Microsoft (MSFT) delivered impressive financial results for its fiscal fourth quarter, exceeding analysts’ expectations on both revenue and profit, fueled by accelerating demand for cloud and AI services.

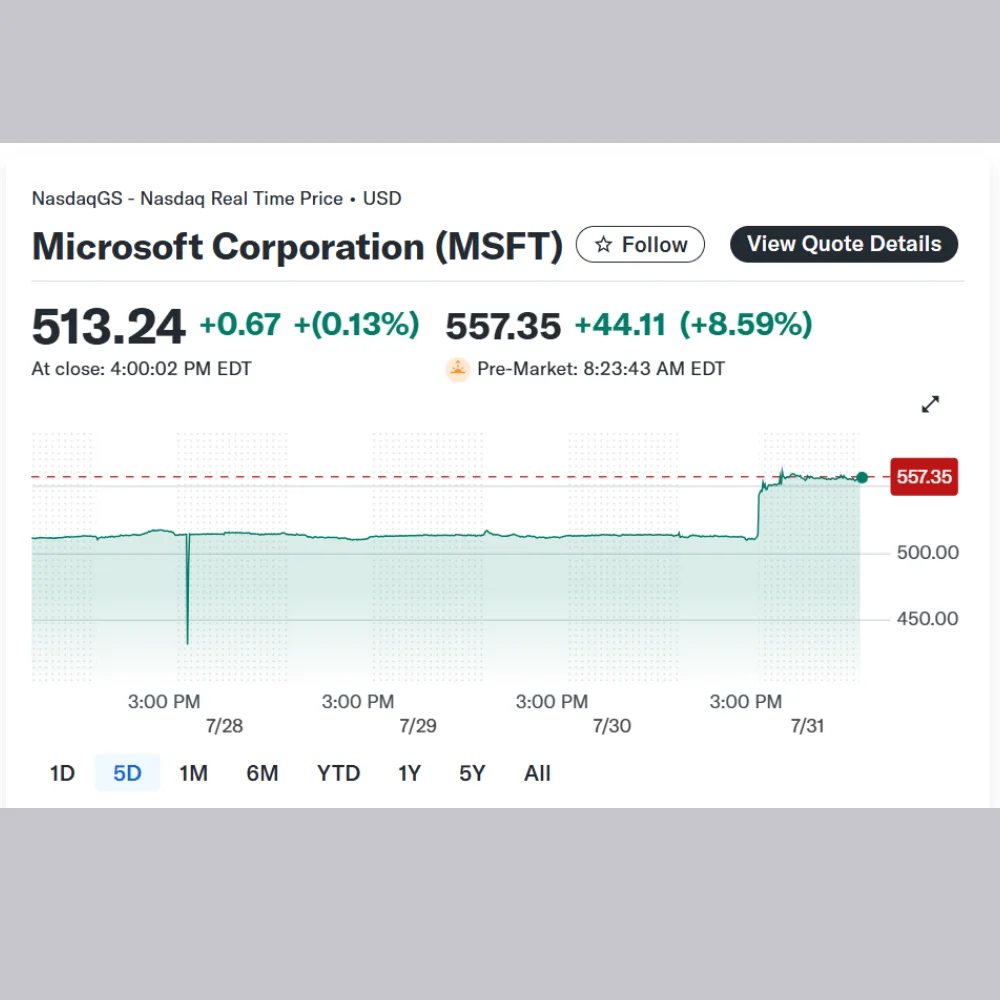

Microsoft’s stock climbed approximately 9% during premarket trading, positioning the tech giant to potentially become the world’s second company to reach a $4 trillion market value.

For the quarter, Microsoft posted adjusted earnings per share (EPS) of $3.65 on revenue of $76.4 billion, surpassing consensus estimates of $3.37 EPS and $73.89 billion in revenue. In comparison, the company reported EPS of $2.95 and revenue of $64.72 billion for the same quarter last year.

Microsoft’s Intelligent Cloud division, which includes its Azure cloud services, brought in $29.8 billion, beating analyst forecasts of $29.09 billion. CEO Satya Nadella emphasized the critical role AI and cloud technologies play in transforming businesses, stating that Azure alone generated over $75 billion in revenue this fiscal year a 34% increase year-over-year.

“We’re building innovative solutions across the tech stack to help organizations grow in this AI-driven era,” Nadella said.

Microsoft revealed plans for unprecedented capital expenditures, projecting $30 billion in infrastructure investments for the ongoing fiscal first quarter. This move positions the company to potentially outpace rivals in AI and data center buildouts. Last quarter, Microsoft spent $24.2 billion, a 27% increase compared to the same period last year.

According to CFO Amy Hood, these investments are directly tied to existing demand. “Our spending is strongly aligned with contracted business that we need to support,” she noted.

Despite trailing behind Amazon Web Services in cloud market share, Microsoft’s increasing revenue and Azure performance are seen as validation of its heavy AI investments. With over 100 million active users now on its AI-powered Copilot tools, the company is clearly gaining traction. By comparison, Google reported 450 million users on its Gemini platform.

Microsoft’s strategic relationship with OpenAI, the creators of ChatGPT, has played a vital role in its AI leadership. However, ongoing renegotiations between the two companies particularly over OpenAI’s transition to a public benefit corporation have introduced uncertainty about Microsoft’s future access and equity stake.

In response, Microsoft is diversifying its AI portfolio, expanding partnerships with companies like xAI, Meta, and France’s Mistral, while also developing its own models and hosting them on Azure for customers.

As a result of these developments and overall market confidence, Microsoft is now just $200 billion shy of the $4 trillion mark, with its shares up approximately 20% in 2025 so far.

Analysts, including those at Wedbush and BofA Global Research, expect AI to remain a primary growth engine for Microsoft, particularly with the full rollout of Copilot and broader enterprise adoption anticipated to peak in fiscal 2026.