In the world of finance, investors and analysts often use various metrics to assess a company’s performance over time. Two commonly used metrics are Year-Over-Year (YOY) and Year-Over-Years (YOYY). While YOY is a familiar term, YOYY might not be as widely recognized but can be equally important. Understanding the differences between these two metrics is essential for anyone looking to make correct financial decisions. This Techbonafie article will explain what YOY and YOYY are, how they are used and why both metrics matter.

What Is Year-Over-Year (YOY)?

Year Over Year (YOY) is a widely used method of comparing financial data from one year to the same period in the previous year. This metric helps analysts, investors and companies assess whether their financial performance is improving, declining or remaining steady over time. For instance, if a company reports that its revenue for Quarter 2 2024 was $90 million and it was $85 million in Quarter 2 2023, the YOY increase in revenue would be 5.9%.

Key Benefits of YOY

- Mitigates Seasonality: YOY comparisons help smooth out seasonal fluctuations. For example, comparing Quarter 4 earnings with Quarter 4 from the previous year avoids the misleading conclusions that might arise incase if you compare Quarter 4 with Quarter 3 due to the holiday season’s impact on sales.

- Simplifies Trend Analysis: YOY metrics provide a straightforward way to analyze trends over time. By comparing identical periods year after year, businesses can identify consistent growth patterns or areas needing improvement.

- Widely Applicable: YOY is not only useful for companies it can also apply to broader economic indicators such as GDP growth, inflation rates or changes in the money supply.

What is Year-Over-Years (YOYY)?

While YOY is helpful for comparing a single year to the previous year, Year-Over-Years (YOYY) takes this a step further by comparing multiple years over a period. YOYY analysis looks at a series of YOY changes over time providing a more comprehensive view of trends. This is particularly useful when you want to understand long-term growth patterns rather than short-term fluctuations.

Key Benefits of YOYY

- Captures Long-Term Trends: YOYY analysis allows for the evaluation of performance across multiple years offering insights into long-term trends that might not be evident in a single YOY comparison.

- Reduces Impact of Anomalies: By looking at a series of YOY changes, YOYY helps smooth out anomalies or one-off events that could skew a single YOY analysis.

- Enhances Predictive Analysis: YOYY can be a powerful tool in forecasting future performance. By understanding the trajectory of multiple YOY changes, analysts can make more informed predictions about a company’s future performance.

Understanding the Differences Between YOY & YOYY

The primary difference between YOY and YOYY lies in the scope and depth of analysis. YOY focuses on a direct comparison between two specific time periods making it ideal for understanding short-term changes. On the other hand YOYY provides a broader view by examining how a company’s performance has evolved over several years offering more context and reducing the noise from short-term fluctuations.

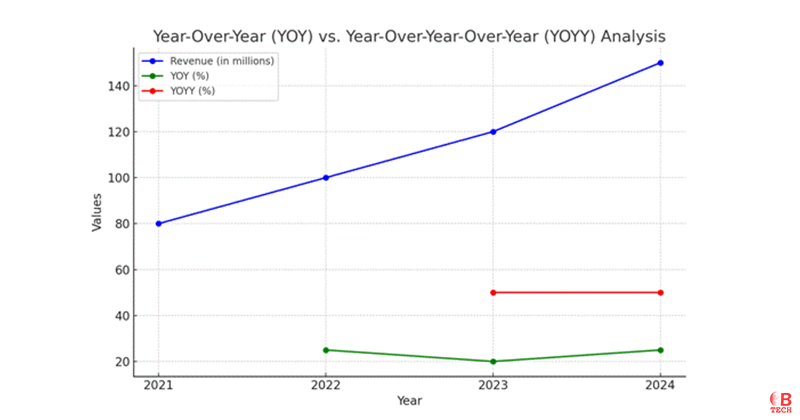

Example of YOY Vs. YOYY

Here is the graph representing the Year-Over-Year (YOY) and Year-Over-Year-Over-Year (YOYY) analysis for the hypothetical tech company’s revenue growth from 2021 to 2024. The blue line represents the revenue in millions, the green line shows the YOY percentage change and the red line illustrates the YOYY percentage change.

When to Use YOY vs. YOYY?

Understanding when to use YOY versus YOYY depends on the specific financial question you are trying to answer:

- Use YOY when: You need to understand how a specific period compares to the same period in the previous year. This is particularly useful for evaluating short-term performance such as quarterly earnings or annual revenue changes.

- Use YOYY when: You want to analyze trends over a longer time frame. YOYY is ideal for identifying sustained growth patterns or long-term declines that may not be apparent from a single YOY comparison.

Final Thought

Both YOY and YOYY are valuable tools in financial analysis, each offering unique insights into a company’s performance. YOY provides a snapshot of year-to-year changes, making it perfect for short-term analysis. In contrast, YOYY offers a broader perspective, capturing long-term trends by examining a series of YOY comparisons. By understanding and utilizing both metrics, investors, analysts and companies can gain a clearer more comprehensive view of financial performance and make better decisions.

Whether you’re assessing quarterly earnings or forecasting long-term growth, knowing when and how to use YOY and YOYY will enhance your ability to analyze financial data effectively.

FAQs

What is YOY in Business?

YOY in business refers to “Year-Over-Year” a method of comparing a company’s performance in a specific period with the same period from the previous year. This comparison helps businesses evaluate their growth, stability or decline over time by mitigating the effects of seasonal variations.

What is GDP YOY?

GDP YOY stands for “Gross Domestic Product Year-Over-Year.” It measures the annual growth rate of a country’s GDP by comparing the GDP of a specific quarter or year with the same quarter or year from the previous year. This metric is commonly used to assess the overall economic growth of a country.

What is the Inflation Rate YOY?

The inflation rate YOY measures the percentage change in the price level of goods and services over a year. It compares the Consumer Price Index (CPI) or other relevant inflation indices from one year to the same period of the previous year to determine how much prices have increased or decreased.

What is YOY Growth Formula?

The YOY growth formula is calculated as follows:

- YOY Growth=(Previous Year ValueCurrent Year Value−1)×100

This formula gives you the percentage growth or decline between two periods.

What is YOY in Real Estate?

YOY in real estate refers to the comparison of real estate metrics such as property prices, sales volumes or rental income between one year and the same period from the previous year. It is used to assess trends in the real estate market such as rising or falling property values.

What is YOY in the Stock Market?

YOY in the stock market refers to the comparison of a stock’s performance such as price changes, earnings or dividends from one year to the same period in the previous year. Investors use YOY analysis to evaluate whether a stock is performing better, worse or similarly compared to the previous year.

What is YOY Percentage?

YOY percentage refers to the percentage change in a particular metric from one year to the same period in the previous year. It is calculated using the YOY growth formula and provides a clear indication of how much a particular measure such as revenue or profit, has increased or decreased over the year.