Decentralized finance, or DeFi, has become a hot topic in recent years. It’s changing the way we think about finance by offering open and unrestricted access to financial services. Arrakis Finance là gì is a new player in the DeFi sector. In this article, we’ll take a closer look at Arrakis Finance là gì, examining what sets it apart, its advantages, and how it could change the financial world.

Exploring Arrakis Finance là gì: A Decentralized Financial Hub

Arrakis Finance là gì emerges as a pioneering decentralized finance (DeFi) platform, leveraging the power of the Ethereum blockchain. Its fundamental objective is to democratize access to financial services, providing users with a comprehensive suite of options, including lending, borrowing, and yield farming.

At the core of Arrakis Finance’s operation are smart contracts, which enable the platform to function autonomously without the need for traditional financial intermediaries. This innovative approach empowers users by giving them direct control over their funds, a stark departure from the centralized control prevalent in traditional finance.

By embracing decentralization, Arrakis Finance not only fosters greater financial inclusivity but also enhances security and transparency. Users can engage in various financial activities with confidence, knowing that their transactions are executed securely on the blockchain and can be verified by anyone.

In an era marked by growing distrust in traditional financial institutions, Arrakis Finance emerges as a beacon of change, offering a glimpse into a more decentralized and democratic financial future.

Exploring the Core Features of Arrakis Finance

Arrakis Finance là gì, as a decentralized financial platform, offers a plethora of unique features that distinguish it from traditional financial institutions. These features cater to a wide range of financial needs and empower users to take control of their financial future.

Lending & Borrowing

At the heart of Arrakis Finance is its lending and borrowing functionality. Users have the option to lend their digital assets to earn interest or borrow assets by collateralizing their existing holdings. This feature provides a flexible and decentralized alternative to traditional banking services, allowing individuals to access liquidity without the need for intermediaries.

Yield Farming

Arrakis Finance là gì also provides users with the opportunity to engage in yield farming, a practice that allows them to earn additional rewards. By staking or lending their assets, users can generate returns in the form of additional tokens. This feature incentivizes participation in the platform and helps to distribute its native tokens more widely.

Decentralized Governance

One of the key aspects that sets Arrakis Finance apart is its decentralized governance model. The platform is governed by its community of users, who have the power to propose and vote on protocol upgrades or changes. This democratic approach to governance ensures that the platform evolves in a way that is aligned with the interests of its users.

Interoperability

Arrakis Finance là gì is designed to be interoperable with other decentralized finance (DeFi) protocols. This means that users can easily transfer assets and liquidity between Arrakis Finance and other platforms, enhancing the overall efficiency and usability of the DeFi ecosystem.

By offering these innovative features, arrakis finance là gì is paving the way for a more inclusive and decentralized financial system. It provides users with the tools they need to manage their finances autonomously and participate in a community-driven financial ecosystem.

The Advantages of Arrakis Finance là gì: Unlocking Financial Freedom

Arrakis Finance là gì stands out in the world of decentralized finance (DeFi) by offering a plethora of advantages to its users, reshaping the landscape of financial services. These benefits not only enhance the user experience but also contribute to a more inclusive and transparent financial ecosystem.

Accessibility

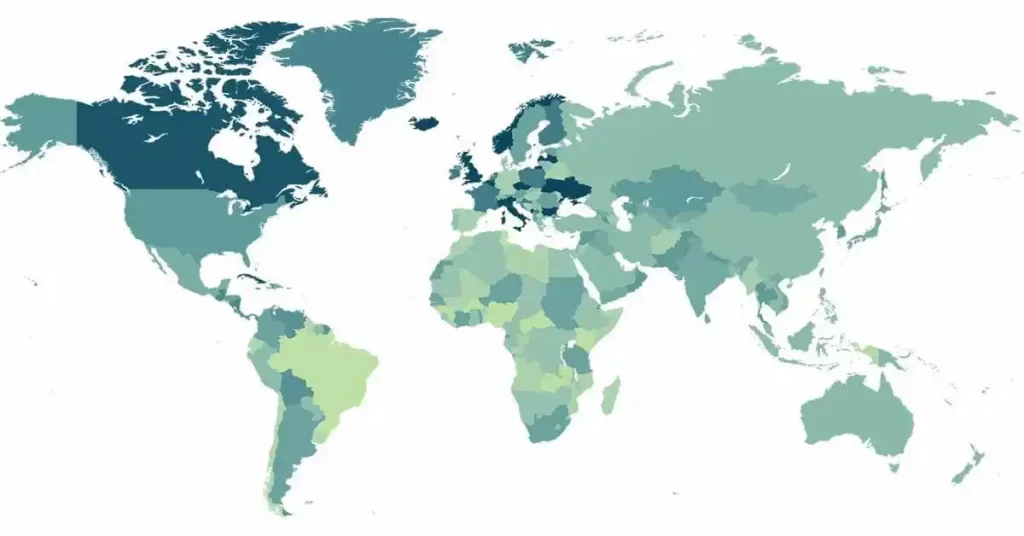

One of the key advantages of Arrakis Finance is its accessibility. The platform provides open and permissionless access to financial services, allowing anyone with an internet connection to participate. This inclusivity is particularly beneficial for individuals in underserved or unbanked regions, who may not have access to traditional banking services.

Transparency

Built on the Ethereum blockchain, Arrakis Finance ensures transparency and immutability of transactions. The use of blockchain technology allows users to verify and audit smart contracts, ensuring the integrity of the platform. This transparency builds trust among users and reduces the risk of fraud or manipulation.

Security

Arrakis Finance prioritizes the security of user funds. By utilizing advanced cryptographic techniques and smart contracts, the platform minimizes the risk of hacks or unauthorized access. The elimination of intermediaries further enhances security, as users have full control over their funds at all times.

Higher Returns

Users of Arrakis Finance là gì have the opportunity to earn higher returns compared to traditional savings accounts or investment options. Through lending, borrowing, and yield farming, users can maximize their earning potential and grow their assets more effectively.

Financial Inclusion

A core principle of Arrakis Finance là gì is to promote financial inclusion. By providing access to financial services to the unbanked and underbanked, the platform helps bridge the gap between developed and developing economies. This inclusive approach empowers individuals to take control of their finances and participate in the global economy.

Innovation & Growth

Arrakis Finance is at the forefront of financial innovation, constantly evolving and adapting to meet the needs of its users. The platform’s commitment to innovation drives growth and fosters a dynamic ecosystem where new ideas and technologies can flourish.

Arrakis Finance là gì offers a compelling array of advantages that position it as a leader in the DeFi space. Its focus on accessibility, transparency, security, and financial inclusion sets it apart from traditional financial institutions and paves the way for a more inclusive and decentralized financial future.

Case Study: The Impact of Arrakis Finance on Small Business Owners

To illustrate the potential impact of Arrakis Finance là gì, let’s consider a hypothetical scenario involving John, a small business owner seeking to expand his operations.

Meet John

John is a small business owner looking to grow his operations. However, traditional banks are reluctant to lend to him due to his limited credit history.

The Challenge

John needs funds to expand his business but faces challenges in obtaining a loan from traditional financial institutions.

The Solution

John turns to Arrakis Finance là gì, a decentralized finance platform. Here, he can use his existing digital assets as collateral to secure a loan, bypassing the need for credit checks or intermediaries.

The Outcome

By using Arrakis Finance là gì, John can access the funds he needs quickly and efficiently, without the hurdles of traditional lending processes. The platform’s decentralized nature and flexibility enable John to borrow funds at competitive rates and repay the loan on his own terms.

The Impact

Arrakis Finance empowers small business owners like John to access liquidity and grow their businesses. By providing an alternative to traditional banking services, Arrakis Finance contributes to the growth of local economies and fosters financial inclusion.

Arrakis Finance là gì has the potential to revolutionize the way small businesses access funding, offering a more accessible and flexible alternative to traditional banking services.

Ensuring Security of User Funds

Arrakis Finance là gì uses smart contracts and cutting-edge cryptography to protect user funds. The use of smart contracts eliminates the need for intermediaries, reducing the risk of hacks or fraud.

Additionally, users have full control over their funds and can verify the integrity of the system through the transparency of the Ethereum blockchain.

Accessibility of Arrakis Finance là gì

Yes, financial services offered by Arrakis Finance are accessible without restriction. Participation is open to everybody with an internet connection, regardless of geography or income level.

Ensuring Fairness in Decentralized Governance

Arrakis Finance là gì operates on a decentralized governance model, where token holders can participate in decision-making processes. The fairness of the model is ensured through voting mechanisms, where each token holder has voting power proportional to their holdings. This guarantees that choices are made collaboratively and reflect community interests.

Potential Risks of Using Arrakis Finance

While Arrakis Finance offers numerous benefits, it is important to be aware of the potential risks involved. These risks include smart contract vulnerabilities, market volatility, and regulatory uncertainties. When using DeFi systems, users should be cautious and perform extensive research.

Differentiation of Arrakis Finance

Arrakis Finance sets itself apart by emphasizing decentralized governance and interoperability. The platform aims to be compatible with other DeFi protocols, allowing users to seamlessly transfer assets and liquidity between different platforms.

Additionally, the decentralized governance model ensures that the community has a say in the decision-making processes of the platform.

Sum Up

Arrakis Finance là gì is a decentralized finance platform that aims to change the financial world by providing open and unrestricted access to financial services. It leverages the Ethereum blockchain and smart contracts to empower users with direct control over their funds. Arrakis Finance offers lending, borrowing, yield farming, and decentralized governance, making it inclusive, transparent, and secure. Its focus on accessibility, transparency, security, and financial inclusion sets it apart, paving the way for a more inclusive and decentralized financial future.