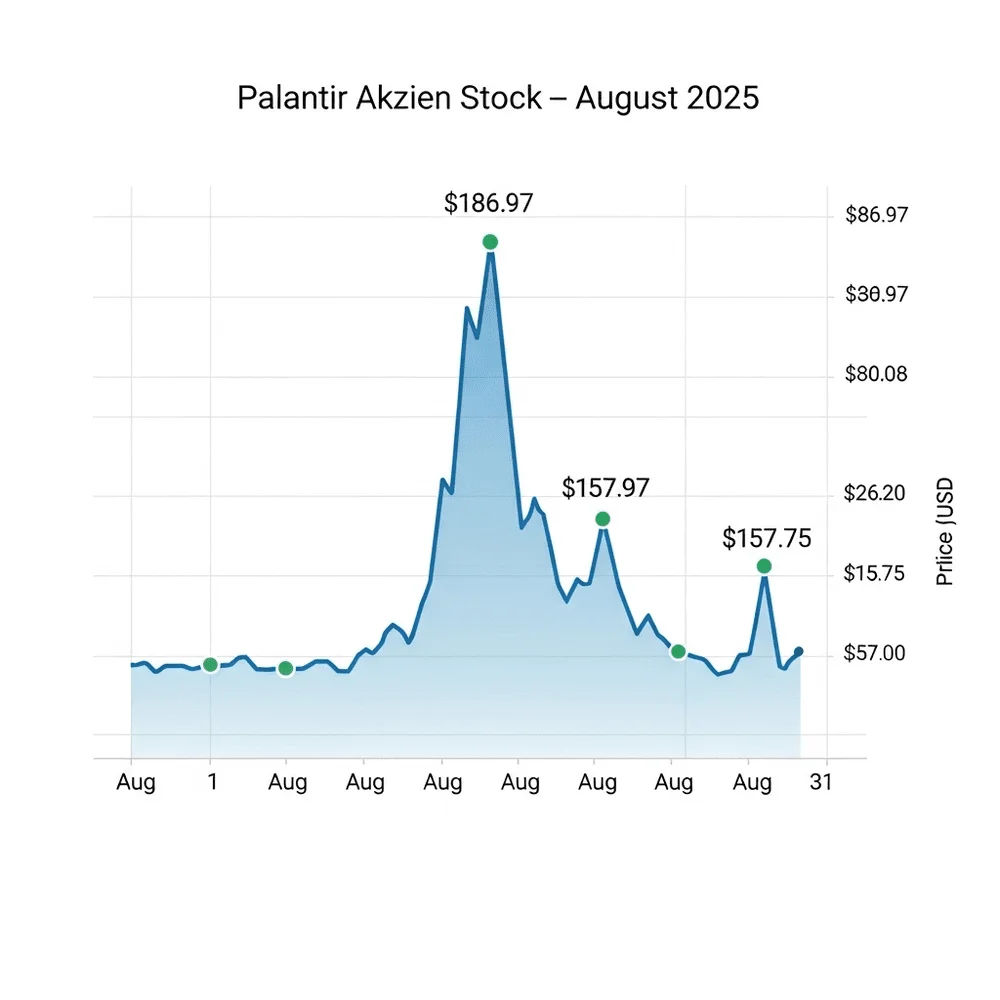

Palantir Technologies Inc. (NASDAQ: PLTR) has experienced a remarkable surge in its stock price in 2025, driven by strong financial performance and heightened investor interest in artificial intelligence (AI) technologies. As of August 20, 2025, Palantir’s stock is trading at $157.75, reflecting a 9.3% decline from its all-time high of $186.97 reached on August 12.

The company’s impressive growth trajectory is evident in its second-quarter 2025 earnings report:

- Revenue: $1.004 billion, a 48% year-over-year increase

- Commercial revenue: Up 93%

- Government contracts: Up 53%

This growth highlights how Palantir is steadily strengthening its presence across both commercial markets and government projects.

The company’s continuous progress in artificial intelligence has further strengthened its market position. The launch of its Artificial Intelligence Platform (AIP) has garnered significant interest, particularly in industries such as manufacturing and healthcare. This strategic focus on AI-driven solutions has positioned Palantir as a key player in the evolving tech landscape.

Despite these positive developments, the company’s stock has faced recent volatility:

- On August 19, 2025, shares fell by 9% amid a broader market pullback in AI stocks, including declines in Nvidia and Meta Platforms.

- Short-seller Andrew Left raised concerns over Palantir’s valuation, citing high price-to-sales and price-to-earnings ratios as indicators of potential overvaluation.

Recent Stock Data Snapshot (August 2025):

| Metric | Value |

| Current Stock Price | $157.75 |

| All-Time High (August 12, 2025) | $186.97 |

| Q2 2025 Revenue | $1.004 billion |

| Commercial Revenue Growth | 93% |

| Government Revenue Growth | 53% |

| Stock Drop (Aug 19, 2025) | 9% |

Institutional investors remain confident in Palantir’s prospects. Meanwhile, the California Public Employees’ Retirement System (CalPERS), recognized as the largest pension fund in the United States, pension fund, increased its holdings in Palantir by approximately 10% in the second quarter of 2025, signaling continued institutional support.

In summary, Palantir Technologies Inc. continues to demonstrate robust financial performance and strategic growth, particularly in the AI sector. While recent stock volatility and valuation concerns warrant attention, the company’s strong fundamentals and institutional backing suggest a promising outlook for investors.