Getting Started with Facebook Pay

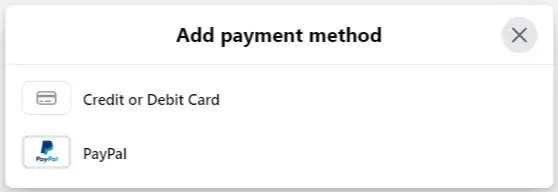

Setting up Facebook Pay is way easy. First, you get into your settings and choose to start using Facebook Pay. You’ll have two options:

- Type in your payment details by hand.

- Link up with your PayPal account for even smoother transactions.

Once you’re all set up, shopping on Facebook family of apps becomes as simple as a pie.

Making Payments

When it’s time to check out, your payment process is straightforward. Whether you’re snagging a cool gadget or paying for a service, Facebook Pay streamlines the transaction. You’ve also got the option to beef up your security. How? By setting up a PIN or enabling a fingerprint or face recognition feature. It’s all about keeping your purchases safe and sound.

In August 2021, Facebook Pay began its journey beyond the apps. It popped up as a fresh checkout option for online stores, starting with Shopify. The motive was to make Facebook Pay a prime payment method for even more online businesses and now, it is called Meta Pay.

Where can you use Facebook Pay?

- Send Money with Ease: Ever wanted to split dinner costs or send a quick thank-you cash gift? With Facebook Pay, you can zip money over to friends and family directly through Facebook Messenger and WhatsApp. It’s like handing cash over, just digitally!

- Support Causes Close to Your Heart: Feeling generous? Facebook Pay lets you donate to charitable causes and fundraisers without a hitch. Whether it’s on Facebook or Instagram, you can contribute to the changes you want to see in the world.

- Shop Your Favorite Brands: Got your eye on something special? Use Facebook Pay to grab goods from your favorite brands right on Instagram and the Facebook Marketplace. It’s shopping made simple, without leaving your social feed.

- Score Tickets to Must-See Events: Planning your next night out? Buy tickets to events directly on Facebook. It’s your gateway to entertainment without the extra hassle of third-party sites.

- Level Up Your App Experience: From gaming to premium features, Facebook Pay opens the door to in-app purchases across all Facebook platforms. Enhance your app experience with just a few taps.

Facebook Pay turns your transactions on Facebook’s platforms into a smooth & secure experience. Whether you’re shopping, sharing or supporting, it’s designed to keep your financial interactions easy and protected.

How to Setup Facebook Pay?

First off, you’ll need to be logged into your Facebook. Once you’re in:

- Hit the Menu, it’s the icon that looks like a little grid right next to your profile picture.

- Look for “Shopping” in the menu, and tap on “Facebook Pay.”

- Hit “Continue” to start adding your payment details into Facebook Pay’s wallet. This is where you can also choose to set up a PIN or use your device’s biometrics for extra security.

- Find the person you want to pay or request money from by searching for their contact.

- Enter how much money you’re talking about.

- Choose “Pay” to send money their way, or “Request” if you’re asking them to send you money.

For Businesses and Sellers

If you’re running a shop on Facebook, Instagram or Messenger, your customers can breeze through checkout with Facebook Pay. Typically, the cash lands in your account instantly. If there’s a hitch, it usually gets sorted within 24 hours.

Integrating with Shopify

For those using Shopify, your Facebook and Instagram checkouts get supercharged by Shopify Payments. This means you can manage all your payment processes under one roof. Once you’ve got Shopify Payments up and running, Shopify Payouts will transfer the dough to you whenever customers use Facebook Pay at checkout.

This setup makes managing online transactions smooth, whether you’re a buyer enjoying the convenience or a seller looking to streamline your payment processes.

How Much Does Facebook Pay Cost?

Facebook Pay doesn’t cost a dime. That’s right, whether you’re a business looking to streamline transactions or someone sending money to a friend, there are no fees attached to sending or receiving money through Facebook Pay.

Is Facebook Pay Secure?

With Facebook’s history of data concerns, it’s natural to question the security of using Facebook Pay.

Here’s the scoop: Facebook Pay is decked out with robust security features aimed at protecting your transactions. Facebook pay secures your payment is the following ways:

- Fighting Fraud with Tech: Facebook has rolled out anti-fraud technology designed to spot and stop unauthorized activities in their tracks.

- Encryption Plus: Your payment information, like card or bank details, gets encrypted. Plus, Facebook stores this data securely to keep it away from prying eyes.

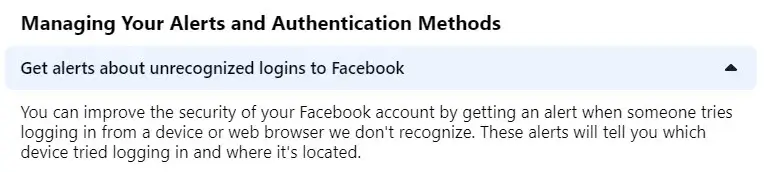

- Stay Alert: If something looks fishy, Facebook Pay is on it by sending you alerts about any odd activity.

- PIN and Biometrics for the Win: For an added security blanket, you can set up a PIN or use your device’s fingerprint or facial recognition features when sending money. This means even if someone gets access to your device, they won’t get easy access to your funds. And you don’t have to worry because your biometric info stays with your device, Facebook doesn’t keep it.

With these measures, Facebook Pay aims to provide a secure environment for your online transactions, ensuring peace of mind when you’re sending money or making purchases.

What are the Pros and Cons of Facebook Pay?

The Upsides of Facebook Pay

- Cost-Effectiveness: Using Facebook Pay won’t cost you a dime. Whether you’re sending or receiving money, there are no fees involved. For businesses looking to keep expenses low, this is a major plus.

- Seamless Social Commerce: Small business owners thriving on social media find Facebook Pay to be a game-changer. It simplifies the payment process across various Facebook apps. This means your customers on Instagram or Messenger can effortlessly settle their bills for your products or services.

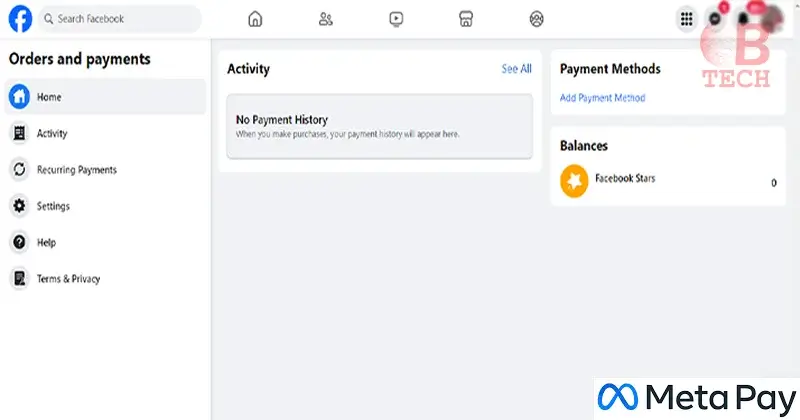

- Ease of Setup and Usage: Getting started with Facebook Pay is easy. Once set up, you can bid farewell to repeatedly entering your card details. Plus, tracking payments and reviewing your transaction history is a clear within the Facebook Pay interface.

The Downsides to Consider

- Limited Scope: While Facebook Pay opens up access to billions of potential customers, its usage is confined to within Facebook’s ecosystem. This means if you have an online storefront outside of Facebook apps, you’ll need to look elsewhere for payment solutions.

- Added Complexity: While Facebook Pay is convenient, it’s not the only player in the digital payment arena. To cater to all customers, you’ll likely still need to offer other payment options. Juggling multiple payment methods could add a layer of complexity to your operations.

- Potential Delay in Deposits: While Facebook Pay transfers money instantly, the actual deposit into your bank account might take a few days. This delay could impact your cash flow, especially if you rely heavily on prompt payments.

For businesses heavily engaged in social media sales or those with a significant presence on Facebook’s platforms, Facebook Pay presents an attractive option. With its free transactions and enhanced security measures, it seems sense that a lot of business owners are using this payment option.