Micro investing lets you start investing with just a few cents using mobile apps. It’s ideal for beginners, students, or anyone wanting to grow wealth slowly without needing large amounts of money or taking big risks.

Why Micro Investing is Gaining Popularity?

Many people today understand the value of saving and investing, but feel unsure where to begin or think they lack enough money. Micro-investing offers a simple solution by turning spare change into investments, making it easier to start small and build long-term financial habits.

How Micro Investing Works?

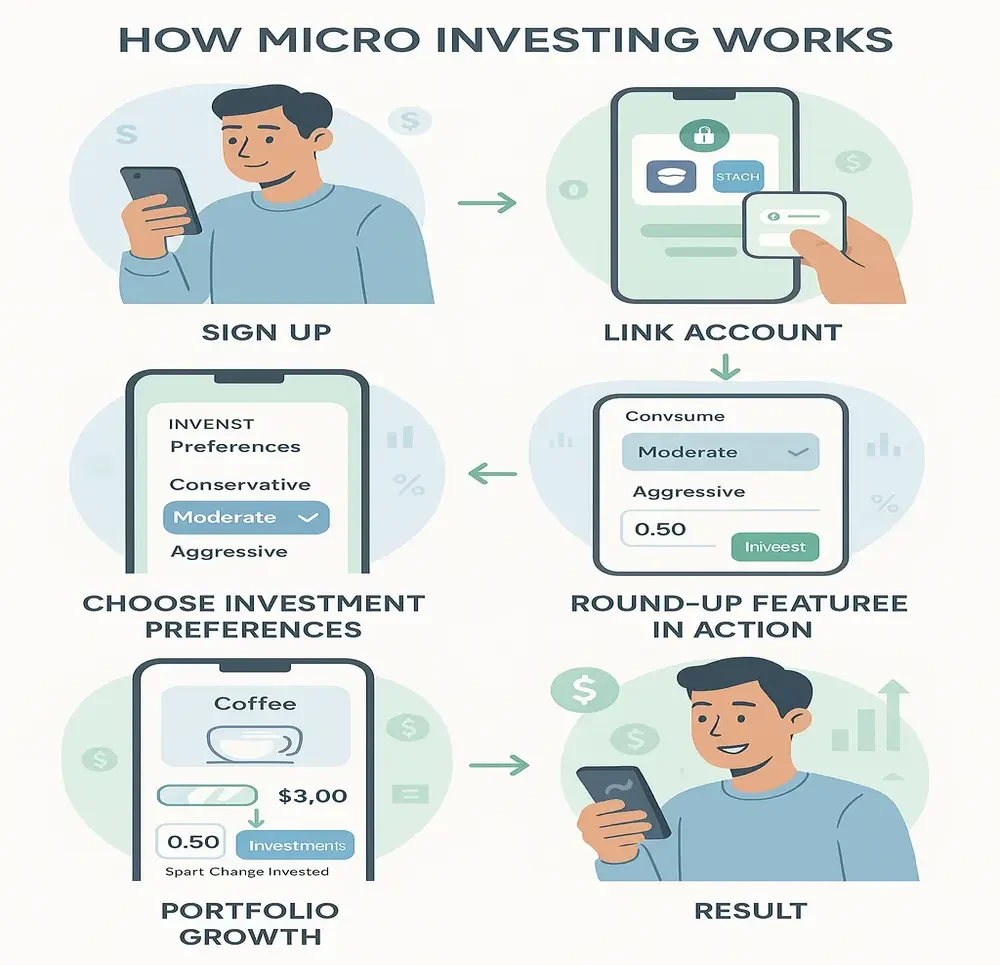

Micro investing gives people the opportunity to start investing with very small amounts of money, even with leftover change from daily purchases. Here’s how the process generally works:

- You sign up for a micro-investing app like Acorns, Stash, or Robinhood.

- To get started, simply link your financial account to the chosen app.

- Choose your investment preferences, like how risky or safe you want your investments to be.

- Start investing regularly, either manually or automatically.

- Some apps round up your purchases. For example, if you buy coffee for $2.50, the app rounds it to $3.00 and invests the 50 cents.

These small amounts slowly add up, and over time, you begin to build a portfolio. Some apps even offer features like cashback investing or recurring contributions, where you can set a fixed amount to invest every week or month.

Features of Micro Investing Apps

Each app is a little different, but most micro-investing platforms offer similar features designed to make investing easy and hands-off.

- Automatic round-ups: Your spare change from daily purchases is invested automatically.

- Recurring investments: You can set a weekly or monthly amount to invest without even thinking about it.

- Educational content: Many apps teach you the basics of investing, which is perfect if you’re a beginner.

- Low or no account minimums: Start with just $1 or even less, depending on the platform.

- Diverse portfolios: Your money is usually invested in ETFs, which are groups of stocks, giving you instant diversification.

Benefits of Micro Investing

Micro investing comes with several advantages that make it a great option for new investors or people who want to grow wealth slowly but surely.

- Low barrier to entry: You don’t need a lot of money to get started.

- Easy to use: Mobile apps make it simple for anyone to invest with just a few taps.

- Builds investing habits: Investing regularly, even in small amounts, helps create good financial habits.

- Teaches you about finance: Many apps explain where your money is going and how investing works.

- Great for long-term growth: With time, your small investments can grow thanks to compound interest and market returns.

Downsides to Keep in Mind

Like all things in finance, micro investing isn’t perfect. While this approach is simple and accessible, there are a few important things to keep in mind before getting started:

- Fees can be high for small balances: Some apps charge $1–$3 per month, which might seem small, but if your balance is low, that fee eats up a big chunk of your earnings.

- Limited investment control: You usually can’t pick individual stocks. The app decides your portfolio based on your risk profile.

- Takes time to see results: Because you’re investing small amounts, it can take a while before you see major growth.

- Not ideal for short-term goals: If you need the money soon, investing it, even in small amounts, might not be wise.

Popular Micro Investing Apps

There are several apps available today that offer micro-investing services. Each one has different features, fees, and benefits. Here are some of the most widely used micro-investing platforms:

- Acorns: This app automatically rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of ETFs.

- Stash: Stash allows users to invest in fractional shares and offers educational tools to support informed financial decisions.

- Robinhood: While not strictly for micro investing, it allows you to buy fractional shares with no commission fees.

- SoFi Invest: Offers commission-free investing, financial planning tools, and even free access to financial advisors.

- Public: Lets you invest in fractional shares and has a social feature where you can follow other investors.

Who Should Consider Micro Investing?

Micro investing is ideal for:

- Beginners who want to learn about investing without risking a lot of money.

- People with tight budgets who can only spare a few rupees or dollars at a time.

- Young adults or students who want to start building wealth early.

- Anyone interested in building long-term financial habits without needing to become a stock market expert.

If you fall into any of these groups, micro-investing is worth trying. It’s a great way to dip your toes into investing, and over time, those tiny amounts can turn into something meaningful.

How to Start Micro Investing?

Getting started is easier than ever. Here’s a simple guide:

- Choose the right app: Research which micro-investing platform suits your needs and budget.

- Download and install the app: Sign up with your basic information.

- Link your bank account or card: This is how the app will fund your investments.

- Set your investment goals: Most apps help you choose what you’re investing in and match you with a suitable risk level based on your preferences.

- Turn on round-ups or recurring contributions: This helps build your investment habit.

- Watch your money grow: Over time, your small contributions can turn into a sizable investment.

Tips for Success in Micro Investing

While micro investing is beginner-friendly, keeping these tips in mind can help you get the most out of it:

- Stay consistent: Even if it’s just $1 a week, regular investing builds good habits and compound growth.

- Don’t panic during market dips: Investments can go up and down. Stay focused on long-term goals.

- Use educational tools in the app: Learn about how the stock market works to become more confident over time.

- Check fees: Make sure the app’s fee structure is worth it for the amount you’re investing.

- Set financial goals: Whether it’s for retirement, a car, or an emergency fund, having a target helps guide your investment journey.

Final Thoughts

Micro investing is a simple and low-stress way to begin building long-term wealth. With modern apps, anyone can start investing small amounts, stay consistent, and grow over time, proving that even small steps today can lead to big financial gains in the future.