Artemis Coin and the Future of Finance; The Next Phase of Financial Evolution

Cryptocurrencies, once considered speculative and volatile, have gradually moved toward the mainstream over the past decade. As governments, financial institutions and businesses explore the future of digital currencies, the introduction of innovative cryptocurrencies continues to reshape the financial landscape. Among these, Artemis Coin (ART) has emerged as a beacon of innovation, balancing advanced technology with user-centric financial solutions. Launched in 2023, Artemis Coin is more than just another digital currency; it represents a unique vision for the future of decentralized finance (DeFi), community ownership and financial inclusivity.

The Genesis of Artemis Coin

Artemis Coin was conceptualized by a team of blockchain veterans and technologists who aimed to address several challenges facing existing cryptocurrencies. These challenges included high transaction fees, slow settlement times and excessive energy consumption associated with proof-of-work (PoW) consensus mechanisms. Artemis was also created in response to the increasing centralization of mining power and decision-making authority in prominent cryptocurrencies like Bitcoin and Ethereum.

Named after the Greek goddess Artemis, the coin symbolizes growth, exploration and protection—qualities that its founders hope to instill in the Artemis ecosystem. The project launched after a successful ICO (Initial Coin Offering) in early 2023, raising $450 million within weeks. From the outset, Artemis Coin sought to carve out a niche by blending cutting-edge technological advancements with a focus on democratization, sustainability and scalability.

Key Features & Technology

1. Proof-of-Stake Consensus Mechanism

Artemis Coin uses an advanced version of the Proof-of-Stake (PoS) consensus mechanism, designed to be highly energy-efficient and scalable. Unlike Bitcoin’s PoW model, which relies on energy-intensive mining, Artemis Coin’s PoS system allows users to “stake” their coins as collateral to validate transactions and secure the network. Validators are randomly selected to confirm blocks based on the amount of Artemis they hold, and they are rewarded for their efforts. This approach eliminates the need for powerful hardware and reduces the network’s carbon footprint by over 90% compared to traditional mining processes.

2. Quantum-Resistant Cryptography

In a world where quantum computing is slowly becoming a reality, many existing cryptocurrencies face potential security threats. Artemis Coin addresses this concern through quantum-resistant cryptographic algorithms. This ensures that, even in the face of significant advances in quantum computing, the network remains secure from attacks that could break standard encryption protocols. Quantum resistance adds a layer of future-proofing to the coin, making it a secure long-term investment for institutional players and individuals.

3. Lightning-Fast Transactions

One of the most distinguishing factors of Artemis Coin is its Artemis Protocol, which enables near-instantaneous transaction settlements. While traditional blockchains can take anywhere from a few minutes (Ethereum) to several hours (Bitcoin) to confirm a transaction, the Artemis Protocol achieves finality in less than three seconds, regardless of the transaction size or geographical location. This protocol uses a system of sidechains and parallel processing to eliminate bottlenecks, making Artemis highly suitable for daily transactions and high-frequency trading.

4. Environmentally Friendly & Sustainable

Artemis Coin has positioned itself as a sustainable cryptocurrency. The reliance on PoS, combined with its energy-efficient infrastructure, results in minimal energy consumption, aligning with global sustainability goals. In fact, Artemis has received several commendations from environmental organizations for its commitment to reducing the carbon footprint associated with blockchain operations.

Governance & Decentralization

One of Artemis Coin’s standout features is its decentralized governance model. Unlike many cryptocurrencies where decisions are made by a small group of developers or miners, Artemis Coin operates through a Decentralized Autonomous Organization (DAO). Every Artemis Coin holder can participate in the decision-making process, voting on key changes to the network, including upgrades, partnerships and the allocation of development funds.

This DAO model not only democratizes the future of Artemis Coin but also empowers its user base to steer the project in a direction that aligns with their collective goals. The team behind Artemis frequently emphasizes that the project’s long-term success hinges on its decentralized nature, positioning it as a community-owned asset rather than a corporately driven one.

Market Potential & Adoption

As of late 2024, Artemis Coin has been gaining significant traction in various sectors, particularly in decentralized finance (DeFi), gaming and the metaverse.

1. DeFi Integration

Artemis Coin’s compatibility with major DeFi protocols has made it an appealing choice for investors seeking yield-generating opportunities. With the launch of Artemis-based decentralized exchanges (DEXs) and lending platforms, users can stake, lend and borrow Artemis tokens seamlessly. Thanks to its low transaction fees and lightning-fast settlement times, Artemis has become a core asset in several liquidity pools across the DeFi landscape.

2. Gaming & Metaverse Applications

The gaming industry has shown considerable interest in Artemis Coin. Its sidechain capabilities and scalability make it ideal for high-volume transactions needed in in-game economies. Some blockchain-based games and virtual worlds now use Artemis Coin as their primary medium of exchange, allowing players to buy, sell and trade assets across various metaverses.

Furthermore, Artemis Coin’s low fees and rapid processing make it a natural fit for play-to-earn games and NFT (non-fungible token) marketplaces, where microtransactions are frequent. Several partnerships with metaverse platforms have been announced and the coin is becoming a staple in virtual asset transactions.

3. Institutional & Governmental Adoption

Artemis Coin’s stability and environmental sustainability have attracted the attention of institutional investors. Several hedge funds and asset management firms have begun incorporating Artemis into their portfolios, particularly due to its quantum resistance and energy-efficient model. Some governments have also expressed interest in using Artemis Coin as part of their national digital currency strategies, particularly for cross-border payments and trade settlements.

Challenges and Risks

Like any emerging technology, Artemis Coin is not without its challenges. Despite its technical strengths, the coin faces stiff competition from established cryptocurrencies such as Ethereum, Solana and emerging projects that offer similar features. Additionally, the regulatory environment surrounding cryptocurrencies remains uncertain, with several governments considering stricter oversight of DeFi platforms and digital assets.

The success of Artemis Coin will also depend on the community’s ability to maintain its decentralized governance structure. As the project grows and attracts more participants, ensuring that decision-making remains equitable and inclusive will be critical. Without careful management, there is always a risk of centralization creeping back into a decentralized system.

Security Architecture of Artemis Coin

Security is a cornerstone of Artemis Coin, with the project introducing several layers of defense to safeguard users and their assets. In addition to its quantum-resistant cryptography, Artemis has adopted several other advanced security features designed to protect against both traditional and emerging threats:

1. Multi-Layered Consensus Validation

Artemis Coin employs a multi-layered consensus validation system. While the primary network operates using Proof-of-Stake (PoS), additional consensus layers check the validity of each transaction through random audits by independent nodes. This significantly reduces the chances of double-spending and ensures that validators remain honest, even when staking large amounts of ART tokens. This system is known as Adaptive Proof-of-Stake, which adapts in real-time to network demands, ensuring scalability without sacrificing security.

2. Zero-Knowledge Proofs

In a push for privacy, Artemis Coin integrates Zero-Knowledge Proofs (ZKPs). ZKPs allow transactions to be verified without revealing the details of the transaction itself, ensuring that users can transact privately without compromising transparency on the blockchain. This technology is particularly important for businesses and institutions that want to protect sensitive transaction information, while still being compliant with regulatory standards that require accountability.

3. Smart Contract Audits & Bug Bounties

Artemis Coin’s developers understand the importance of transparency and security in smart contract execution. To that end, they regularly undergo third-party smart contract audits from trusted security firms. Additionally, they offer bug bounties to independent security researchers, encouraging the discovery and patching of vulnerabilities before they can be exploited. This proactive approach has allowed Artemis Coin to maintain a clean track record in terms of security incidents.

Strategic Partnerships & Ecosystem Growth

The growth of Artemis Coin is driven not only by its technical prowess but also by its partnerships and ecosystem expansion. By aligning with key industry players, Artemis Coin has created a robust network of collaborators that enhance its usability and market potential.

1. Collaborations with Traditional Finance

Artemis Coin has forged partnerships with several traditional financial institutions that see value in its high-speed transaction capabilities and sustainability focus. These partnerships aim to integrate Artemis Coin into existing payment systems, particularly for cross-border transactions. Banks and remittance services are testing Artemis as an alternative to SWIFT for international payments, which often take days and incur significant fees.

2. Integration with Popular Wallets & Exchanges

To boost accessibility, Artemis Coin has prioritized integration with major cryptocurrency wallets, ensuring that users can store, send and receive Artemis with ease. As of 2024, leading wallets such as MetaMask, Trust Wallet and Ledger all support Artemis Coin. Additionally, Artemis is available on top-tier cryptocurrency exchanges including Binance, Coinbase and Kraken, with plans to list on decentralized exchanges (DEXs) like Uniswap and PancakeSwap.

3. NFTs & Tokenized Assets

The booming NFT (non-fungible token) market has not escaped the attention of Artemis Coin’s developers. Artemis has built a seamless NFT marketplace where creators can mint and trade their digital assets. Thanks to Artemis’s low fees and fast transactions, NFT creators and collectors experience reduced friction compared to Ethereum-based platforms. Some artists and game developers have already migrated to Artemis, leveraging its scalability for high-traffic NFT drops and in-game asset trading.

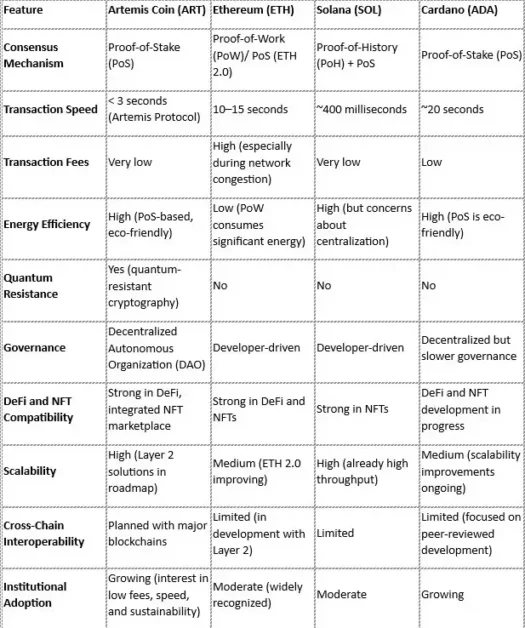

Artemis Coin Vs Other Cryptocurrencies

Artemis Coin stands out in an increasingly crowded cryptocurrency space by offering a combination of features that appeal to both retail users and institutional investors. Here’s how it compares to some of the leading players:

Summary

- Artemis Coin: Fast transactions (<3 seconds), low fees, energy-efficient, quantum-resistant, DAO governance, strong DeFi and NFT integration, cross-chain interoperability planned.

- Ethereum: High fees, slower transactions, transitioning to Proof-of-Stake (ETH 2.0), widely used in DeFi and NFTs.

- Solana: Very fast, low fees, but faces centralization concerns; popular for NFTs.

- Cardano: Energy-efficient, slower governance and scalability improvements, strong academic approach, growing DeFi and NFT ecosystem.

Roadmap to Future

Artemis Coin’s team has outlined a comprehensive roadmap to guide its evolution over the coming years. Some of the key milestones expected to propel the project forward include:

1. Layer 2 Scaling Solutions

Although Artemis Coin’s base layer already offers impressive transaction speeds, the development team is exploring Layer 2 scaling solutions to ensure that the network can handle even larger transaction volumes without compromising on cost or speed. The goal is to support millions of transactions per second (TPS), which would place Artemis Coin among the most scalable blockchains in the world, rivaling the throughput of traditional payment processors like Visa or Mastercard.

2. Cross-Chain Interoperability

The future of blockchain likely lies in a multi-chain world, where various blockchains can communicate and transfer assets seamlessly. Artemis Coin plans to build cross-chain bridges with other prominent blockchains such as Ethereum, Solana and Binance Smart Chain. This will allow users to move assets between ecosystems, participate in decentralized finance (DeFi) opportunities across chains and create a more connected DeFi environment.

3. Artemis Ventures Fund

To encourage innovation within the Artemis ecosystem, the development team has announced the launch of the Artemis Ventures Fund. This decentralized venture capital fund will provide financial support to startups and projects building on the Artemis blockchain. The goal is to foster a diverse array of applications, including DeFi projects, NFT platforms and enterprise solutions, which will drive further adoption and value creation for the Artemis Coin.

As 2024 progresses, Artemis Coin is poised to capitalize on several global trends. First, the ongoing regulatory clarity around cryptocurrencies is likely to benefit compliant projects like Artemis, which already adhere to robust KYC (Know Your Customer) and AML (Anti-Money Laundering) standards. Additionally, the increasing institutional interest in DeFi and NFTs will create new opportunities for Artemis to expand its ecosystem and attract large-scale investments.

Finally, the impending growth of quantum computing could create vulnerabilities for many blockchain networks but Artemis’s early adoption of quantum-resistant algorithms positions it as one of the safest options for long-term investors. As the world transitions to a more decentralized, digital financial system, Artemis Coin is well-positioned to be at the forefront of this transformation.

In summary, Artemis Coin is not just another cryptocurrency; it represents a new paradigm in blockchain technology, emphasizing security, speed, sustainability and community ownership. With a strong roadmap, an expanding ecosystem, and a clear vision for the future, Artemis Coin is well on its way to becoming a key player in the next generation of digital assets.

Conclusion

Artemis Coin is well-positioned to become a leading player in the cryptocurrency market. By addressing key concerns related to security, sustainability and governance, Artemis offers a forward-looking solution for both institutional and individual investors. Its focus on scalability, speed and environmental impact, coupled with a robust decentralized governance structure, makes it one of the most promising digital assets of the post-2023 era.

As the world continues to embrace blockchain technology and digital currencies, Artemis Coin stands at the intersection of innovation and practicality, pushing the boundaries of what’s possible in decentralized finance. With strong community backing, cutting-edge technology and growing institutional interest, Artemis Coin could very well become a defining currency in the financial ecosystems of tomorrow.