What Is Elf Labs?

Elf Labs (Toon Studio, Inc.) is a creative startup focused on building a character-driven mobile platform called “Elf Mobile” and original content around proprietary IP. Based in California, the company offers Class B non-voting shares via Regulation CF crowdfunding. It’s not publicly listed, so share liquidity is low, and offerings come with minimum investments and fees.

Certainly! Here are some additional useful details related to Elf Labs and tracking its stock-style investments that weren’t covered in the infographic:

Company Overview & Market Strategy

- Founded: 2021

- Headquarters: Los Angeles, California

- Industry Focus: Original character-based entertainment and mobile services

- Business Model: Monetizes intellectual property (IP) through licensing, merchandise, and mobile subscriptions

Elf Labs is blending mobile telecom services with narrative-based content, which is a rare hybrid in the startup ecosystem. This niche positioning could allow them to capitalize on underserved market segments, especially among younger digital audiences.

Equity Structure and Share Details

- Type of Stock Offered: Class B Non-Voting Shares

- Valuation Cap (latest round): $25 million pre-money valuation

- Minimum Investment: $1,000

- Investor Fees: ~2.5% processing fee through DealMaker Securities

- Voting Rights: Investors do not receive board or strategic control

This structure makes it easier for founders to maintain control but may limit influence for early-stage investors.

Timeline of Key Events

| Date | Event |

|---|---|

| Q1 2024 | Launched the first equity crowdfunding round |

| Q4 2024 | Signed a content deal with CompaxDigital |

| Q1 2025 | Closed $1.5M fundraising with DealMaker |

| Q2 2025 | Began beta development of the “Elf Mobile” network |

| H2 2025 | Anticipated launch of Elf Mobile (soft rollout) |

Marketing & User Growth Initiatives

- Target Users: Gen Z and Gen Alpha mobile users

- Marketing Channels: Influencer partnerships, TikTok shorts, character content

- User Acquisition Strategy: Early adopters receive exclusive perks, loyalty tokens, and branded content previews

They’re aiming to make their elf characters as recognizable as Pokémon or Hello Kitty, with the twist of integrated mobile services.

Regulatory Compliance

Elf Labs files under Reg CF with the SEC. This means:

- Required to submit Form C filings

- Must disclose annual financials, risks, and business models

- Limits per investor are capped based on income/net worth

This transparency protects investors but also creates ongoing reporting pressure on the company.

Competitor Landscape

Elf Labs may face indirect competition from:

- Entertainment IP Companies (e.g., Hasbro, Funko)

- Telecom Startups (e.g., Gigs, Mint Mobile)

- Streaming Platforms (e.g., YouTube Kids, Netflix Kids)

Its hybrid model crosses multiple verticals, making it both unique and harder to benchmark for valuation.

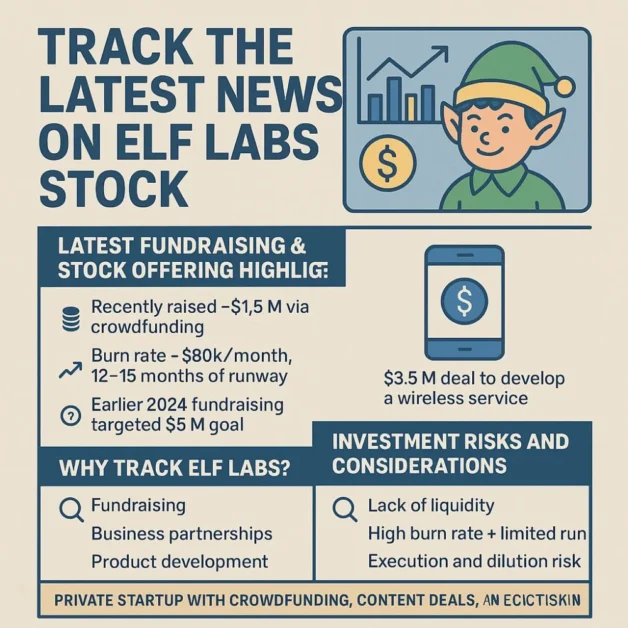

Latest Fundraising & Stock Offering Highlights

- Elf Labs recently closed a crowdfunding round, raising approximately $1.5 million in February 2025 and issuing roughly 798,515 Class B shares. Prior rounds in 2024 brought in $1.86 million, and long-term cash reserves are still strong at around $1.27 million.

- Burn rate remains about $80,000/month, giving roughly 12–15 months of runway, assuming no major changes.

- Earlier in 2024, Elf Labs targeted a $5 million funding goal, though unmet, this shows ambition and appetite for growth.

Key takeaways:

- Private startup, not public; invest through crowdfunding.

- Minimum investment ~$1,000 with 2.5% fees.

- Good capital cushion—but runway is finite.

- Focus on mobile platforms and streaming/licensing content.

Major Development: “Elf Mobile” Deal

Elf Labs signed a $3.5 million development deal with CompaxDigital to build “Elf Mobile,” a wireless service tied to their characters and content. This deal signals a strong hold on their content IP, sets the stage for direct-to-consumer distribution, and could strengthen future monetization opportunities.

Investment Risks and Considerations

- Lack of liquidity: Class B shares are non-tradable on public exchanges, with a typical one-year lock-up and limited transfer options.

- High burn rate + limited runway: Needs further funding in the next year or must become self-sustaining.

- Execution risk: Scaling a new product (Elf Mobile) and monetizing IP in a competitive content landscape is challenging. A common startup risk.

- Regulatory and dilution risk: Future funding raises could dilute current holdings, and oversight is minimal compared to public companies.

Public Comparisons: e.l.f. Beauty Stock

Though unrelated, the public company e.l.f. Beauty (NYSE: ELF) is often confused with Elf Labs by ticker. Here’s a snapshot:

- Current share price: $117.63, +6.07% on July 18, 2025.

- Analysts rate it a moderate buy, with a 12-month target of $123.38 (+4.8%). The Q4 fiscal 2025 call is scheduled for May 28, 2025.

- Institutional activity includes Vanguard, BlackRock, and Baillie Gifford—although ELF’s price is off ~30% from July 2024 highs.

Why Track Elf Labs?

Tracking Elf Labs is about staying on top of their evolving business ahead of any major milestones:

- Fundraising updates: Any new crowdfunding or private investment affects the runway and cap structure.

- Business partnerships: Deals like the $3.5M content deal reveal momentum.

- Product development: Beta launches or user growth of Elf Mobile can change valuation projections.

- IP releases & licensing deals: Cartoon media, branded partnerships, or merchandise news suggest monetization.

- Regulatory filings, such as FY-end reports and Form C, indicate financial performance and strategic direction.

How to Stay Updated?

To stay informed:

- Follow crowdfunding platforms, especially DealMaker Securities, where Elf Labs is offering shares.

- Review SEC filings (Form C, updates) via SEC.gov; these give accurate financial and operating details.

- Subscribe to company communications, like investor emails, Q&As, and press releases.

- Track trade and license deals via business news, especially for mobile, content, and IP partnerships.

- Join investor communities, if available; forums or social groups might share insights or rumors.

For Users Who Want Clear Takeaways

- Is Elf Labs publicly traded?

No, it’s private; investing happens through crowdfunding platforms. - Can I sell shares easily?

No, shares are non-voting, there’s a one-year lock-up, and there are limited transfer options. - Should I watch e.l.f. Beauty (NYSE: ELF)?

Only if you want to compare a public ticker, Elf Labs, and e.l.f. Beauty, a completely different company.

Where to learn more?

- SEC filings (for real data)

- DealMaker listings

- Company press releases

- Industry news sites

Conclusion

Elf Labs is a pre-revenue startup with strong IP foundations, launching its first major partnerships and aiming to break into mobile entertainment. The company’s crowdfunding model limits investor liquidity and comes with execution risks, but early signs, including capital raises and a marquee deal, suggest possible upside.

If you’re interested in “tracking the latest news on Elf Labs stock,” focus on official filings, deal announcements, product updates, and crowdfunding rounds. Each could shift valuation and investor sentiment.

Tracking Elf Labs is a long-term journey into startup development and crowdfunding investing. It’s about monitoring business momentum, fundraising rounds, partnerships, and content rollout; each may significantly impact value. Stay focused on official sources and track progress over time.