A strong rally is driving Maruti Suzuki’s stock in 2025, and here’s the update told in a fresh, forward-looking, and easy style without any headings, just flowing straight into the story.

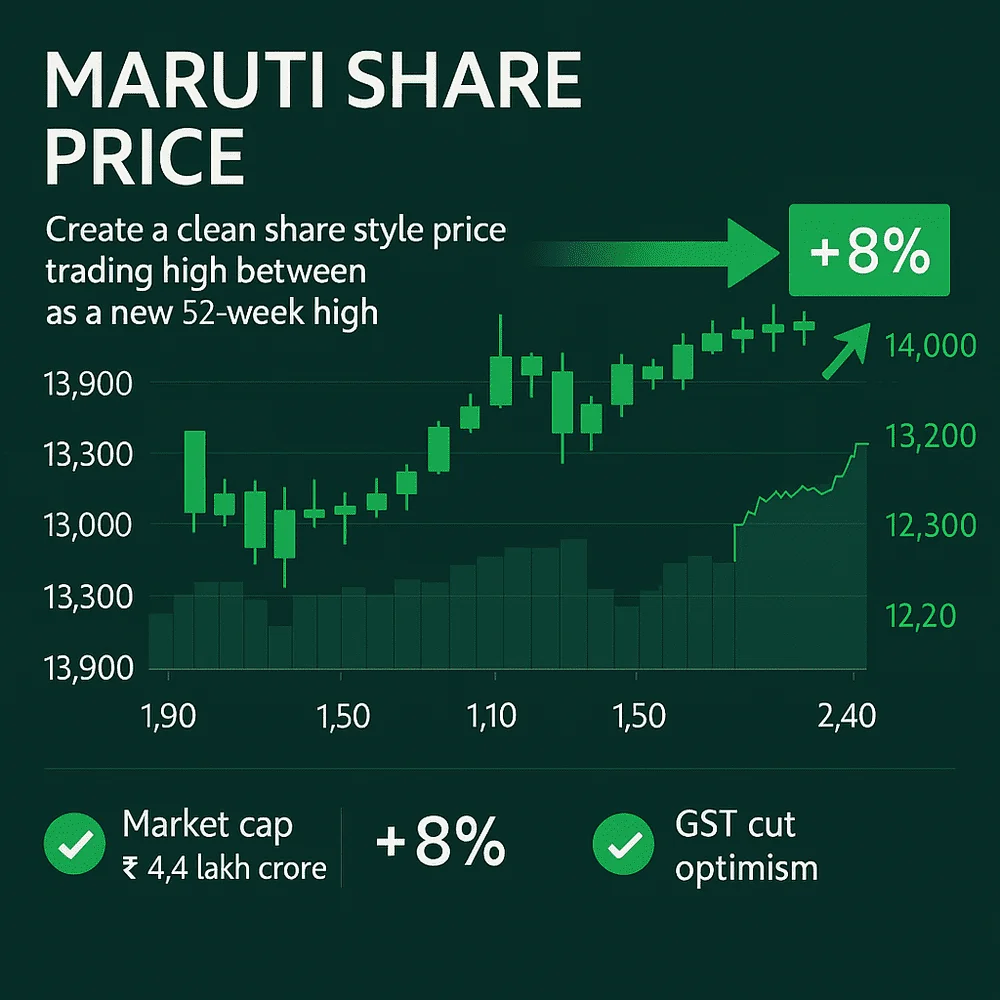

The stock soared to a new 52-week high today, riding a broad auto-sector rally powered by strong expectations of GST reforms that could slash the GST rate on small cars from 28% to 18%. Movers like Maruti are benefiting from this optimism, with shares leaping between 6% and 8% in early trading.

Markets responded in full force: Nifty Auto saw an over 4% jump, and Maruti itself surged more than 8%, a clear winner of the day. This dramatic spike is tied directly to policy hopes that GST reforms before Diwali are expected to reduce costs for buyers, stimulate demand for small vehicles, and boost automakers’ margins.

Against this backdrop, Maruti’s share price rally isn’t just a technical spike; it reflects deep structural optimism, with a potential GST overhaul acting as a multibagger catalyst.

Looking at fundamentals: as of midday today, Maruti Suzuki traded in the ₹13,900–₹14,000 range, pushing past its previous high of ₹13,541.65. Returns are impressive: roughly 11% gain in the past week, about 7–9% over the past month and six months. The company commands a commanding market cap of around ₹4.4 lakh crore, with a P/E near 30 and a P/B around 4.2–4.5.

Putting it all together, today marks a bold rally for Maruti. The GST cut expectations are steering investor sentiment, but under that lie solid fundamentals, massive market share (45%), strong financials, and long-term growth drivers like SUVs and EVs. Even though valuations are stretched, the tax reforms are likely to energize real demand and profitability, supporting future gains.

Here’s a quick snapshot:

| Metric | Value / Insight |

| Current price | ₹13,900–14,000 (new 52-week high) |

| Today’s rise | ~6–8% |

| Weekly gain | ~11% |

| 6-month gain | ~9–10% |

| Market Cap | ~₹4.4 lakh crore |

| Valuation | P/E ≈ 30, P/B ≈ 4.2–4.5 |

| Key catalyst | GST reduction from 28% to 18% for small cars |

| Sector pull | Nifty Auto index up ~4%, broader market rallying |

| Outlook | Positive: Demand boost, margin tailwinds, policy support |

Analysts suggest that if GST reforms materialize as expected, Maruti’s share price could maintain its upward momentum, keeping it in focus for investors in the months ahead.