Investing can seem overwhelming, especially with the vast array of stocks available. However, 5StarsStocks.com simplifies this process by focusing on value stocks—companies that are undervalued by the market but have strong fundamentals. This platform offers tools and insights to help both beginners and seasoned investors make informed decisions.

What is 5StarsStocks.com?

5StarsStocks.com is an online platform dedicated to helping investors identify promising value stocks. It provides a range of tools, resources, and expert analyses to guide users in making sound investment choices. By focusing on undervalued stocks with solid growth potential, the platform aims to assist users in building robust investment portfolios.

Key Features of 5StarsStocks.com

1. Stock Recommendations

The platform offers regular stock recommendations based on thorough analyses. These picks are selected for their strong fundamentals and potential for growth, providing users with actionable investment ideas.

2. Screening Tools

5StarsStocks.com provides screening tools that allow users to filter stocks based on various metrics such as:

- Price-to-Earnings (P/E) Ratio: Helps identify stocks that may be undervalued relative to their earnings.

- Dividend Yield: Assists in finding stocks that offer regular income through dividends.

- Price-to-Book (P/B) Ratio: Indicates whether a stock is trading below its book value.

- Earnings Growth: Highlights companies with consistent earnings growth, suggesting stability.

3. Educational Resources

For those new to investing, 5StarsStocks.com offers educational content that covers:

- Basics of value investing

- How to evaluate stocks

- Understanding financial statements

- Using technical analysis

4. Expert Analysis

The platform features insights from experienced analysts who monitor market trends and provide forecasts based on financial data. This expert commentary helps users stay informed about potential investment opportunities.

5. Stock Alerts

Users can set up alerts to be notified when a stock meets specific criteria, such as reaching a target price or experiencing significant changes. This feature ensures that investors can act promptly on potential opportunities.

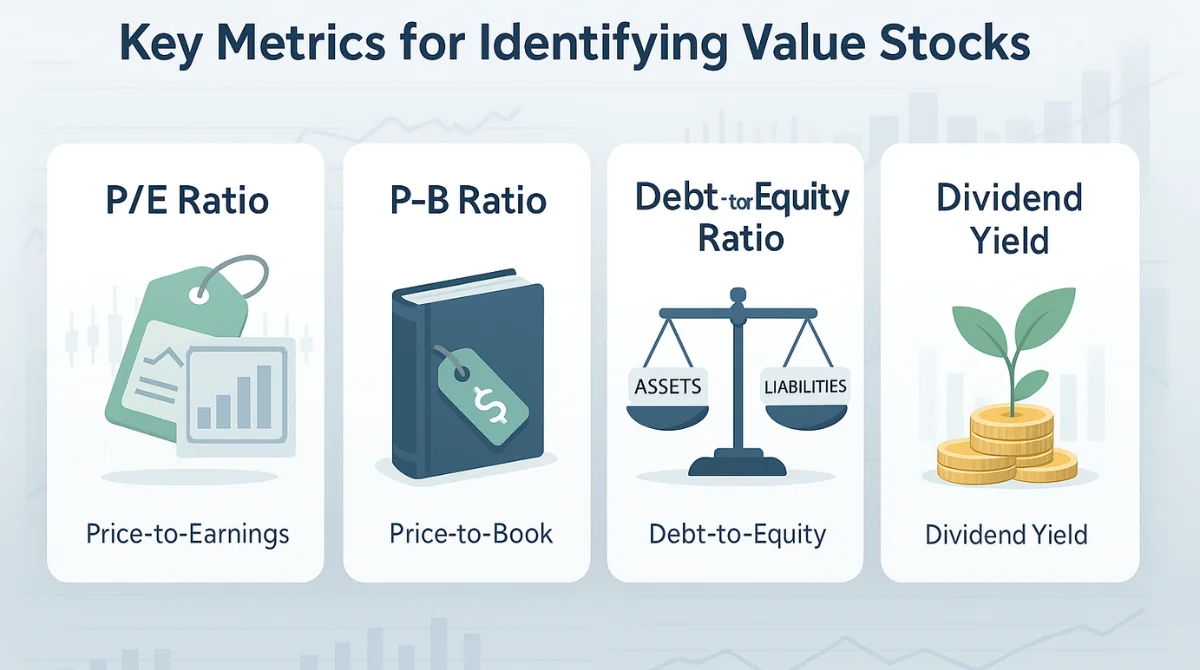

Key Metrics for Identifying Value Stocks

To determine whether a stock is undervalued, investors often look at several financial ratios:

- Price-to-Earnings (P/E) Ratio: This ratio compares a company’s share price to its earnings per share. A lower P/E ratio may indicate that the stock is undervalued.

- Price-to-Book (P/B) Ratio: This measures a company’s market value relative to its book value. A P/B ratio below 1 can suggest that the stock is trading for less than its net asset value.

- Debt-to-Equity Ratio: This ratio assesses a company’s financial leverage by comparing its total liabilities to shareholders’ equity. Lower ratios are generally preferable, indicating less risk.

- Dividend Yield: This shows how much a company pays out in dividends each year relative to its stock price. Higher yields can be attractive to income-focused investors.

By analyzing these metrics, investors can identify stocks that may be undervalued and have the potential for growth.

How to Identify Value Stocks on 5StarsStocks.com?

Step 1: Use Screening Tools

Begin by utilizing the platform’s screening tools to filter stocks based on your investment criteria. For instance, you might look for stocks with a low P/E ratio and high dividend yield.

Step 2: Analyze Stock Fundamentals

Examine the financial health of the shortlisted companies by reviewing their earnings reports, revenue growth, and other key financial metrics. This analysis helps determine whether a stock is truly undervalued.

Step 3: Monitor Market Trends

Stay updated on broader market trends and economic indicators that could impact your investments. 5StarsStocks.com provides market news and insights to help you make informed decisions.

Step 4: Review Historical Performance

Assess the historical performance of potential investments to understand their past behavior and volatility. This information can provide context for future performance expectations.

Step 5: Set Alerts

Configure alerts to notify you of significant changes in stock prices or other relevant events. This proactive approach ensures you don’t miss out on timely investment opportunities.

Benefits of Using 5StarsStocks.com for Value Investing

Here’s a detailed explanation of each benefit of using 5StarsStocks.com for value investing, written in simple, clear language:

User-Friendly Interface

One of the biggest advantages of 5StarsStocks.com is how easy it is to use. Whether you’re just starting your investment journey or have been investing for years, the platform’s design is clean, simple, and easy to navigate. Everything is laid out clearly so you can find what you’re looking for without confusion. You don’t need to be a financial expert to get started — the interface makes it comfortable even for beginners to explore value stocks with confidence.

Comprehensive Analysis

5StarsStocks.com gives you detailed information about each stock. This includes full access to financial statements like income reports, balance sheets, and cash flow data. It also breaks down important performance metrics such as earnings per share (EPS), return on equity (ROE), and other ratios that help you understand how strong or weak a company is. This depth of analysis helps investors make better decisions by looking beyond just the stock price.

Educational Support

The platform doesn’t just show you numbers — it teaches you what they mean. There are many learning resources such as articles, tutorials, videos, and guides that explain key investing principles. This is perfect for beginners who want to learn how to evaluate stocks and understand investing terms. Even experienced investors can benefit from a refresher or deeper understanding of newer strategies and trends.

Expert Insights

Sometimes, numbers alone don’t tell the whole story. That’s where expert opinions come in. 5StarsStocks.com features analysis and commentary from professional market experts and financial analysts. These experts give their views on market trends, company strengths, risks to watch out for, and where the best opportunities might be. Their insights can guide your thinking and help you spot opportunities or avoid mistakes that might not be obvious at first glance.

Real-Time Alerts

Timing can be important in investing, and this platform keeps you updated. With real-time alerts, you can receive notifications when a stock you’re watching drops in price, when company news breaks, or when any metric you’ve set is triggered (like a change in P/E ratio). This means you don’t have to be glued to your screen all day — 5StarsStocks.com will let you know when something important happens, helping you stay informed and ready to act.

In short, 5StarsStocks.com gives you everything you need to succeed in value investing. It’s easy to use, gives you powerful tools, keeps you informed, and helps you grow your knowledge over time. Whether you’re buying your first stock or refining a long-term investment plan, this platform can make the journey easier and more effective.

Building a Diversified Portfolio

Diversification means not putting all your eggs in one basket. In investing, this means spreading your money across different types of companies and industries. Why do this? Because if one area of the market isn’t doing well, others might still be performing okay, which helps reduce the chance of losing too much money at once.

For example, if you only invest in tech companies and the tech industry faces a downturn, your whole portfolio could suffer. But if you also have investments in healthcare, energy, or consumer goods, those might stay strong or even grow, balancing out the losses from tech. This way, you’re not depending on just one area to grow your money.

5StarsStocks.com makes this easier by organizing stocks into different sectors like technology, healthcare, finance, energy, and more. This helps you choose stocks from different parts of the economy so you can build a well-balanced portfolio that spreads out the risk. The idea is to give you more stability, especially during times when the market gets unpredictable.

Long-Term Investment Strategies

Value investing is all about finding good companies that are currently undervalued—that means their stock price is lower than what they’re really worth. These stocks often fly under the radar, but they have solid business models, good management, and strong potential.

The goal of value investing isn’t to make quick profits. It’s a long-term game. Investors who follow this strategy usually buy these undervalued stocks and then hold onto them for years, waiting patiently for the market to eventually realize how good these companies really are. Once that happens, the stock price often goes up, and that’s when the investor sees a good return.

Patience is super important here. Sometimes, it can take months or even years for the stock price to catch up with the company’s true value. But for those who are disciplined and don’t panic during market ups and downs, this strategy can pay off really well over time.

5StarsStocks.com supports this approach by giving you detailed insights into the financial health of companies, making it easier to spot these hidden gems and hold them with confidence as part of your long-term plan.

Success Stories of 5StarsStocks.com

Investors from all walks of life have found success using 5StarsStocks.com. From beginners like Sarah, who doubled her investment in a healthcare stock, to retirees like Linda and Mark, who built a stable, diversified portfolio for retirement—many have seen real results. James, once frustrated by trends, now thrives with focused value picks, while college student Ali turned a $500 investment into major gains. These stories show that with the right tools, research, and patience, anyone can grow their wealth. 5StarsStocks.com makes value investing simple, smart, and accessible for everyone, no matter their experience or budget.

FAQ

1. How frequently are stock recommendations updated on 5StarsStocks.com?

5StarsStocks.com regularly updates its stock recommendations to reflect the latest market trends and financial data. Typically, new recommendations are added weekly, with updates also provided when there’s a major shift in market conditions or a change in a company’s fundamentals. This ensures investors always have access to timely and relevant opportunities.

2. Does 5StarsStocks.com provide guidance based on specific industries?

Yes, 5StarsStocks.com categorizes its stock picks by sectors such as technology, healthcare, energy, finance, and more. This allows investors to explore opportunities within industries they’re interested in or to diversify across multiple sectors for better risk management. The platform also offers insights into sector trends and how certain economic factors may affect them.

3. How often is the investment research on 5StarsStocks.com refreshed?

The investment research and analysis on 5StarsStocks.com are updated consistently, often on a weekly basis or whenever significant developments occur. Whether it’s earnings reports, economic shifts, or corporate news, the platform keeps users informed with the most current and accurate information to support sound investment decisions.

4. Can I trust the recommendations provided by 5StarsStocks.com?

The stock recommendations on 5StarsStocks.com are backed by thorough research, financial analysis, and expert insights. While no investment is without risk, the platform emphasizes long-term value and strong fundamentals, helping users avoid hype-driven choices. Many users have reported positive experiences following these picks, though it’s always wise to do your own due diligence or consult with a financial advisor.

Conclusion

Investing doesn’t have to be complicated, and 5StarsStocks.com proves that with the right tools, clear guidance, and a focus on value, anyone can become a smarter investor. Whether you’re a beginner taking your first steps into the stock market or an experienced investor looking to refine your strategy, the platform offers everything you need—powerful screening tools, expert insights, real-time alerts, and sector-based recommendations.

By focusing on undervalued stocks with strong potential, 5StarsStocks.com helps you make informed decisions and build a portfolio that can grow steadily over time. From educational resources to success stories from real users, the platform shows that long-term investing is within reach—even if you’re just getting started.

If you’re ready to take control of your financial future and start investing with confidence, 5StarsStocks.com is a great place to begin. With a user-friendly experience and a strong foundation in value investing, it can help you turn market knowledge into meaningful results.

Related Topic: How To Invest In Tech Stocks With High Growth Potential?