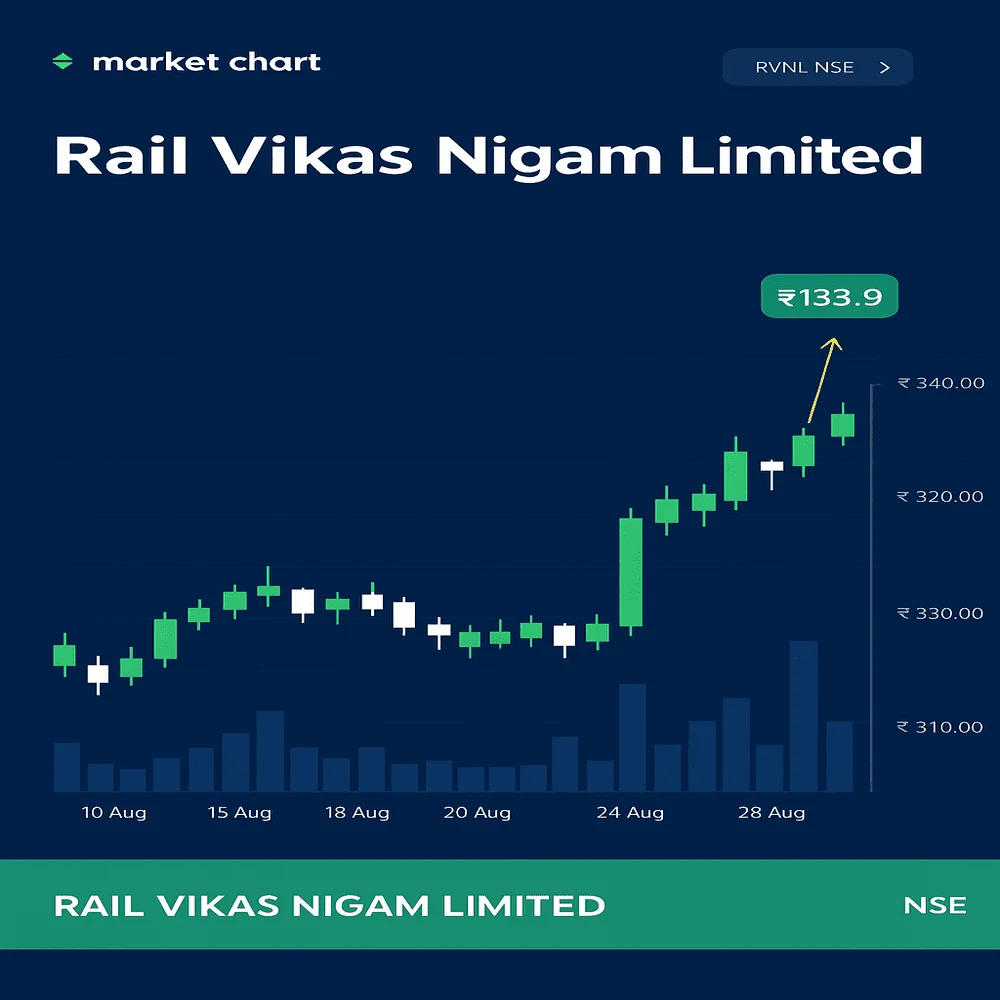

Rail Vikas Nigam Limited (RVNL), a Navratna public sector undertaking under the Ministry of Railways, has seen significant variations in its share price in recent times. On August 18, 2025, the stock saw a 2% increase, reaching ₹330.65 on the Bombay Stock Exchange (BSE), following the announcement of a ₹178.65 crore contract from IRCON International for signaling and telecom works, including new interlocking systems and control upgrades, to be completed within the year.

However, this positive movement was preceded by a significant decline. On August 13, 2025, RVNL’s shares fell by up to 3.7%, closing at ₹316.75, after the company reported a 40% year-on-year drop in its profit for the June quarter, indicating weaker operational performance and revenue contraction.

The stock’s performance has been under scrutiny, with some analysts expressing caution. Antique Stock Broking lowered RVNL’s target price to ₹204 from ₹216, citing a 37% potential downside, as the company’s Q1 revenue declined 4% year-on-year to ₹3,900 crore, and EBITDA margin contracted sharply to 1.4% due to Bharat Net expenses.

Despite these challenges, RVNL’s order book remains robust, and the recent contract wins suggest ongoing project acquisition momentum. Investors should monitor the company’s operational performance closely, as it will be crucial in determining the stock’s future trajectory.

In summary, while RVNL’s share price has shown resilience with recent gains, the underlying financial performance and market sentiment indicate a cautious outlook. Potential investors should consider these factors and stay informed about the company’s developments before making investment decisions.

Key Highlights:

- August 18, 2025: Stock rose 2% to ₹330.65 on BSE due to the ₹178.65 crore IRCON International contract.

- August 13, 2025: Shares dropped 3.7% to ₹316.75 after a 40% YoY profit decline in Q1.

- Antique Stock Broking lowered its target price from ₹216 to ₹204, highlighting a potential 37% downside risk for investors.

- Q1 revenue declined 4% YoY to ₹3,900 crore; EBITDA margin contracted to 1.4% due to Bharat Net expenses.

Strong order book and ongoing project wins indicate continued momentum.

RVNL Share Price Summary:

| Date | Closing Price (₹) | Change (%) | Key Event |

| 13 Aug 2025 | 316.75 | -3.7 | Q1 profit decline reported |

| 18 Aug 2025 | 330.65 | +2.0 | ₹178.65 crore IRCON International contract won |