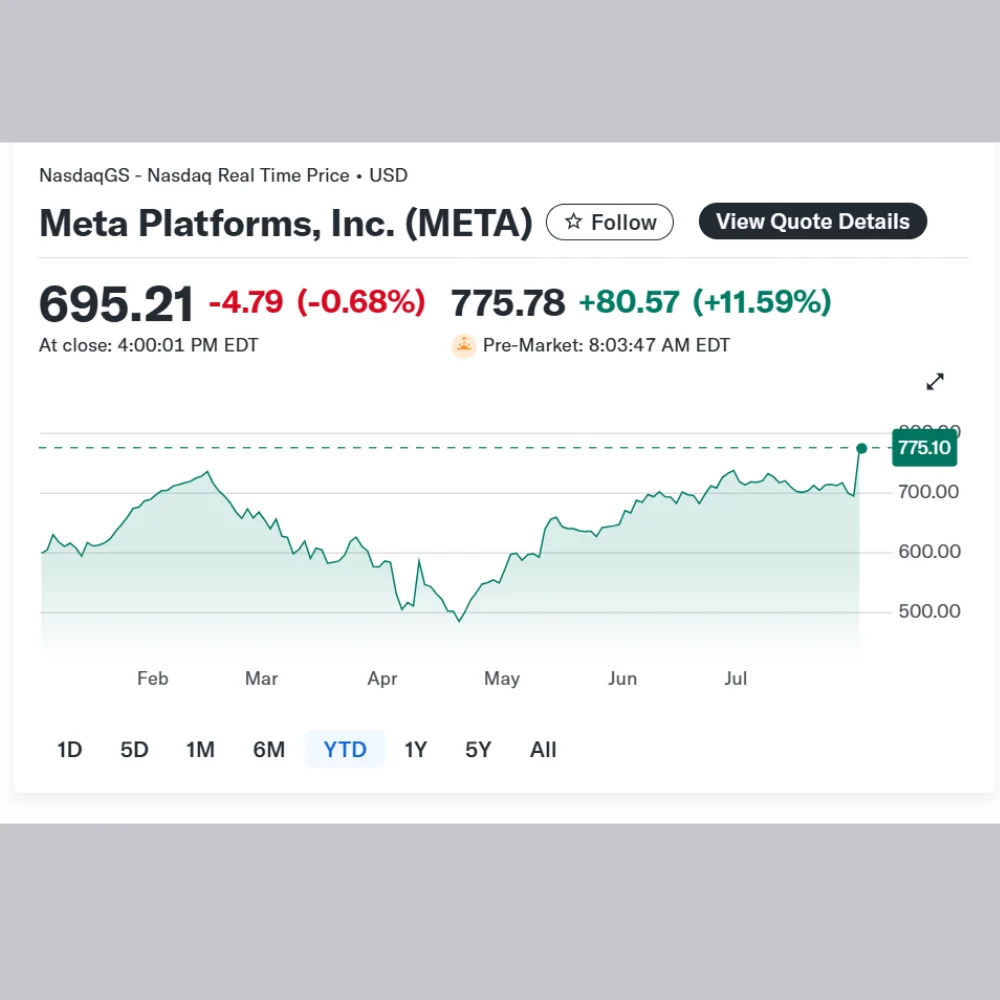

Meta Platforms (META) shares surged by 12% in premarket trading on Thursday after the tech giant reported stronger-than-expected second-quarter earnings and provided a robust revenue outlook for the third quarter.

Meta, the parent company of Facebook, projected its third-quarter revenue to fall between $47.5 billion and $50.5 billion significantly exceeding Wall Street’s forecast of $46.2 billion.

For Q2, Meta reported earnings per share of $7.14 on revenue of $47.5 billion, well ahead of the expected $5.89 EPS and $44.83 billion revenue, based on Bloomberg consensus data. By comparison, the same quarter last year saw EPS of $5.16 and revenue of $39.07 billion.

Meta’s advertising revenue, which forms a substantial part of its overall earnings, climbed to $46.5 billion surpassing the projected figure of $44.07 billion. Meanwhile, its Reality Labs division posted a $4.5 billion loss, which was slightly less than the projected $4.8 billion loss.

This earnings beat comes amid Meta’s aggressive investment in artificial intelligence. Just last week, CEO Mark Zuckerberg introduced Shengjia Zhao, a former OpenAI researcher instrumental in developing ChatGPT, as the head of Meta’s new Superintelligence Lab.

Meta has also been expanding its AI portfolio by investing $14.3 billion in Scale AI and hiring its CEO Alexandr Wang. In addition, former GitHub CEO Nat Friedman, Safe Superintelligence CEO Daniel Gross, and Ruoming Pang, Apple’s former head of AI foundation models, have joined the company.

To support its AI growth, Meta is building massive data center infrastructure. According to Zuckerberg, the firm is allocating hundreds of billions of dollars to construct multiple multi-gigawatt data centers, including a major project named Hyperion, which will eventually handle up to 5 gigawatts of power.

CFO Susan Li addressed the increase in spending in the earnings statement, noting that infrastructure will be the primary driver of cost growth moving forward. She also mentioned that higher employee compensation particularly for technical hires will be the second-largest contributor to expenses.

“We expect a higher year-over-year expense growth rate in 2026 compared to 2025 due to increased depreciation and operational costs, as well as full-year compensation for new hires,” Li stated.