As the business landscape evolves rapidly, companies need smarter ways to plan, manage, and measure performance. Oracle EPM (Enterprise Performance Management) is a cloud-based suite that helps organizations budget, forecast, report, and make data-driven decisions. From startups to large enterprises, it enables faster, more accurate performance management.

Who Uses Oracle EPM System and Why It Matters?

The Oracle EPM System is used by finance teams, business managers, analysts, and even IT departments. It helps them understand how the business is performing and what can be done to improve it. You can think of it as a smart assistant that provides you with insights and tools to run your business more effectively. Companies in almost every industry, such as retail, banking, healthcare, and manufacturing, use Oracle EPM to manage everything from budgeting to regulatory compliance.

Understanding Core Modules of the Oracle EPM System

Let’s break it down further and look at what the Oracle EPM System includes. Oracle EPM consists of various specialized modules, each designed to perform a distinct function within the system.

These modules are designed to cover various areas like planning, profitability, financial consolidation, tax reporting, and account reconciliation. The beauty of Oracle EPM is that all of these modules are integrated into one platform, so your teams can work together seamlessly.

Key Components of Oracle EPM System

Here are the main parts of Oracle EPM that businesses use daily:

- Planning and Budgeting Cloud Service (PBCS): This module helps companies create financial plans, set budgets, and forecast future trends. It replaces manual spreadsheets with automated models.

- Financial Consolidation and Close (FCCS): It simplifies the complex task of combining financial data from multiple sources and helps close books faster with fewer errors.

- Account Reconciliation: This tool automates the task of matching financial data, ensuring your books are always balanced.

- Profitability and Cost Management (PCM): It helps you analyze the cost of products or services, so you can improve your profit margins.

- Narrative Reporting: This feature allows you to create financial reports with written commentary, which is great for sharing insights with executives or stakeholders.

- Tax Reporting: Manages global tax provision and reporting while staying compliant with legal standards.

Each module can work alone or with the others, making Oracle EPM flexible for different business sizes and needs. Since it’s cloud-based, your team can access it from anywhere, which is especially helpful for remote work.

Why Businesses Use Oracle EPM?

Now let’s talk about why so many companies trust the Oracle EPM System. The main goal is to improve business performance by making smarter, faster decisions based on real data. Many organizations face challenges due to fragmented data and time-consuming manual planning processes. Oracle EPM fixes that by automating the process and putting everything in one place.

Here are some common benefits:

- Faster Financial Planning: Planning and budgeting usually take weeks. Oracle EPM significantly reduces the time required by using pre-designed templates and automated processes.

- More Accurate Forecasts: Pulling real-time data, it provides better predictions for future business performance.

- Better Collaboration: With role-based access and cloud sharing, teams can work together in real-time.

- Compliance and Transparency: Built-in controls help you meet financial regulations without extra software.

- Scalability: Oracle EPM adapts seamlessly to businesses of all sizes, from mid-sized firms to large global enterprises.

How Oracle EPM Works in Real Life?

Let’s say a company wants to plan its budget for next year. Normally, teams might use spreadsheets and emails to go back and forth, which can take weeks and lead to mistakes. With Oracle EPM, the finance team uses the Planning and Budgeting module to enter expected income, expenses, and growth targets. Meanwhile, department heads update their inputs, and the system brings it all together into one plan. Managers can then view dashboards that show where money is being spent, where savings are possible, and what changes can boost profits.

Example

Another example is the month-end financial close. Instead of doing this manually, the FCCS module automates the process, pulls in data from different branches, reconciles accounts, and creates reports, saving days of work.

Who Should Use Oracle EPM?

Oracle designed EPM for organizations that manage budgeting, forecasting, financial reporting, and performance tracking. It primarily serves:

- CFOs and finance teams who need reliable financial data

- Business analysts who want to study trends and suggest strategies

- IT managers who want secure, integrated solutions

- Executives who want quick insights from dashboards and reports

Whether you are a finance-heavy organization or a growing business looking to stay on top of your numbers, Oracle EPM offers tools to manage your entire business performance.

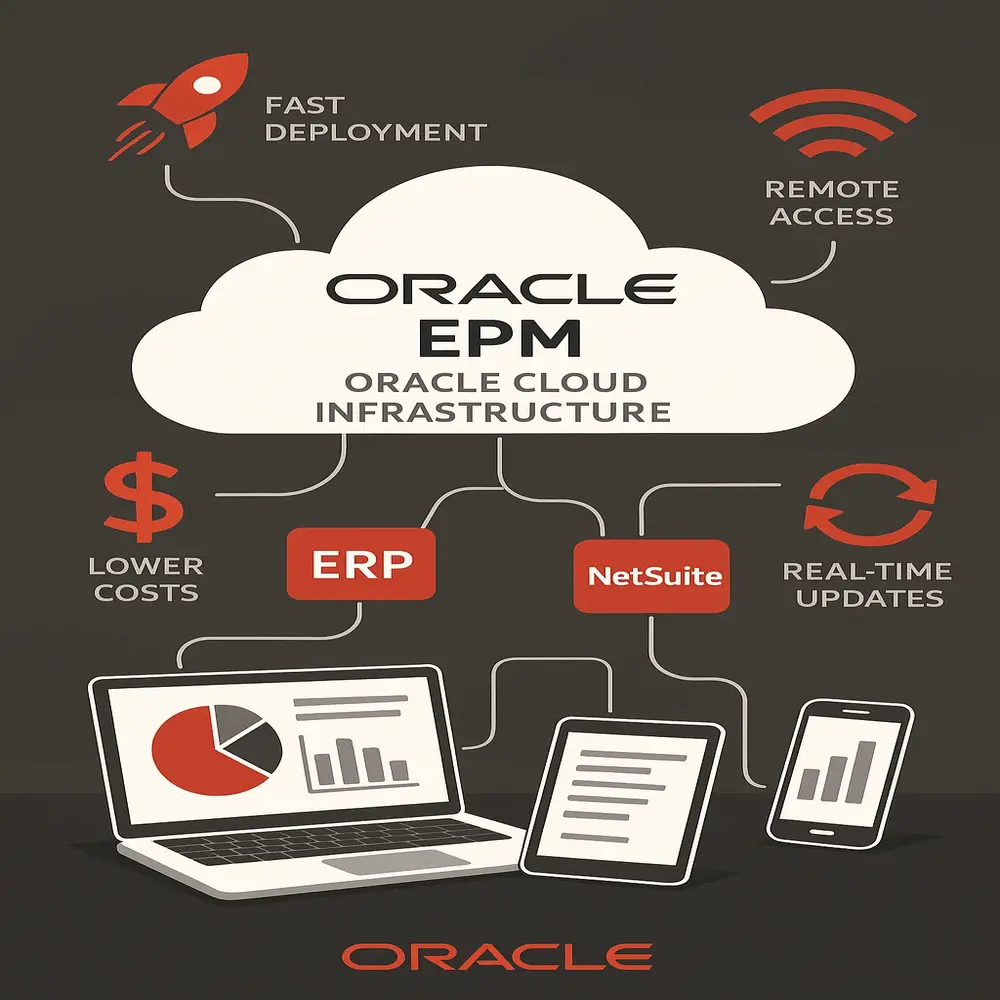

Cloud Advantage of Oracle EPM

One of the biggest strengths of Oracle EPM is that it runs on the Oracle Cloud Infrastructure (OCI). That means you don’t need to install software on your computers or worry about updates. The cloud securely stores all data, while Oracle manages backups, updates, and security patches.

This also means you get:

- Faster deployment (no longer installation times)

- Lower costs (no need for hardware)

- Access from anywhere (on laptop, mobile, or desktop)

- Real-time updates (no version conflicts)

For businesses already using other Oracle applications like ERP or NetSuite, EPM integrates smoothly. That means less time syncing data and more time analyzing it.

How Secure Is Oracle EPM?

Security is a top concern when it comes to financial systems. Oracle EPM delivers strong enterprise-grade security by implementing role-based access controls, advanced encryption, and real-time user activity monitoring. You can control who sees what and ensure sensitive data stays safe. Since it follows global compliance standards like GDPR and SOX, it’s also suitable for businesses working internationally.

Final Thoughts

Oracle EPM is a powerful cloud-based system that goes beyond budgeting it streamlines planning, reporting, compliance, and analysis in one platform. It helps businesses make smarter, data-driven decisions while improving accuracy and efficiency. For companies still using spreadsheets and manual processes, switching to Oracle EPM can be a major upgrade.