The allotment date for the National Securities Depository Limited (NSDL) IPO has been officially set as August 4, 2025, following a three‑day subscription window that opened on July 30 and closed on August 1. The NSDL IPO, structured entirely as an offer-for-sale of 5.01 crore equity shares within a price range of ₹760 to ₹800 per share, received an overwhelming response from the market, culminating in an overall subscription of approximately 41.02 times the issue size.

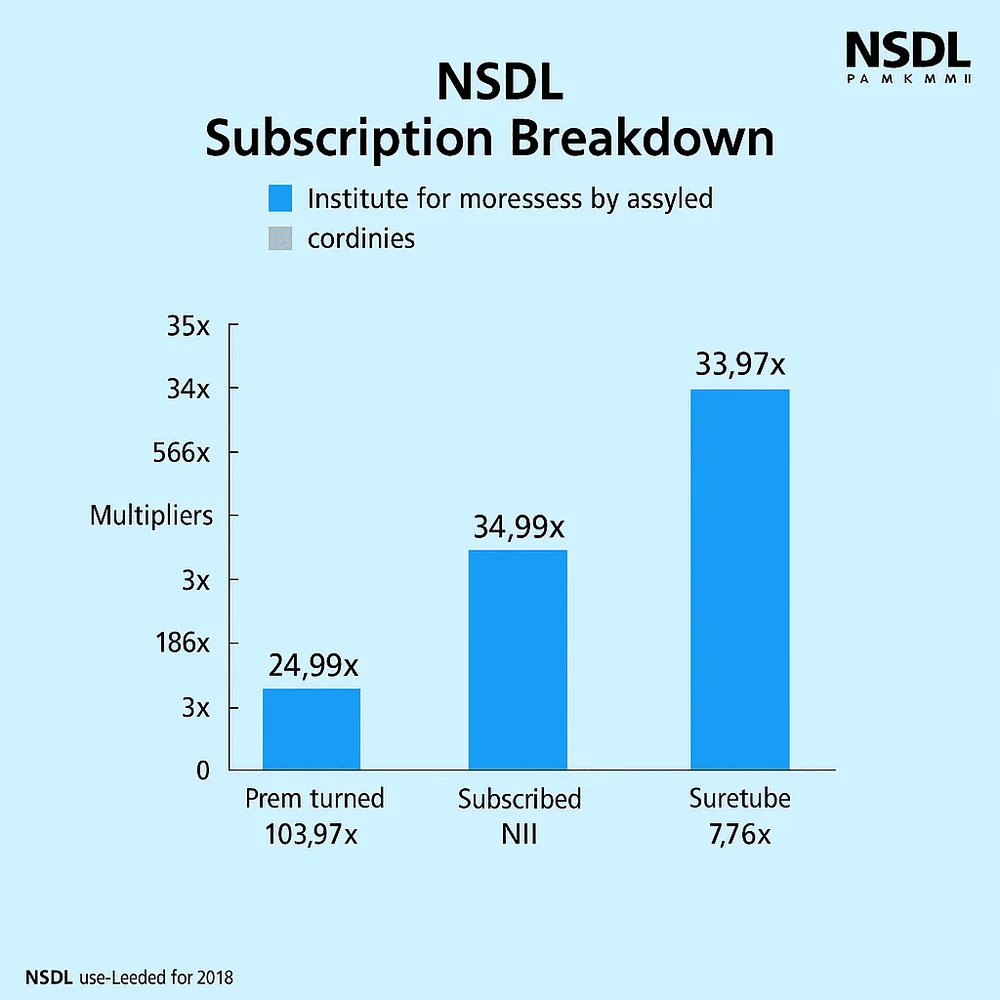

Qualified Institutional Buyers (QIBs) subscribed 103.97 times, followed by NIIs at 34.98 times and retail investors at 7.76 times their quota.

That high level of demand set the stage for a strong grey market sentiment, with NSDL shares quoted at an estimated ₹120–₹137 above the ₹800 issue price, suggesting a 15–17% potential listing gain.

Once the allotment is finalised on August 4, successful applicants can expect the shares to be credited to their demat accounts, and refunds to unsuccessful bidders, by August 5. The listing of NSDL shares is scheduled to take place on August 6, 2025, on the Bombay Stock Exchange (BSE), with a probable concurrent listing on the National Stock Exchange (NSE).

To check your allotment status, investors can use one of the following platforms:

- Registrar (MUFG Intime / Link Intime): select NSDL IPO, enter PAN or application number or DP/Client ID, then submit to view status.

- BSE website: choose “Equity” as issue type and “NSDL Limited” as issue name, input PAN/application number, confirm captcha, and search.

- NSE website: available for verification via IPO bid details form, though some platforms may redirect to registrar or BSE . Here’s a snapshot of the key dates:

| Event | Date |

| IPO open date | July 30, 2025 |

| IPO close date | August 1, 2025 |

| Allotment date | August 4, 2025 |

| Refund & demat credit date | August 5, 2025 |

| Listing date | August 6, 2025 |

The NSDL IPO is notable not only for its overwhelming response but also for the fact that it did not raise fresh capital. Instead, it allowed existing institutional shareholders such as NSE, SBI, IDBI, HDFC Bank, and SUUTI to unlock value. Its position as India’s oldest demat depository gives it foundational strength, while the high interest and grey market pricing signal that the listing has significant upside potential.