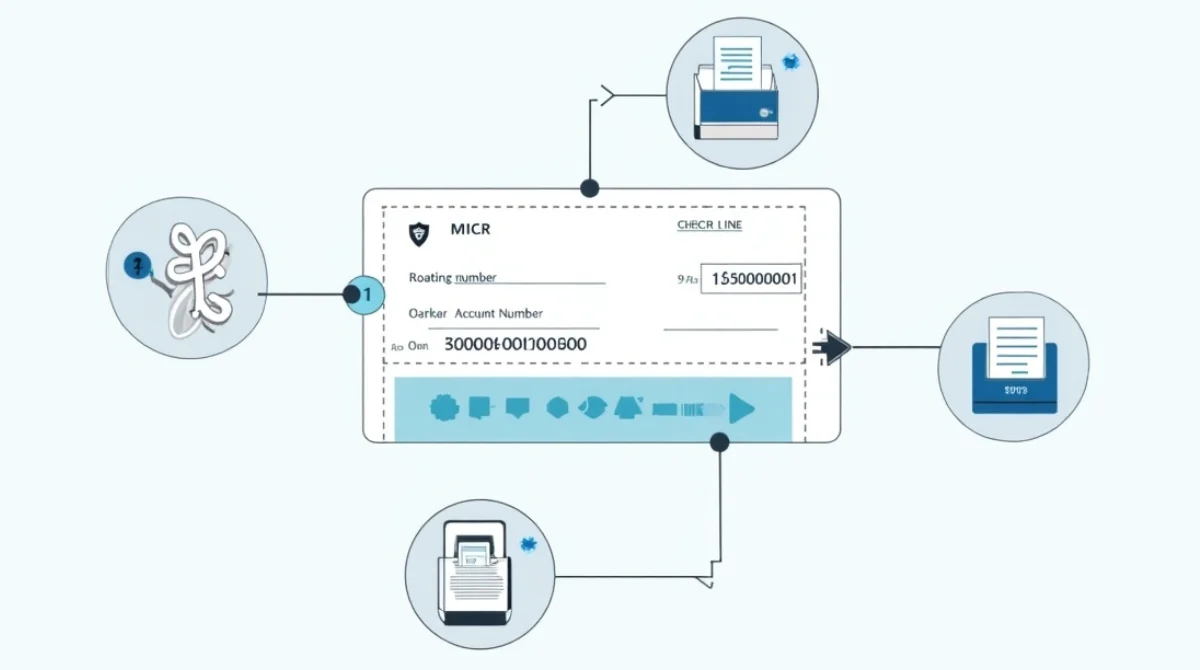

The MICR line on a check contains critical information, such as:

- Routing Number (tells which bank issued the check)

- Account Number (the check writer’s bank account number)

- Check Number (the number of the check in the checkbook)

These characters are printed using a font called E-13B (used in the U.S. and several other countries) or CMC-7 (used in Europe and some other regions). The design of these fonts helps machines detect characters accurately, even if they are smudged or partially hidden.

Why is Magnetic Ink Used?

Regular ink won’t do the job when it comes to MICR. That’s because magnetic ink has iron oxide in it, making it magnetic. When a check is processed using a MICR reader, the machine employs magnetic technology to accurately identify the characters, enhancing both the speed and security of the transaction.

Here’s why magnetic ink is important:

- Security: Replicating magnetic ink with standard printers is extremely difficult, making forgery and tampering less likely.

- Accuracy: Machines can easily read the magnetic signal of characters, even if they are slightly dirty or wrinkled.

- Speed: A high volume of checks can be processed rapidly and efficiently with minimal human intervention.

How Does MICR Work?

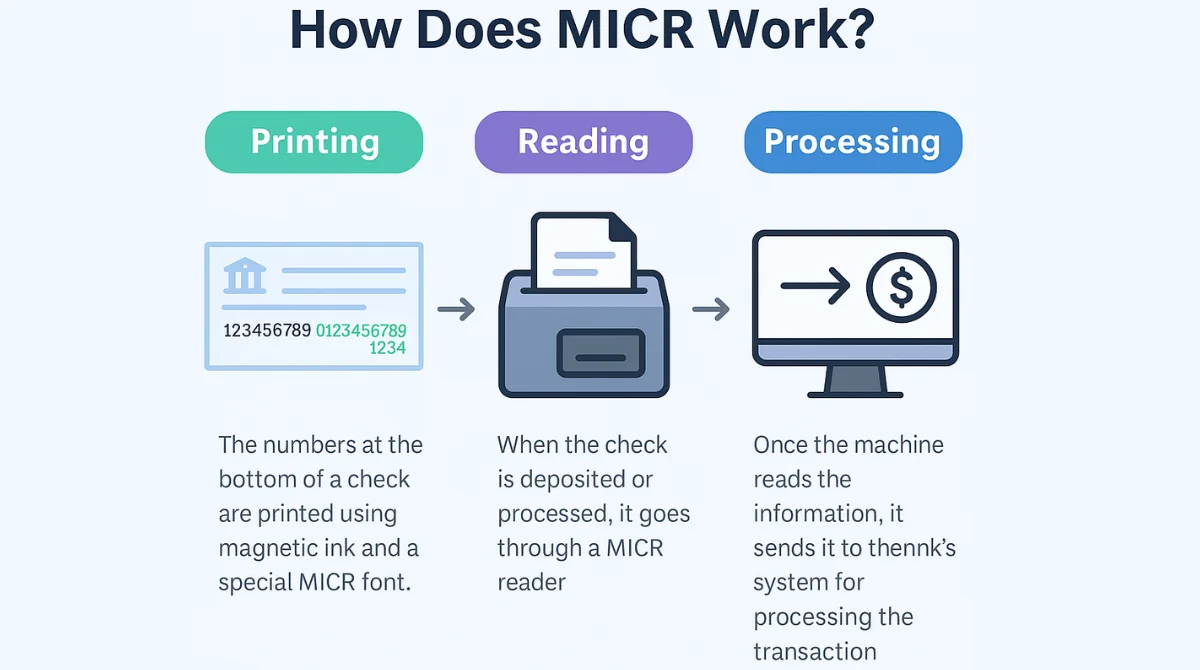

The working process of MICR involves three simple steps:

- Printing: The numbers at the bottom of a check are printed using magnetic ink and a special MICR font.

- Reading: When the check is deposited or processed, it goes through a MICR reader. This reader has a magnet and a sensor that scans the magnetic signals of the characters.

- Processing: Once the machine reads the information, it sends it to the bank’s system for processing the transaction.

The beauty of this system is that even if the characters are hidden under stamps or marks, the machine can still read the magnetic signals. This reduces errors and delays.

Where is MICR Used?

Although MICR is most commonly seen on checks, it is also used in:

- Bank deposit slips

- Payroll checks

- Government-issued checks

- Money orders

- Certified financial documents

Basically, any document that involves sensitive banking transactions can use MICR to ensure accurate and secure handling.

MICR vs Barcodes and QR Codes

You might wonder why banks don’t just use barcodes or QR codes for check processing. While these technologies are great for scanning, they are not as reliable in financial settings.

Here’s a comparison:

| Feature | MICR | Barcode / QR Code |

| Ink Type | Magnetic Ink | Regular Ink |

| Readable by Humans | Yes | No |

| Security Level | High (hard to copy) | Medium (easier to copy) |

| Usage in Banking | Very common | Rare |

| Machine-readable | Yes | Yes |

As you can see, MICR stands out because it offers a high level of security and is still readable by the human eye, which is a great backup if machines fail.

Benefits of Using MICR

MICR brings a lot of benefits to the banking world and beyond. Some of the key advantages include:

- Reduces Fraud: Magnetic ink is hard to reproduce, which keeps check fraud in check.

- Improves Efficiency: Banks can process thousands of checks daily without manual input.

- Ensures Consistency: No matter the condition of the check, machines can read the magnetic characters reliably.

- Supports Automation: MICR allows for full automation of document handling in banks.

- Provides Legal Proof: MICR-encoded documents are accepted as legal evidence in many countries.

What Equipment is Used in MICR?

To use MICR, you need some specialized tools:

- MICR Printers: These are either impact or laser printers that support magnetic ink.

- MICR Toner or Ink: Special ink that contains iron oxide and can be magnetized.

- MICR Readers/Scanners: Devices that read the magnetic characters and convert them to digital data.

Some high-end multifunction printers also come with built-in MICR printing capabilities. However, banks and financial institutions usually prefer dedicated MICR equipment for high-volume operations.

Common Mistakes in MICR Printing

While MICR is a reliable system, certain errors can still happen if proper care is not taken. Some common issues include:

- Using regular ink instead of magnetic ink

- Misalignment of MICR fonts on checks

- Using wrong fonts (other than E-13B or CMC-7)

- Poor quality printing that affects magnetic readability

These mistakes can lead to rejected checks, processing delays, and even security issues. That’s why it’s important to follow printing standards carefully when dealing with MICR documents.

Future of MICR Technology

While digital banking and mobile payments are growing, MICR is still widely used around the world, especially for corporate and government transactions. The reliability, security, and simplicity of the system make it hard to replace completely.

However, MICR is being combined with newer technologies like:

- OCR (Optical Character Recognition)

- Blockchain record-keeping

- AI-powered fraud detection

This hybrid approach helps banks maintain high levels of security while moving towards digital transformation.

Conclusion

MICR may sound technical, but its purpose is simple and vital. Using magnetic ink and special fonts, it allows banks to process checks quickly and securely. MICR helps prevent fraud, improves efficiency, and remains essential in modern banking. Whether you’re a banker, business owner, or just curious, understanding MICR gives insight into the secure systems behind financial transactions.

Related Topic: Laserski Printer: Choosing the Best for Your Business Needs