Introduction

Tesla is without a question the leader when it comes to electric vehicles (EVs). With its stylish and high-tech plug-in electric cars, the company has turned EVs from a niche interest to a worldwide trend, especially during the global energy transition craze.

The late American-Serbian creator and electrical engineer Nikola Tesla is remembered by the brand, which is closely linked to Elon Musk, the CEO and principal stakeholder of Tesla. Musk is a mysterious, powerful, and out-of-the-ordinary businessman who has invested in several innovative companies.

Even though its market value has increased, Tesla is still the world’s biggest electric car maker. From its high point of $1.23 trillion on November 6, 2021, to $582.53 billion in January 2024, its market value has dropped more than half. But even though it’s unstable, its position in the EV market hasn’t changed.

Although Elon Musk is charismatic, Tesla is not only his domain. The business has a broad ownership base, with many additional investors owning sizeable stakes in TSLA stock. Gaining insight into these parties helps to paint a more complete picture of Tesla’s ownership structure.

Tesla’s list of individual owners shows the wide range of people who have put money into the company. Also, looking at the big investors who own many Tesla shares can tell you much about the investing climate around the huge electric car company.

By looking at Tesla’s investors besides Elon Musk, we can better understand how the company is owned and what that means for the future of electric transportation.

Key Players in Tesla’s Ownership Landscape: An Analysis

Musk: The Principal Stakeholder

Elon Musk, possessing an impressive 715.022 million shares, assumes the role of the most substantial individual shareholder of Tesla, accounting for a significant 20.6% of the company’s ownership. As the primary catalyst for Tesla’s forward-thinking and inventive endeavors, Musk’s impact transcends the boundaries of his ownership stake.

The Vanguard Group is leading the way for institutional investors.

The Vanguard Group occupies the foremost position among institutional investors, with 225.94 million shares, representing 7% of Tesla’s ownership. The significant investment capital they possess serves as evidence of institutional investors’ faith in the future potential of Tesla.

Elon Musk’s Function within the Operations of Tesla

Elon Musk assumes leadership responsibilities at Tesla about product design, engineering, and worldwide production, encompassing a wide range of electric vehicles battery merchandise, and solar energy solutions. His proactive demeanor demonstrates his dedication to propelling Tesla to triumph.

The Effects of Musk’s Behavior: A Volcanic Journey for Stockholders

Elon Musk’s erratic conduct and candid comments frequently incited significant volatility in Tesla stock price. An event occurred on August 7, 2018, when Elon Musk tweeted proposing financing Tesla privately at $420 per share. This action prompted regulatory scrutiny from the Securities and Exchange Commission (SEC).

The Intervention of the SEC

As a result of the SEC’s inquiry into Musk’s remark, Tesla encountered legal consequences. Elon Musk’s chairmanship was revoked, and the company he represented, Tesla, was subject to a significant punishment of $40 million. This occurrence brought attention to the regulatory scrutiny that Musk’s communications were subject to.

Reactions of the Market: The Twitter Acquisition Scandal

Tsla stock price experienced an unexpected decline of more than 60% in 2022 after Elon Musk procured the social media platform Twitter, which was subsequently rebranded as X. This acquisition demonstrated the market’s awareness of Musk’s entrepreneurial pursuits outside of Tesla.

An examination of the ownership structure of Tesla reveals a multifaceted interaction between institutional and individual stakeholders, all of whom are impacted by the visionary leadership and intermittent controversies that have surrounded Elon Musk.

Unveiling Tesla Shareholders: An In-Depth Analysis

Introduction to Tesla’s Investor Landscape

Tesla, headquartered in Silicon Valley, boasts a diverse array of investors ranging from individual shareholders to large institutional firms. With 3.179 billion outstanding shares as of January 2024, Tesla’s ownership structure reflects the broad interest in the company’s future.

Key Players in Tesla’s Ownership

Elon Musk, along with prominent investment management firms such as Vanguard Group, BlackRock, State Street Corp, and Geode Capital Management, holds sway over Tesla’s ownership landscape. These stakeholders represent a blend of individual, retail, and institutional investors, each contributing to Tesla’s market dynamics.

Unraveling Tesla’s Largest Shareholders

Delving into the specifics, it’s crucial to identify who holds the lion’s share of Tesla stock among both individual and institutional investors. Understanding the distribution of ownership sheds light on the diverse interests invested in Tesla’s success.

By examining the details of Tesla’s shareholder structure, we gain valuable insights into the driving forces behind the company’s growth trajectory and its significance within the broader investment landscape.

Exploring Tesla Top Individual Shareholders

Elon Musk: The Visionary Leader

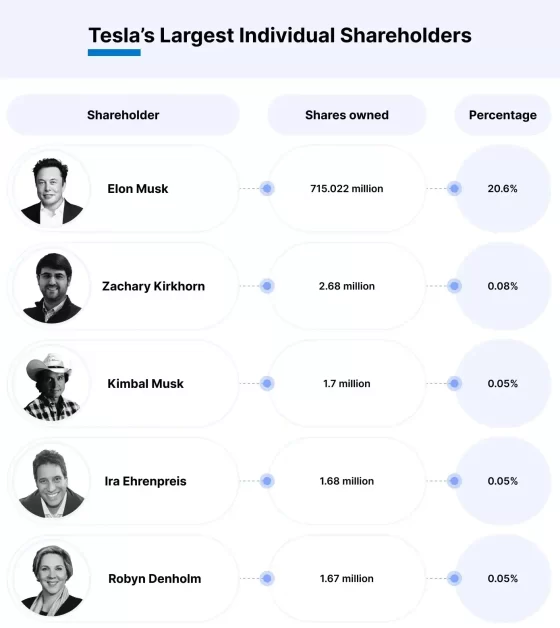

Elon Musk, Tesla’s CEO and founder, holds a staggering 715.022 million shares of Tesla, representing a significant 20.6% of the company’s outstanding shares as of March 2023. Musk’s influential role extends beyond Tesla, encompassing ventures like SpaceX and the social media platform X. His dynamic leadership has been pivotal in shaping Tesla’s trajectory since its inception.

Zachary Kirkhorn: Former CFO Turned Shareholder

Zachary J. Kirkhorn, once Tesla’s Chief Financial Officer, emerged as the second-largest individual shareholder with 2.68 million shares, amounting to 0.08% ownership. Despite his unexpected departure in August 2023, Kirkhorn’s stake underscores his previous involvement in Tesla’s financial landscape.

Kimbal Musk: Culinary Entrepreneur & Shareholder

Elon Musk’s younger brother, Kimbal Musk, holds 1.7 million Tesla shares, constituting 0.05% ownership. Beyond his stake in Tesla, Kimbal is renowned for his ventures in the culinary industry, co-founding restaurants like The Kitchen and engaging in urban farming initiatives. His diverse interests complement Elon tech-centric endeavors.

Ira Ehrenpreis: Venture Capitalist & Director

Ira Ehrenpreis, Tesla independent director, possesses 1.68 million shares, representing 0.05% ownership. As the founder of venture capital firm DBL Partners, Ehrenpreis focuses on investments in clean energy and sustainable solutions, aligning with Tesla mission of promoting renewable energy and innovation.

Robyn Denholm: Executive with Automotive Acumen

Robyn Denholm, an Australian executive and Tesla independent director since 2014, owns 1.67 million shares. With a background in tech and auto industries, including stints at Telstra Corporation Limited and Toyota Motor Australia, Denholm brings valuable expertise to Tesla boardroom, contributing to its strategic direction.

These top individual shareholders play integral roles in Tesla journey, each contributing unique perspectives and expertise to drive the company’s continued success and innovation.

Exploring Tesla Largest Institutional Shareholders

The Vanguard Group: A Financial Powerhouse

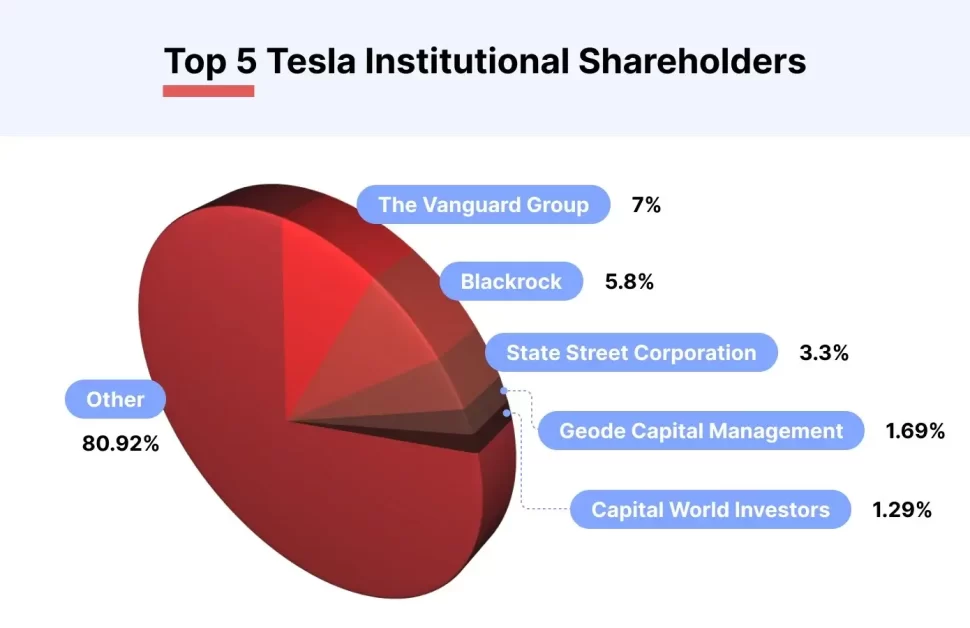

The Vanguard Group, the world’s second-largest asset management company, holds significant sway over Tesla ownership landscape. With 225.94 million shares, representing nearly 7% of Tesla’s stock as of September 30, 2023, Vanguard’s influence is formidable. Unlike traditional firms, Vanguard is owned by investors who entrust their funds, amounting to a staggering $8.2 trillion in assets under management as of April 2023.

BlackRock: A Titan in Asset Management

BlackRock, the world’s largest asset management firm, commands a substantial presence in Tesla ownership structure. Holding 186.65 million shares, accounting for 5.8% of Tesla outstanding shares as of September 2023, BlackRock’s strategic investments reflect its massive $9.1 trillion in assets under management, solidifying its position as a key player in global finance.

State Street Corp: A Pillar of Stability

State Street Corporation, one of the world’s leading asset managers, boasts impressive credentials in Tesla investor lineup. With 104.86 million shares valued at $19.21 billion, State Street Corp holds 3.3% of Tesla outstanding stock as of September 30, 2023. Its $3.7 trillion in assets under management underscores its role as a stalwart in the financial industry.

Geode Capital Management: Navigating Asset Management

Geode Capital Management emerges as Tesla fourth-largest institutional shareholder, wielding considerable influence with 53.87 million shares valued at $9.87 billion. Founded in 2001, this Massachusetts-based firm manages assets worth $1 billion, further solidifying its significance in the investment landscape.

Capital World Investors: A Legacy of Investment Expertise

Capital World Investors, one of the world’s oldest investment managers dating back to the 1930s, holds a notable position in Tesla ownership hierarchy. With 41.1 million shares valued at $7.53 billion, Capital World Investors’ legacy of investment expertise is reflected in its 1.29% ownership stake in Tesla, contributing to its enduring success in the financial arena.

These institutional powerhouses play pivotal roles in shaping Tesla trajectory, reflecting the diverse interests and strategic investments driving the company’s growth and innovation in the electric vehicle industry.

The Significance of Ownership in Tsla Stock Future

Elon Musk’s Dominance: Shaping Tesla Path

Elon Musk’s ownership of approximately 20% of Tesla’s outstanding tsla stock solidifies his position as the company’s largest shareholder. This sizable stake far surpasses that of both individual and institutional investors. As a result, Musk’s influence over Tesla future direction and growth remains unparalleled, underscoring his pivotal role in steering the company’s trajectory.

Institutional Giants: Vanguard & BlackRock

In contrast, institutional heavyweights like Vanguard and BlackRock command significant stakes in Tesla, with ownership percentages of 7% and 5.8% respectively. While their combined influence is formidable, it pales in comparison to Musk’s substantial holding. These institutions wield considerable sway over Tesla’s shareholder landscape, contributing to the company’s stability and market presence.

Diverse Individual Ownership

Individual investors, in contrast, collectively own less than 1% of Tesla shares. While their ownership may seem modest in comparison to Musk and institutional investors, their presence underscores the widespread interest in Tesla Stock among retail investors. Despite their smaller individual stakes, these investors play a crucial role in diversifying Tesla ownership base and contributing to its market liquidity.

The Continuation of Musk’s Influence

With Elon Musk’s overwhelming shareholding, his impact on Tesla future business decisions and growth trajectory remains profound. His visionary leadership and strategic vision will continue to shape Tesla journey in the electric vehicle industry and beyond. As the largest shareholder, Musk’s influence is set to endure, cementing his role as a driving force behind Tesla ongoing success and innovation.

Frequently Asked Questions about Tesla Stock Price

Who Owns Tesla?

The largest shareholders of Tesla include Elon Musk and prominent investment management firms such as Vanguard Group, BlackRock, State Street Corp, and Geode Capital Management.

Who Are Tesla Biggest Shareholders?

Elon Musk, Tesla CEO, holds the most shares, accounting for roughly 20% of the company. Other major investors include asset management companies like Vanguard Group, BlackRock, and State Street Corporation. Additionally, Musk’s younger brother, Kimbal, is a significant individual shareholder in Tesla.

Who Owns 100% of Tesla Shares?

No single entity or individual owns 100% of Tesla. However, Elon Musk stands as the largest shareholder.

How Much of Tesla Does Elon Musk Own?

Elon Musk retains the title of the largest Tesla shareholder, possessing 715.022 million shares, which equates to approximately 20% of Tesla ownership.

Final Bite

Tesla ownership landscape is a complex interplay between individual investors, institutional giants like Vanguard and BlackRock, and the visionary leadership of Elon Musk. Musk’s substantial ownership stake, representing around 20% of the company, gives him significant influence over Tsla stock future direction. Institutional investors also hold sizable portions of Tesla stock, contributing to its stability and market presence. Despite Musk’s dominance, individual investors play a role in diversifying ownership and contributing to market liquidity.

Overall, Elon Musk’s leadership and strategic vision will continue to shape Tesla journey in the electric vehicle industry, ensuring its ongoing success and innovation.

Automotive Related Articles: