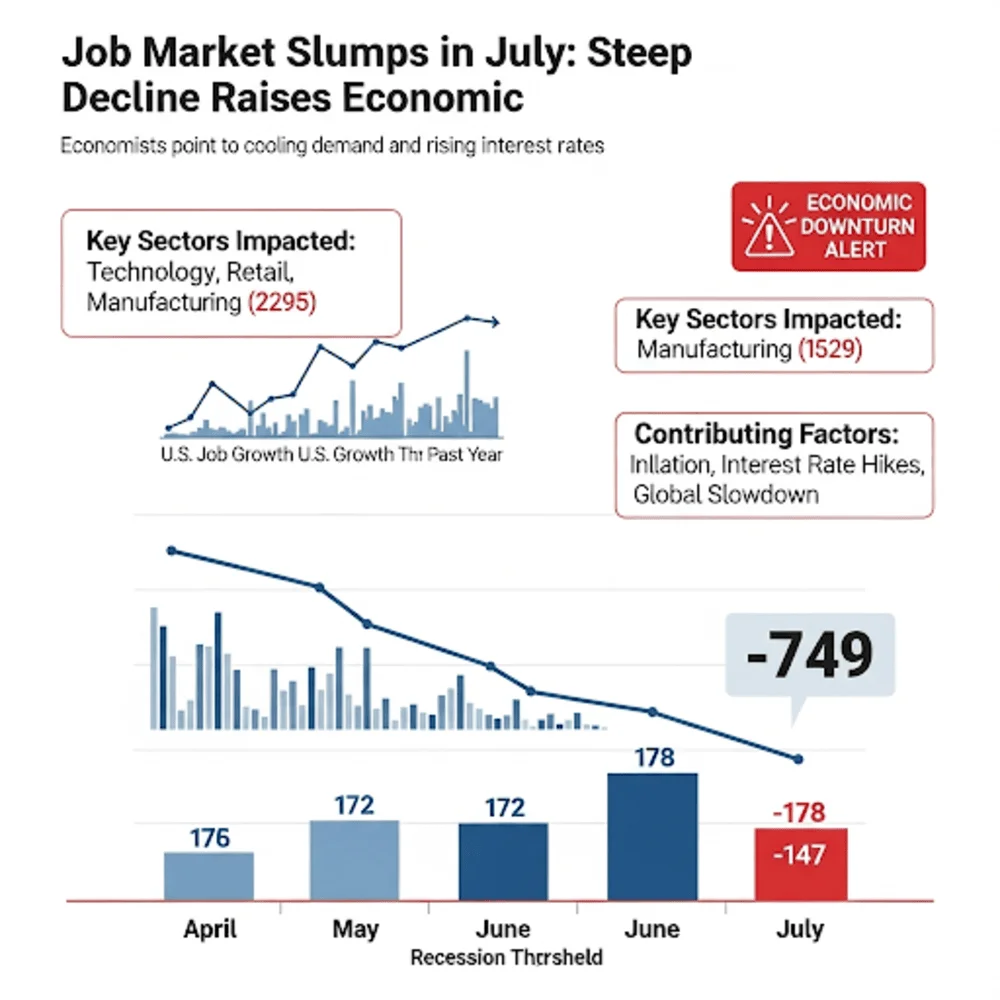

The Dow Jones Industrial Average closed lower today, sliding by approximately 542 points (about 1.2 %) to settle at 43,588.58, capping off its worst daily drop since May as investors reacted to weak July jobs data and sweeping new tariffs. Economic concerns intensified when the Bureau of Labor Statistics reported that only 73,000 nonfarm jobs were added in July, far below expectations, and past months’ job totals were revised down by 258,000. Those figures have shaken confidence in the resilience of the U.S. labor market and raised speculation that the Federal Reserve may lower interest rates as early as September.

In tandem with poor employment readings, President Trump’s announcement of sweeping tariffs on goods from over 60 countries rattled global trade sentiment. Markets are bracing for these tariffs to take effect on August 7, which could lift consumer prices and compress corporate margins. Treasury yields tumbled in response: the two‑year yield plunged by roughly 25 basis points, its sharpest drop since August 2024, suggesting heightened recession fears, and the U.S. dollar slipped nearly 1 % amid softening risk appetite.

Within the Dow 30 itself, defensive large-cap names outperformed. Sherwin‑Williams shares were among the day’s top gainers, rising about 3.8 %, followed by Home Depot, Johnson & Johnson, Merck, Coca‑Cola, and McDonald’s, all posting gains between 0.9 % and 1.7 %. By contrast, heavyweight names such as Apple, Microsoft, Goldman Sachs, Visa, JPMorgan Chase, Caterpillar, and UnitedHealth were among the worst hit, each declining between 1.4 % and 2.5 %.

Market strategists described the move as a “one‑two punch” of discouraging labor data and renewed tariff escalation that tested investors’ risk appetite. Although the Dow declined, analysts noted that the sell‑off remained somewhat contained compared to losses in the broader S&P 500 and Nasdaq, which fell 1.6 % and 2.2 % respectively. Attention will remain firmly focused on upcoming economic indicators, including ISM services data and durable goods orders, as well as any signals from Federal Reserve officials on the pace of future rate cuts.

Traders are also watching corporate earnings season, where results from mega‑caps like Caterpillar, Disney, and McDonald’s could help support or weigh down the index. Given strained trade conditions and mixed economic signals, volatility is expected to remain elevated in next week’s market action.