In the world of accounting, ensuring that all financial records are accurate and balanced is crucial. One tool that accountants employ for this is the post-closing trial balance.This document plays a vital role in the accounting cycle, helping businesses confirm that their books are in order before moving into a new accounting period.

What Is a Post-Closing Trial Balance?

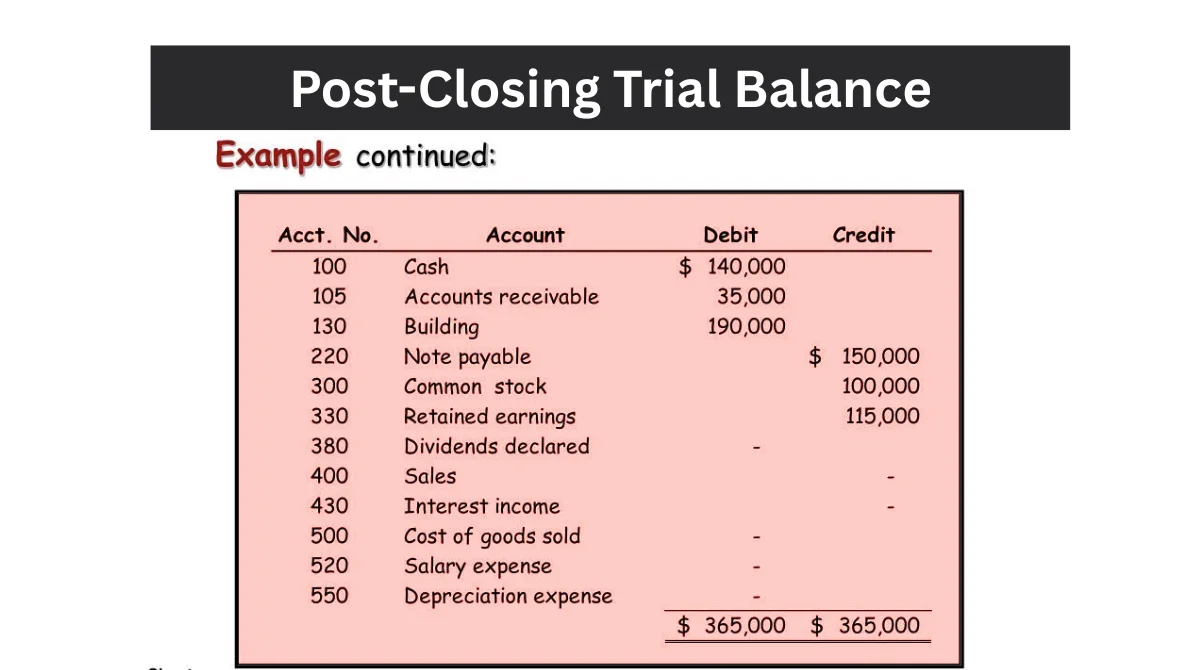

A list of all the permanent accounts and their balances following the completion of all closing entries is known as a post-closing trial balance. Assets, liabilities, and equity accounts are examples of permanent accounts; in other words, any account that retains its balance throughout the following accounting period. Temporary accounts, such as revenues, expenses, and dividends, are closed at the end of the period and thus do not appear on this trial balance.

The primary purpose of the post-closing trial balance is to ensure that total debits equal total credits after the closing entries are posted. This equality confirms that the ledger is balanced and ready for the next accounting period .

The Accounting Cycle’s Use of the Post-Closing Trial Balance

The accounting cycle consists of several steps that businesses follow to record and process financial transactions. One of the last phases in this cycle is the post-closing trial balancing. Here’s how it fits in:

- Transaction Analysis and Journal Entries: Recording all financial transactions as they occur.

- Posting to the Ledger: Transferring journal entries to the general ledger.

- Unadjusted Trial Balance: Listing all accounts and their balances before adjustments.

- Adjusting Entries: Making necessary adjustments for accrued and deferred items.

- Adjusted Trial Balance: Listing all accounts and their balances after adjustments.

- Financial Statements: Preparing income statements, balance sheets, and cash flow statements.

- Closing Entries: Closing temporary accounts to retained earnings.

- Post-Closing Trial Balance: Ensuring that all temporary accounts are closed and that debits equal credits.

By completing the post-closing trial balance, businesses can confirm that their books are balanced and that all temporary accounts have been properly closed .

Components of a Post-Closing Trial Balance

A post-closing trial balance often has the following components:

- Account Name: The name of each permanent account, such as Cash, Accounts Receivable, Accounts Payable, and Retained Earnings.

- Debit Balance: The balance amount for accounts that have a debit balance.

- Credit Balance: The balance amount for accounts that have a credit balance.

It’s important to note that only permanent accounts with non-zero balances are included in the post-closing trial balance. Temporary accounts should have zero balances after closing entries are made.

How to Prepare a Post-Closing Trial Balance?

Preparing a post-closing trial balance involves several steps:

- Close Temporary Accounts: Transfer the balances of all temporary accounts (revenues, expenses, and dividends) to the Retained Earnings account. Temporary account balances are reset to zero using this technique.

- Post Closing Entries: Record the closing entries in the general ledger to reflect the transfer of balances.

- List Permanent Accounts: After the closing items have been posted, make a list of every permanent account along with its amount.

- Verify Debits and Credits: Ensure that the total debits equal the total credits. If not, look into it and fix any inconsistencies.

By following these steps, businesses can confirm that their books are balanced and ready for the next accounting period .

Importance of the Post-Closing Trial Balance

The post-closing trial balance serves several important purposes:

- Verification of Ledger Accuracy: It confirms that all temporary accounts have been closed and that the ledger is balanced.

- Preparation for the Next Period: It ensures that only permanent accounts with accurate balances are carried forward into the new accounting period.

- Error Detection: If debits and credits don’t match, it signals that there may be errors in the closing entries that need to be addressed.

- Audit Readiness: Stakeholders and auditors can feel confident that the financial records are accurate and comprehensive when there is a balanced post-closing trial balance.

Common Errors and How to Avoid Them

While preparing a post-closing trial balance is straightforward, certain errors can occur:

- Failing to Close All Temporary Accounts: Ensure that all revenue, expense, and dividend accounts are closed to prevent them from appearing on the post-closing trial balance.

- Incorrect Posting of Closing Entries: Double-check that all closing entries are accurately recorded in the general ledger.

- Transposition Errors: Be cautious of simple mistakes like transposing numbers, which can cause imbalances.

- Including Zero-Balance Accounts: Only include accounts with non-zero balances to maintain the accuracy of the trial balance .

By being vigilant and methodical, these common errors can be avoided, ensuring the integrity of the financial records.

Tools Used to Create It

Today, most businesses use accounting software to handle trial balances. Software like QuickBooks, Xero, Wave, or Zoho Books automates much of the closing process and generates trial balances with just a few clicks. However, knowing how to read and understand the report is still essential for making sound business decisions.

Real-Life Example

Let’s say you own a small business. At the end of the year, your revenue is $100,000, your expenses are $70,000, and you paid out $5,000 in dividends.

- Step 1: You close out the $100,000 revenue, $70,000 expenses, and $5,000 dividends to retained earnings.

- Step 2: These temporary accounts now show zero.

- Step 3: Your post-closing trial balance might show:

-

- Cash: $20,000

- Accounts Receivable: $5,000

- Equipment: $10,000

- Accounts Payable: $3,000

- Retained Earnings: $32,000

This list verifies that you are prepared for the upcoming year and that your debits and credits are equal.

Conclusion

The post-closing trial balance, an essential tool in the accounting process, serves as a final check to ensure that the ledger is balanced and that all temporary accounts have been closed. By preparing this document, businesses can confidently move into the next accounting period, knowing that their financial records are accurate and complete.

Understanding and correctly preparing a post-closing trial balance not only aids in maintaining accurate financial records but also provides assurance to stakeholders and auditors that the company’s financial statements are reliable.