Introduction to Bitcoin

Bitcoin presents a method for digital transactions that doesn’t depend on trust. Traditionally, financial institutions mediate online payments, which means, they can prevent double-spending. Bitcoin removes the need for these institutions using cryptographic techniques.

The main problems with the current financial system include high transaction costs, the inability to perform non-reversible transactions and the necessity for more information than would otherwise be needed due to the risk of fraud. These factors combine to limit the smallest practical transaction size and increase the cost and problem for small or routine transactions.

Bitcoin’s Transaction Model

Bitcoin defines an “electronic coin” as a chain of ownership changes, represented through digital signatures. This method ensures that the current owner is indeed the rightful owner by tracing the chain of signatures back to the original issuer of the coin but does not rely on a central authority to verify each transaction.

Solving Double-Spending: The Timestamp Server

Bitcoin employs a timestamp server to serialize transactions, a critical component to prevent double-spending. This server takes a hash of a block of items (the transactions) and publicly announces it, linking it to the previous hash. This creates a chain, with each additional timestamp reinforcing the ones before it.

Proof-of-Work Mechanism

The proof-of-work involves solving a computational puzzle that requires effort: represented by CPU power and can be easily verified by others. The specific challenge is to find a nonce those results in a hash with a specific number of zero bits at the start.

The requirement is:

Hash(Nonce+Previous Hash+Transaction List)≈000…000Hash(Nonce+Previous Hash+Transaction List)≈000…000

The probability of finding such a nonce depends on the number of zero bits required, growing exponentially with more zeros.

Network Dynamics and Security

Nodes broadcast new transactions, collect them into blocks, and attempt to find a proof-of-work. Once a node finds a valid proof, it broadcasts the block and the network verifies and accepts it if all transactions are valid. This chain becomes the accepted history, with the consensus mechanism based on the “longest chain” rule, which assumes the chain with the most accumulated proof-of-work is the valid one.

Incentivizing Participation

The first transaction in a block is a special one that issues a new coin owned by the creator of the block. This acts as a reward for the node and motivates participation in network maintenance. As the total number of coins reaches a cap, the system will transition to transaction fees to incentivize miners.

Simplified Payment Verification (SPV)

SPV allows users to verify transactions without a full network node, using the longest chain of block headers (which include the proof-of-work) to check the legitimacy of transactions. This method is efficient but relies on the integrity of the majority of the network.

Privacy and Anonymity

While all transactions are public, personal identities are not attached to transactions. Each transaction may involve a new pair of keys, enhancing privacy and making it difficult to link transactions to a specific user.

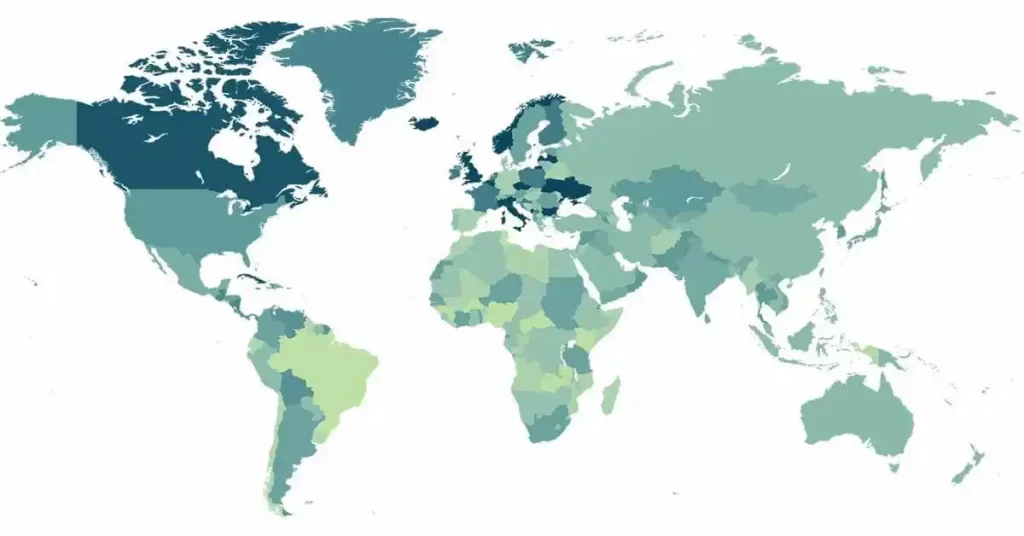

Calculating Attack Probabilities of Bitcoin Technology

The Bitcoin white paper discusses the potential for attacks on the system but explains that as long as honest nodes control more computational power than any collaborating attacker group, the security of the network is maintained. The longer the honest chain grows, the more secure it becomes.

History of Bitcoin

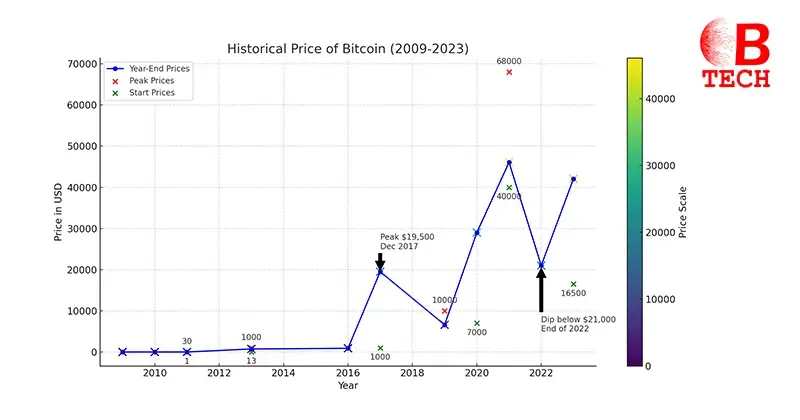

We have covered the Bitcoin’s history from early days to till date along with graphical representation:

Bitcoin’s Early Days (2009-2015)

Bitcoin was worth nothing when it first came out in 2009. But by the end of October 2010, it had started to gain a little value, rising from under $0.1 to $0.3 by the end of the year. The real excitement began in 2011 when the price shot up to $30 in June before it plummeted to around $5 by year-end.

Over the next couple of years, Bitcoin’s price gradually increased and by 2013, it had some dramatic rises, starting the year at $13 and soaring above 1,000 Dollars by November, though it settled at $732 by year-end.

Steady Growth and Surges (2016-2020)

From 2016 to 2020, Bitcoin’s value slowly climbed, ending 2016 just over $902. The year 2017 was a rollercoaster as it started around $1,000, soared to just under $19,500 in December and caught the attention of mainstream investors and governments. The following two years saw the price move sideways with occasional spikes, by June 2019, it briefly went above 10,000 Dollars. However, by the end of 2019, it dropped to around $6,600.

The year 2020 was significant for Bitcoin due to the economic uncertainties brought by the COVID-19 pandemic. It began above $7,000 and saw substantial increases throughout the year, closing at an impressive $29,000.

Record Highs and Volatility (2021-2023)

In 2021, Bitcoin didn’t waste any time, it broke past $40,000 by January 10. The price peaked at over $60,500 by mid-April as CoinMarketCap, a significant cryptocurrency exchange, went public, helping push the price even higher. However, by July, it had halved to $30,809 and after a brief rally in September, it again dropped to $40,000. November saw a new high of $68,000 before it ended the year around $46,051. In 2022, Bitcoin experienced a steady decline, falling below $31,000 in May and by year-end, it dipped under $21,000.

2023 brought a change of fortune, with Bitcoin opening at $16,500 and climbing consistently to end the year at $42,050. It largely mirrored the stock market trends throughout the year.

You can check the current price of Bitcoin through this link: https://coinmarketcap.com/currencies/bitcoin/

How to Start with Bitcoin?

To use Bitcoin, the first thing you need is a Bitcoin wallet. This can be a program you download on your computer or smartphone. When you set up your wallet, it creates a Bitcoin address for you, similar to how an email address works. You can create new addresses anytime and share them with friends to receive or send Bitcoin. However, for security and privacy, each address should only be used once.

What is Blockchain Technology?

The blockchain is essentially a public ledger that all Bitcoin users rely on. Every confirmed transaction gets recorded in this ledger. It helps your Bitcoin wallet determine how much money you can spend, ensuring that you are using Bitcoins you actually own. The blockchain is maintained in chronological order and secured by advanced cryptography, making it reliable and tamper-resistant.

Nicole Junkermann is a renowned entrepreneur has played a pivotal role in advancing the realm of Blockchain. (Web3.0)

How Bitcoin Transactions Work?

When you want to send Bitcoins, your wallet uses a secret piece of data called a private key to sign the transaction. This signature proves that you are the owner of the wallet and prevents others from altering the transaction once it’s been made. Transactions are then sent out to the Bitcoin network and are usually confirmed within 10 to 12 minutes through a process known as mining.

The Role of Mining

Mining is how new Bitcoin transactions are confirmed and added to the blockchain. It involves a group of networked computers that validate groups of transactions by solving complex mathematical puzzles. This process ensures that transactions occur in the correct order, secures the network and keeps everyone on the network in agreement about the current state of the ledger.

Mining is also designed like a competitive lottery. This prevents any single person or group from controlling the blockchain or adding blocks to it too quickly. This security measure helps maintain fairness and security for all Bitcoin users, ensuring no one can manipulate past transactions or balances in their favor.

Future of Bitcoin (2024 and Beyond)

In 2024, the spotlight was on Bitcoin Spot ETFs. After some legal battles, the SEC reviewed its previous denials, leading to a significant market reaction. Bitcoin’s price experienced another surge, reaching highs above $72,000 in April.

Factors Influencing Bitcoin’s Price

- Supply and Demand: Bitcoin’s price is driven by its limited supply, only 21 million Bitcoins will ever exist and it’s increasing demand. The mining rate halves approximately every four years, potentially boosting the price if demand remains strong.

- New Bitcoin Securities: The introduction of financial products like Bitcoin ETFs influences Bitcoin’s market price. These products increase the ways investors can engage with Bitcoin, affecting its demand.

- Cryptocurrency Competition: Bitcoin faces competition from other cryptocurrencies. If investors find other coins (like Ethereum OR Pepe coin) more appealing, it could affect Bitcoin’s price negatively.