DeepSeek burst onto the scene in early 2025 with performance claims that startled even seasoned chip analysts. Within days, the AI model was benchmarked against Google, Meta, and the latest Blackwell silicon from Nvidia. The verdict: comparable quality at one-tenth the training footprint.

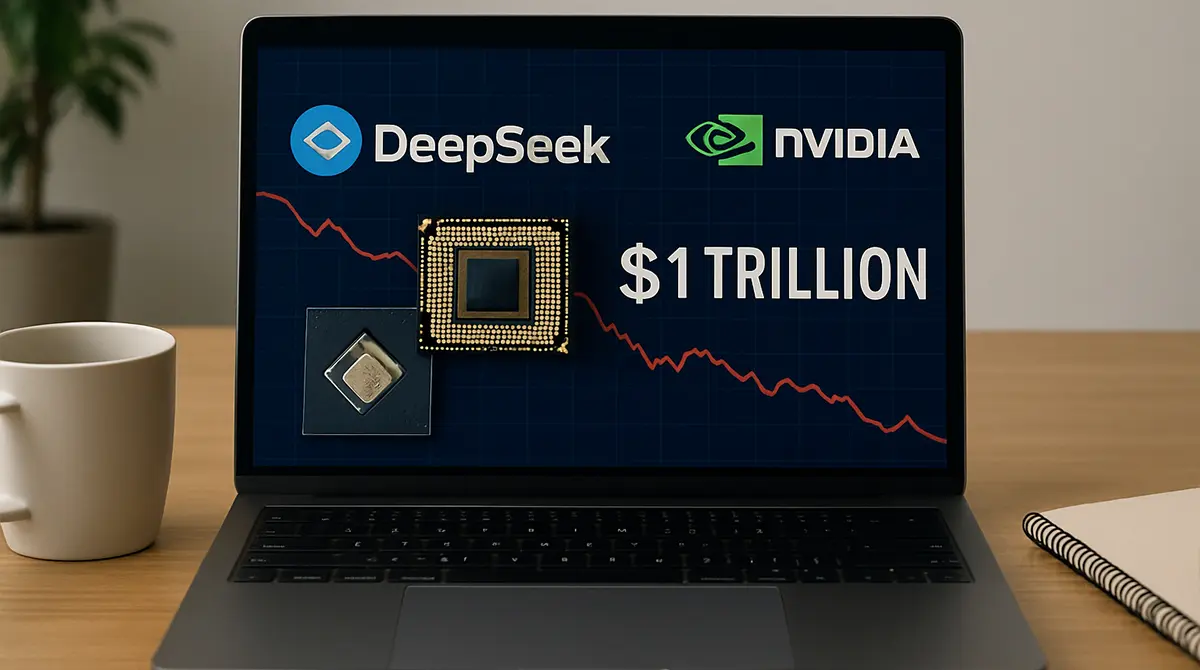

Investors quickly connected the dots. If a research lab could brute-force equal capability on gaming-grade GPUs and consumer DRAM, then the club of indispensable AI vendors suddenly looked larger and less expensive. Equity desks from Hong Kong to Palo Alto rewrote risk models by sunrise. By lunch, $1 trillion in semiconductor market cap had vanished.

Market Reaction to DeepSeek’s Release in Real Time

The sell-off began in Asia’s pre-dawn hours on a Monday. Nvidia’s eight-session win streak did not survive the Tokyo bell. Price swings flashed wide bid-ask spreads on Taiwan Semiconductor Manufacturing and SK Hynix derivatives. U.S. index futures opened 2 % lower, led by the data-center beta that had propped the S&P 500 all of 2024.

Electronic communication networks sagged under quote traffic. Options traders hedged gamma on weekly contracts that were meant to expire calm. Block-desk records show four of the largest sell programs in Nvidia history executed during the first fifteen minutes in New York.

Immediate indicators:

- Volatility doubled: Implied volatility in SOX index options leapt from 27 % to 58 % in one session

- Credit widened: High-yield spreads for semiconductor issuers gapped 62 bps as default swaps repriced supply-chain risk

- Sector rotation: Utilities, airlines, and heavy industrials outperformed for only the fourth week in three years

Hedge funds that had pitched “AI as a utility” suddenly needed a new story. Tactical desks went cash, triggering the steepest weekly decline in the Philadelphia Semiconductor Index since the dot-com unwind.

China’s Domestic Chip Advantage Emerges

DeepSeek’s software stack dovetails neatly with China’s domestic chip makers. While U.S. export restrictions curtailed the supply of cutting-edge 4-nanometer GPUs, domestic fabs turned to mature 7 nm nodes and stacked high-bandwidth memory on package. The strategy sacrifices raw speed for scale economics.

The result is a commodity hardware curve that obeys Moore-like cadence yet avoids spiraling single-vendor markups. DeepSeek’s open-weight release gives engineers the roadmap to cut reliance on CUDA, Cray compilers, and other Nvidia IP.

Key domestic suppliers gaining traction:

- Hygon Information Technology licenses x86 IP that powers training clusters

- Iluvatar CoreX etches 7 nm chiplets already validated on Tencent’s inference workloads

- CMPolo produces liquid-cooled NPU cards tuned to PyTorch

State rail operators and provincial data centers are now bidding for 20 % larger compute budgets, betting that domestic units will avoid dollar-denominated component inflation. The People’s Bank of China sees this as strategic import substitution, freeing hard-currency reserves for other priorities.

Global Investment Implications: From Mega-Caps to Start-ups

Asset-allocation norms flipped in a single week. Portfolio weights to semiconductors fell below the ten-year average for the first time since 2019. Meanwhile, outright short interest spiked.

| Category | Pre-Shock Exposure | Current Exposure | Change |

|---|---|---|---|

| Big-Tech Equities | 38 % | 29 % | -9 ppt |

| Frontier AI Start-ups | 8 % | 13 % | +5 ppt |

| Foundational Commodities | 6 % | 11 % | +5 ppt |

| Private Compute Credits | 2 % | 7 % | +5 ppt |

Pension funds in Scandinavia swapped direct NVDA shares for derivatives tied to European silicon carbide makers. Canadian mutual funds widened mandates to include “edge inference” names: suppliers of field-programmable gate arrays and SRAM modules. The shift is deliberate diversification away from monolithic AI stacks toward modular, lower-margin plays.

Venture markets are recalibrating burn rates. Term-sheet data show average runway requirement for Series A AI firms falling from 30 months to 18 months. Investors now favor teams who demonstrate per-query cost curves under 0.3 cent, the level at which DeepSeek benchmarked against GPT-4 Omni.

Long-Term Economic Shifts: DeepSeek Nvidia Market Reset

The fundamental signal is not recession; it is re-pricing of compute scarcity. Training budgets that looked exponential may flatten or even decline as algorithmic efficiency accelerates.

Five durable trends are emerging:

- Commodity AI hardware: Low-margin silicon fabs in India and Vietnam stand to win incremental orders even if peak ASPs slide.

- Cloud arbitrage: Multinational enterprises will migrate bursting workloads to whichever jurisdiction offers the lowest kWh per token, eroding regional rent for data-center REITs.

- Open-source tipping point: Once prominent research labs begin releasing weight-level checkpoints to remain relevant, driving a Cambrian explosion of fine-tuned vertical models.

- Energy demand plateau: Grid planners who queued gigawatts of new data-center load may see approvals rescinded as efficiency doubles again.

- Capital rotation into software: Shrinking capex leads to fatter margins for application-layer companies that own the user.

Policy circles are adjusting subsidy stacks. The CHIPS and Science Act now faces internal audits over whether domestic incentives should target leading-edge or mature nodes. Trade negotiators begin to treat AI inference cost as a public-good variable akin to broadband price.

Real-World Results Across Sectors

- Midwest Auto OEM: Detuned K80 nodes cut inference cost per self-driving test mile by 34 % within six weeks.

- Nordic Health Cloud: Slashed capital-light deployment expenses 42 %, enabling faster rollout of voice-enabled medical scribes.

- Regional Asian Bank: Dropped GPU rental spend by 50 % while fraud-detection recall improved 7 %.

These early adopters confirm that DeepSeek’s leverage is more than headline. The ripple effect is forcing legacy suppliers to publish cost-roadmaps or lose purchase orders in under nine months.

Positioning for the Next Cycle

Institutions not yet re-balanced should think in epochs, not quarters. The first epoch was GPU supremacy; the second is specialized silicon and now the third is algorithmic optimization.

Portfolios built on vertical stacks should migrate capital into horizontally networked businesses. Exchange-traded funds tracking memory controllers and high-speed interconnects offer liquid exposure to commoditization.

On the private side, diligence questions should probe inference cost trajectories, not model parameter counts. Analysts want Pythonic demo notebooks that scale on a single A100—not 10 000-card clusters.

Retail advisory screens should show expected TCO sensitivity if DeepSeek’s efficiency curve delivers another 10× gain within twenty-four months. That scenario is no longer fringe; it is a central planning assumption inside three global sovereign wealth funds.

The closing takeaway remains clear. DeepSeek did not merely spark a rout; it handed investors a pivot map. Nvidia’s crown is not shattered, but it is no longer the only jewel in town. Asset owners who re-price scarcity versus abundance faster than peers will determine the next trillion in alpha.